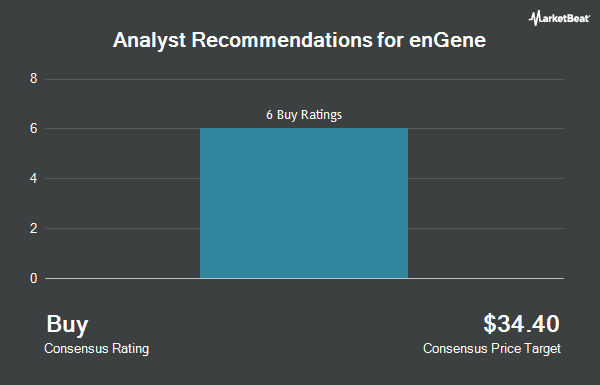

enGene Holdings Inc. (NASDAQ:ENGN - Get Free Report) has been assigned an average rating of "Buy" from the seven analysts that are currently covering the company, Marketbeat reports. One research analyst has rated the stock with a hold rating, five have issued a buy rating and one has given a strong buy rating to the company. The average 1-year price target among brokerages that have issued a report on the stock in the last year is $19.50.

Several brokerages have commented on ENGN. Morgan Stanley lowered their price objective on shares of enGene from $19.00 to $18.00 and set an "overweight" rating for the company in a research report on Friday, September 12th. HC Wainwright restated a "buy" rating and set a $25.00 price objective on shares of enGene in a research report on Monday, September 8th.

Get Our Latest Stock Report on ENGN

enGene Stock Up 11.3%

Shares of ENGN opened at $7.60 on Thursday. enGene has a one year low of $2.65 and a one year high of $11.00. The company has a market cap of $389.04 million, a P/E ratio of -4.00 and a beta of -0.28. The company has a debt-to-equity ratio of 0.09, a current ratio of 10.34 and a quick ratio of 10.34. The firm has a 50 day simple moving average of $4.90 and a two-hundred day simple moving average of $4.23.

enGene (NASDAQ:ENGN - Get Free Report) last announced its quarterly earnings data on Thursday, September 11th. The company reported ($0.57) EPS for the quarter, missing the consensus estimate of ($0.51) by ($0.06). Research analysts forecast that enGene will post -1.56 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of ENGN. Affinity Asset Advisors LLC acquired a new position in shares of enGene during the second quarter worth $280,000. Adage Capital Partners GP L.L.C. increased its holdings in shares of enGene by 2.7% during the first quarter. Adage Capital Partners GP L.L.C. now owns 1,571,642 shares of the company's stock worth $7,041,000 after buying an additional 41,874 shares in the last quarter. ADAR1 Capital Management LLC acquired a new position in shares of enGene during the first quarter worth $107,000. Jane Street Group LLC acquired a new position in shares of enGene during the fourth quarter worth $93,000. Finally, Paloma Partners Management Co acquired a new position in shares of enGene during the second quarter worth $38,000. 64.16% of the stock is currently owned by institutional investors and hedge funds.

enGene Company Profile

(

Get Free Report)

enGene Holdings Inc, through its subsidiary enGene, Inc, operates as a clinical-stage biotechnology company that develops genetic medicines through the delivery of therapeutics to mucosal tissues and other organs. Its lead product candidate is EG-70 (detalimogene voraplasmid), which is a non-viral immunotherapy to treat non-muscle invasive bladder cancer patients with carcinoma-in-situ (Cis), who are unresponsive to treatment with Bacillus Calmette-Guérin.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider enGene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and enGene wasn't on the list.

While enGene currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.