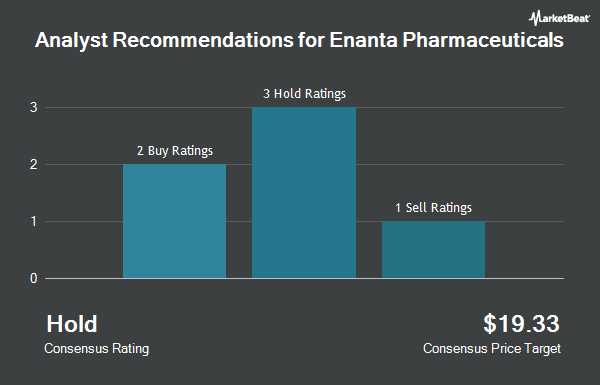

Shares of Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA - Get Free Report) have earned a consensus rating of "Moderate Buy" from the five brokerages that are currently covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, three have given a buy recommendation and one has given a strong buy recommendation to the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is $18.00.

ENTA has been the subject of several research reports. Wall Street Zen upgraded shares of Enanta Pharmaceuticals from a "sell" rating to a "hold" rating in a research report on Sunday, June 22nd. JMP Securities upped their target price on shares of Enanta Pharmaceuticals from $23.00 to $24.00 and gave the company a "market outperform" rating in a report on Tuesday, June 3rd.

Get Our Latest Stock Report on ENTA

Enanta Pharmaceuticals Trading Up 1.9%

Shares of Enanta Pharmaceuticals stock traded up $0.14 on Friday, hitting $7.70. The stock had a trading volume of 135,156 shares, compared to its average volume of 282,381. The stock has a market cap of $164.63 million, a price-to-earnings ratio of -1.70 and a beta of 0.84. Enanta Pharmaceuticals has a 52-week low of $4.09 and a 52-week high of $17.24. The company's 50 day moving average price is $6.40 and its 200 day moving average price is $6.07.

Enanta Pharmaceuticals (NASDAQ:ENTA - Get Free Report) last issued its quarterly earnings data on Monday, May 12th. The biotechnology company reported ($1.06) earnings per share for the quarter, missing analysts' consensus estimates of ($1.04) by ($0.02). The firm had revenue of $14.93 million during the quarter, compared to analysts' expectations of $15.96 million. Enanta Pharmaceuticals had a negative net margin of 149.57% and a negative return on equity of 79.83%. Analysts predict that Enanta Pharmaceuticals will post -4.65 EPS for the current fiscal year.

Institutional Investors Weigh In On Enanta Pharmaceuticals

Several large investors have recently modified their holdings of ENTA. AlphaQuest LLC increased its stake in Enanta Pharmaceuticals by 16.4% in the 4th quarter. AlphaQuest LLC now owns 22,260 shares of the biotechnology company's stock valued at $128,000 after buying an additional 3,137 shares during the period. Thrivent Financial for Lutherans acquired a new stake in shares of Enanta Pharmaceuticals in the 4th quarter worth $254,000. Intech Investment Management LLC purchased a new stake in shares of Enanta Pharmaceuticals in the fourth quarter valued at about $58,000. American Century Companies Inc. increased its stake in shares of Enanta Pharmaceuticals by 10.5% during the fourth quarter. American Century Companies Inc. now owns 36,962 shares of the biotechnology company's stock worth $213,000 after acquiring an additional 3,501 shares during the period. Finally, Norges Bank acquired a new position in shares of Enanta Pharmaceuticals during the fourth quarter worth about $234,000. Hedge funds and other institutional investors own 94.99% of the company's stock.

Enanta Pharmaceuticals Company Profile

(

Get Free ReportEnanta Pharmaceuticals, Inc, a biotechnology company, discovers and develops small molecule drugs for the treatment of viral infections and liver diseases. Its product pipeline comprises EDP-514, which is in phase 1b clinical development for the treatment of chronic infection with hepatitis B virus or HBV; EDP-938 and EDP-323, which is in phase II clinical development for the treatment of respiratory syncytial virus; EDP-235, which is in phase II clinical development for the treatment of human coronaviruses; and Glecaprevir, which is in the market for the treatment of chronic infection with hepatitis C virus or HCV.

Further Reading

Before you consider Enanta Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enanta Pharmaceuticals wasn't on the list.

While Enanta Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.