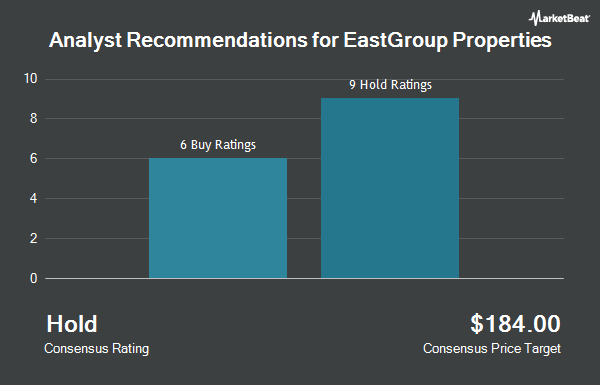

EastGroup Properties, Inc. (NYSE:EGP - Get Free Report) has received a consensus rating of "Moderate Buy" from the fourteen research firms that are presently covering the stock, MarketBeat reports. Six analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating on the company. The average 12 month price objective among brokers that have covered the stock in the last year is $189.3077.

EGP has been the topic of a number of research analyst reports. Wells Fargo & Company set a $215.00 price target on EastGroup Properties and gave the company an "overweight" rating in a report on Sunday, July 13th. Robert W. Baird lowered their price target on EastGroup Properties from $194.00 to $190.00 and set an "outperform" rating on the stock in a report on Wednesday, May 7th. Royal Bank Of Canada lowered their price target on EastGroup Properties from $183.00 to $182.00 and set a "sector perform" rating on the stock in a report on Tuesday, July 29th. Raymond James Financial reissued a "strong-buy" rating on shares of EastGroup Properties in a report on Wednesday, May 7th. Finally, Truist Financial lowered their price target on EastGroup Properties from $180.00 to $177.00 and set a "buy" rating on the stock in a report on Monday, May 5th.

Get Our Latest Analysis on EGP

EastGroup Properties Stock Performance

Shares of EGP traded up $1.48 during midday trading on Tuesday, hitting $169.82. 347,683 shares of the stock traded hands, compared to its average volume of 325,197. EastGroup Properties has a 1-year low of $137.67 and a 1-year high of $192.21. The firm has a market capitalization of $9.06 billion, a PE ratio of 36.68, a price-to-earnings-growth ratio of 3.45 and a beta of 1.01. The company has a debt-to-equity ratio of 0.43, a quick ratio of 0.16 and a current ratio of 0.16. The business's 50 day moving average price is $166.03 and its two-hundred day moving average price is $168.87.

EastGroup Properties (NYSE:EGP - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The real estate investment trust reported $2.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.20 by $0.01. EastGroup Properties had a net margin of 34.85% and a return on equity of 7.29%. The company had revenue of $177.29 million during the quarter, compared to the consensus estimate of $175.80 million. During the same quarter in the previous year, the company posted $2.05 earnings per share. The company's revenue for the quarter was up 11.4% compared to the same quarter last year. EastGroup Properties has set its Q3 2025 guidance at 2.220-2.300 EPS. FY 2025 guidance at 8.890-9.030 EPS. Equities research analysts predict that EastGroup Properties will post 8.94 EPS for the current fiscal year.

EastGroup Properties Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Tuesday, September 30th will be issued a dividend of $1.55 per share. This represents a $6.20 dividend on an annualized basis and a dividend yield of 3.7%. This is a positive change from EastGroup Properties's previous quarterly dividend of $1.40. The ex-dividend date of this dividend is Tuesday, September 30th. EastGroup Properties's dividend payout ratio is 120.95%.

Institutional Trading of EastGroup Properties

Several institutional investors have recently modified their holdings of the company. Vanguard Group Inc. lifted its holdings in shares of EastGroup Properties by 1.5% in the second quarter. Vanguard Group Inc. now owns 7,306,840 shares of the real estate investment trust's stock valued at $1,221,119,000 after buying an additional 108,561 shares during the period. State Street Corp lifted its holdings in shares of EastGroup Properties by 2.5% in the second quarter. State Street Corp now owns 2,667,793 shares of the real estate investment trust's stock valued at $449,491,000 after buying an additional 65,060 shares during the period. Norges Bank acquired a new stake in shares of EastGroup Properties in the second quarter valued at $252,405,000. Price T Rowe Associates Inc. MD lifted its holdings in shares of EastGroup Properties by 35.1% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,318,090 shares of the real estate investment trust's stock valued at $232,184,000 after buying an additional 342,620 shares during the period. Finally, Principal Financial Group Inc. lifted its holdings in shares of EastGroup Properties by 234.7% in the first quarter. Principal Financial Group Inc. now owns 1,222,064 shares of the real estate investment trust's stock valued at $215,267,000 after buying an additional 856,971 shares during the period. Institutional investors and hedge funds own 92.14% of the company's stock.

EastGroup Properties Company Profile

(

Get Free Report)

EastGroup Properties, Inc NYSE: EGP, a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

Further Reading

Before you consider EastGroup Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EastGroup Properties wasn't on the list.

While EastGroup Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.