Electron Capital Partners LLC trimmed its stake in Vertiv Holdings Co (NYSE:VRT - Free Report) by 91.2% during the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 21,175 shares of the company's stock after selling 220,640 shares during the period. Electron Capital Partners LLC's holdings in Vertiv were worth $2,406,000 as of its most recent filing with the SEC.

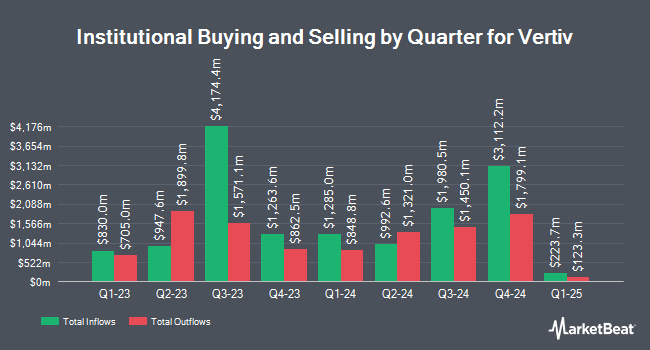

Other large investors have also recently made changes to their positions in the company. SOA Wealth Advisors LLC. acquired a new position in Vertiv during the fourth quarter worth $26,000. OLD Second National Bank of Aurora purchased a new position in Vertiv during the 4th quarter valued at about $30,000. Tradewinds Capital Management LLC grew its position in Vertiv by 61.3% in the 4th quarter. Tradewinds Capital Management LLC now owns 292 shares of the company's stock valued at $33,000 after acquiring an additional 111 shares in the last quarter. FNY Investment Advisers LLC purchased a new stake in Vertiv during the fourth quarter worth about $34,000. Finally, Pittenger & Anderson Inc. boosted its stake in shares of Vertiv by 92.0% in the fourth quarter. Pittenger & Anderson Inc. now owns 313 shares of the company's stock valued at $36,000 after purchasing an additional 150 shares during the period. 89.92% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several brokerages have commented on VRT. Cowen reissued a "buy" rating on shares of Vertiv in a research report on Thursday, April 24th. JPMorgan Chase & Co. decreased their target price on Vertiv from $132.00 to $100.00 and set an "overweight" rating for the company in a report on Tuesday, April 8th. Melius Research restated a "hold" rating and set a $125.00 price target on shares of Vertiv in a report on Tuesday, January 28th. KGI Securities began coverage on Vertiv in a research note on Thursday, April 24th. They issued a "hold" rating for the company. Finally, The Goldman Sachs Group lowered their price target on shares of Vertiv from $135.00 to $85.00 and set a "buy" rating for the company in a report on Thursday, April 10th. Five analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $120.38.

Get Our Latest Stock Report on Vertiv

Vertiv Stock Performance

VRT traded up $2.46 during trading on Friday, hitting $95.01. 9,123,436 shares of the stock were exchanged, compared to its average volume of 8,981,587. The firm has a market capitalization of $36.18 billion, a P/E ratio of 74.23, a PEG ratio of 1.07 and a beta of 1.71. Vertiv Holdings Co has a 1-year low of $53.60 and a 1-year high of $155.84. The stock has a fifty day moving average price of $80.14 and a two-hundred day moving average price of $106.87. The company has a quick ratio of 1.02, a current ratio of 1.65 and a debt-to-equity ratio of 1.19.

Vertiv (NYSE:VRT - Get Free Report) last announced its earnings results on Wednesday, April 23rd. The company reported $0.64 EPS for the quarter, beating analysts' consensus estimates of $0.62 by $0.02. Vertiv had a net margin of 6.19% and a return on equity of 61.41%. The business had revenue of $2.04 billion for the quarter, compared to analysts' expectations of $1.94 billion. During the same period in the previous year, the company posted $0.43 EPS. The company's quarterly revenue was up 24.2% on a year-over-year basis. As a group, sell-side analysts predict that Vertiv Holdings Co will post 3.59 earnings per share for the current year.

Vertiv Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, March 27th. Shareholders of record on Tuesday, March 18th were paid a dividend of $0.0375 per share. This represents a $0.15 annualized dividend and a yield of 0.16%. The ex-dividend date was Tuesday, March 18th. Vertiv's dividend payout ratio is presently 8.72%.

Vertiv Profile

(

Free Report)

Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Featured Stories

Before you consider Vertiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertiv wasn't on the list.

While Vertiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.