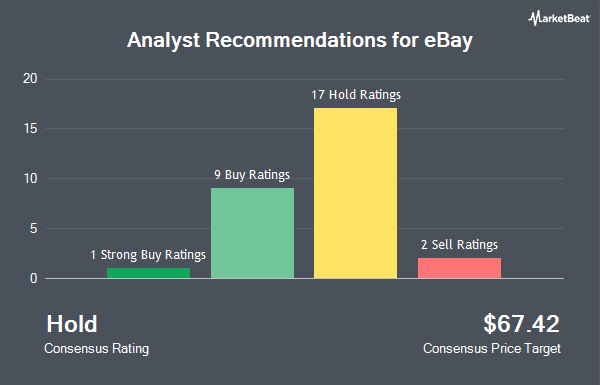

eBay Inc. (NASDAQ:EBAY - Get Free Report) has been assigned a consensus rating of "Hold" from the twenty-nine ratings firms that are covering the company, Marketbeat.com reports. Two equities research analysts have rated the stock with a sell rating, seventeen have given a hold rating, nine have assigned a buy rating and one has issued a strong buy rating on the company. The average 1-year target price among brokerages that have updated their coverage on the stock in the last year is $67.42.

EBAY has been the topic of several analyst reports. Bank of America dropped their price target on shares of eBay from $72.00 to $71.00 and set a "neutral" rating on the stock in a research note on Thursday, February 27th. Benchmark increased their price objective on shares of eBay from $65.00 to $75.00 and gave the company a "buy" rating in a report on Thursday, February 27th. Daiwa America upgraded shares of eBay from a "hold" rating to a "strong-buy" rating in a report on Monday, May 12th. Susquehanna increased their price objective on shares of eBay from $65.00 to $70.00 and gave the company a "neutral" rating in a report on Monday, May 5th. Finally, Needham & Company LLC increased their price objective on shares of eBay from $72.00 to $78.00 and gave the company a "buy" rating in a report on Thursday, May 1st.

Check Out Our Latest Research Report on eBay

eBay Stock Performance

Shares of NASDAQ:EBAY traded up $0.57 during trading hours on Friday, hitting $72.15. The stock had a trading volume of 4,064,653 shares, compared to its average volume of 4,991,491. The stock's fifty day simple moving average is $67.02 and its 200 day simple moving average is $65.77. eBay has a 1-year low of $51.38 and a 1-year high of $72.94. The firm has a market capitalization of $33.26 billion, a price-to-earnings ratio of 18.13, a PEG ratio of 2.22 and a beta of 1.30. The company has a debt-to-equity ratio of 1.14, a quick ratio of 1.25 and a current ratio of 1.25.

eBay (NASDAQ:EBAY - Get Free Report) last announced its quarterly earnings results on Wednesday, April 30th. The e-commerce company reported $1.38 EPS for the quarter, beating the consensus estimate of $1.34 by $0.04. eBay had a net margin of 19.68% and a return on equity of 30.97%. The company had revenue of $2.59 billion for the quarter, compared to analyst estimates of $2.55 billion. During the same quarter last year, the business earned $1.25 earnings per share. eBay's revenue was up 1.1% compared to the same quarter last year. Sell-side analysts anticipate that eBay will post 3.86 earnings per share for the current fiscal year.

eBay Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, June 13th. Investors of record on Friday, May 30th will be paid a $0.29 dividend. This represents a $1.16 dividend on an annualized basis and a yield of 1.61%. The ex-dividend date of this dividend is Friday, May 30th. eBay's dividend payout ratio is 27.62%.

Insider Buying and Selling

In other eBay news, CEO Jamie Iannone sold 10,000 shares of the stock in a transaction that occurred on Monday, May 5th. The shares were sold at an average price of $69.83, for a total value of $698,300.00. Following the completion of the sale, the chief executive officer now owns 570,754 shares in the company, valued at $39,855,751.82. This represents a 1.72% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP Cornelius Boone sold 3,958 shares of the stock in a transaction that occurred on Tuesday, March 18th. The stock was sold at an average price of $67.06, for a total transaction of $265,423.48. Following the completion of the sale, the senior vice president now owns 94,392 shares of the company's stock, valued at approximately $6,329,927.52. The trade was a 4.02% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 187,755 shares of company stock valued at $12,943,715. Company insiders own 0.64% of the company's stock.

Institutional Investors Weigh In On eBay

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Wealth Preservation Advisors LLC purchased a new stake in eBay in the 1st quarter worth approximately $26,000. Golden State Wealth Management LLC bought a new position in shares of eBay during the 4th quarter valued at $27,000. Orion Capital Management LLC bought a new position in shares of eBay during the 4th quarter valued at $27,000. Abound Financial LLC bought a new position in shares of eBay during the 1st quarter valued at $29,000. Finally, Pinney & Scofield Inc. bought a new position in shares of eBay during the 4th quarter valued at $31,000. Hedge funds and other institutional investors own 87.48% of the company's stock.

eBay Company Profile

(

Get Free ReporteBay Inc, together with its subsidiaries, operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally. The company's marketplace platform includes its online marketplace at ebay.com, off-platform businesses, and the eBay suite of mobile apps.

Further Reading

Before you consider eBay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eBay wasn't on the list.

While eBay currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.