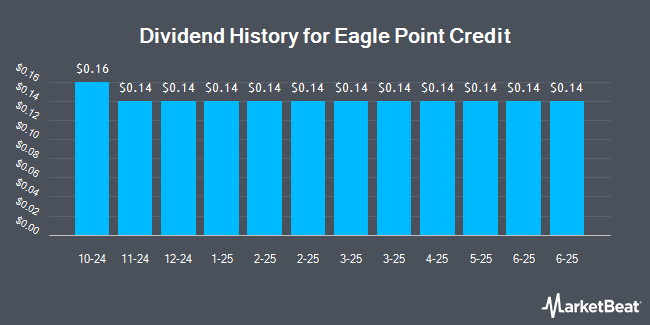

Eagle Point Credit Company Inc. (NYSE:ECC - Get Free Report) declared a monthly dividend on Tuesday, August 12th. Stockholders of record on Tuesday, October 14th will be given a dividend of 0.14 per share by the investment management company on Friday, October 31st. This represents a c) annualized dividend and a dividend yield of 25.3%. The ex-dividend date of this dividend is Tuesday, October 14th.

Eagle Point Credit has a dividend payout ratio of 178.7% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities research analysts expect Eagle Point Credit to earn $1.10 per share next year, which means the company may not be able to cover its $1.68 annual dividend with an expected future payout ratio of 152.7%.

Eagle Point Credit Stock Performance

ECC stock opened at $6.64 on Friday. The firm has a market cap of $510.95 million, a PE ratio of 60.37 and a beta of 0.39. The company has a quick ratio of 2.23, a current ratio of 2.23 and a debt-to-equity ratio of 0.32. The business has a 50 day moving average of $6.92 and a 200-day moving average of $7.36. Eagle Point Credit has a 12-month low of $6.00 and a 12-month high of $9.81.

About Eagle Point Credit

(

Get Free Report)

Eagle Point Credit Company Inc is a closed ended fund launched and managed by Eagle Point Credit Management LLC. It invests in fixed income markets of the United States. The fund invests equity and junior debt tranches of collateralized loan obligations consisting primarily of below investment grade U.S.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eagle Point Credit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eagle Point Credit wasn't on the list.

While Eagle Point Credit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.