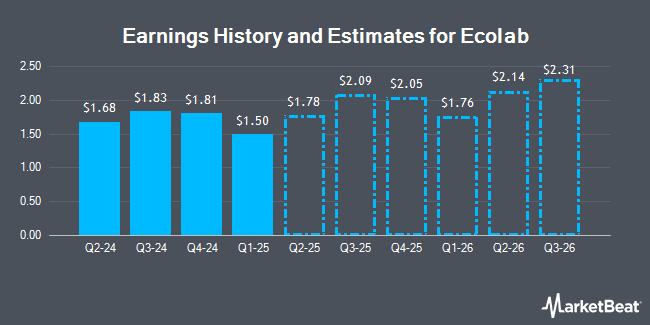

Ecolab (NYSE:ECL - Get Free Report) updated its FY 2025 earnings guidance on Tuesday. The company provided earnings per share (EPS) guidance of 7.420-7.620 for the period, compared to the consensus estimate of 7.504. The company issued revenue guidance of -. Ecolab also updated its Q3 2025 guidance to 2.020-2.120 EPS.

Analyst Upgrades and Downgrades

A number of brokerages have recently commented on ECL. Robert W. Baird raised shares of Ecolab from a "neutral" rating to an "outperform" rating and raised their target price for the company from $273.00 to $300.00 in a research note on Wednesday. Wells Fargo & Company set a $260.00 target price on shares of Ecolab and gave the company an "equal weight" rating in a research note on Tuesday, May 20th. Oppenheimer raised shares of Ecolab to an "outperform" rating in a research note on Wednesday. UBS Group raised shares of Ecolab from an "underperform" rating to a "buy" rating in a research note on Wednesday. Finally, Citigroup cut their price objective on shares of Ecolab from $320.00 to $315.00 and set a "buy" rating on the stock in a report on Wednesday. Three analysts have rated the stock with a hold rating, twelve have issued a buy rating and four have assigned a strong buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $290.71.

View Our Latest Stock Report on ECL

Ecolab Stock Performance

Shares of NYSE:ECL traded down $0.96 during trading on Friday, reaching $260.80. 858,978 shares of the company's stock traded hands, compared to its average volume of 1,332,002. The company has a debt-to-equity ratio of 0.80, a current ratio of 1.44 and a quick ratio of 0.98. The company has a 50 day moving average of $266.76 and a 200-day moving average of $256.28. The stock has a market capitalization of $73.97 billion, a P/E ratio of 34.82, a price-to-earnings-growth ratio of 2.82 and a beta of 1.03. Ecolab has a 12 month low of $221.62 and a 12 month high of $274.17.

Ecolab (NYSE:ECL - Get Free Report) last posted its earnings results on Tuesday, July 29th. The basic materials company reported $1.89 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.90 by ($0.01). The firm had revenue of $4.03 billion for the quarter, compared to analyst estimates of $4.03 billion. Ecolab had a net margin of 13.59% and a return on equity of 22.52%. On average, equities analysts expect that Ecolab will post 7.54 EPS for the current year.

Ecolab Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Tuesday, June 17th were paid a dividend of $0.65 per share. This represents a $2.60 dividend on an annualized basis and a yield of 1.0%. The ex-dividend date of this dividend was Tuesday, June 17th. Ecolab's payout ratio is presently 34.71%.

Insider Transactions at Ecolab

In related news, Director David Maclennan purchased 500 shares of Ecolab stock in a transaction dated Wednesday, May 7th. The stock was bought at an average cost of $251.75 per share, with a total value of $125,875.00. Following the purchase, the director owned 19,465 shares in the company, valued at approximately $4,900,313.75. The trade was a 2.64% increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 0.04% of the stock is owned by insiders.

Institutional Trading of Ecolab

An institutional investor recently raised its position in Ecolab stock. Brighton Jones LLC increased its position in shares of Ecolab Inc. (NYSE:ECL - Free Report) by 164.7% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,700 shares of the basic materials company's stock after acquiring an additional 2,302 shares during the quarter. Brighton Jones LLC's holdings in Ecolab were worth $867,000 as of its most recent SEC filing. 74.91% of the stock is currently owned by institutional investors.

About Ecolab

(

Get Free Report)

Ecolab Inc provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through three segments: Global Industrial; Global Institutional & Specialty; and Global Healthcare & Life Sciences. The Global Industrial segment offers water treatment and process applications, and cleaning and sanitizing solutions to manufacturing, food and beverage processing, transportation, chemical, metals and mining, power generation, pulp and paper, commercial laundry, petroleum, refining, and petrochemical industries.

Further Reading

Before you consider Ecolab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ecolab wasn't on the list.

While Ecolab currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.