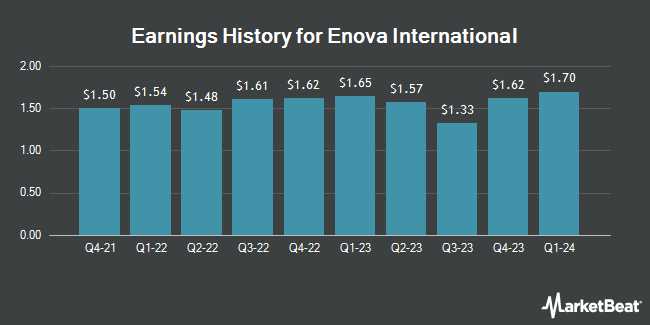

Enova International (NYSE:ENVA - Get Free Report) released its quarterly earnings data on Thursday. The credit services provider reported $3.23 earnings per share for the quarter, beating analysts' consensus estimates of $3.00 by $0.23, Briefing.com reports. The firm had revenue of $764.04 million during the quarter, compared to analyst estimates of $756.69 million. Enova International had a return on equity of 23.51% and a net margin of 8.75%. The business's quarterly revenue was up 21.6% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.21 earnings per share.

Enova International Trading Down 4.8%

ENVA stock traded down $5.40 during midday trading on Friday, reaching $106.34. The company's stock had a trading volume of 927,192 shares, compared to its average volume of 348,506. The company has a debt-to-equity ratio of 3.14, a quick ratio of 18.55 and a current ratio of 18.55. The stock has a fifty day simple moving average of $103.56 and a two-hundred day simple moving average of $101.07. Enova International has a 1 year low of $72.43 and a 1 year high of $119.06. The firm has a market capitalization of $2.70 billion, a price-to-earnings ratio of 11.29 and a beta of 1.48.

Insiders Place Their Bets

In related news, CEO David Fisher sold 5,000 shares of the firm's stock in a transaction dated Monday, July 14th. The stock was sold at an average price of $115.23, for a total transaction of $576,150.00. Following the sale, the chief executive officer owned 348,223 shares of the company's stock, valued at $40,125,736.29. This trade represents a 1.42% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, General Counsel Sean Rahilly sold 9,046 shares of the firm's stock in a transaction dated Monday, May 5th. The shares were sold at an average price of $95.05, for a total value of $859,822.30. Following the sale, the general counsel directly owned 103,842 shares in the company, valued at approximately $9,870,182.10. The trade was a 8.01% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 18,046 shares of company stock worth $1,830,112. Insiders own 8.40% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts recently commented on the company. TD Cowen raised Enova International from a "hold" rating to a "buy" rating and set a $17.00 price target for the company in a research note on Tuesday, April 1st. Seaport Res Ptn raised shares of Enova International to a "strong-buy" rating in a report on Wednesday, May 14th. Finally, JMP Securities restated a "market outperform" rating and issued a $135.00 price target on shares of Enova International in a research note on Wednesday, April 30th. One equities research analyst has rated the stock with a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Buy" and a consensus price target of $111.00.

Read Our Latest Research Report on Enova International

About Enova International

(

Get Free Report)

Enova International, Inc, a technology and analytics company, provides online financial services in the United States, Brazil, and internationally. The company provides installment loans; line of credit accounts; CSO programs, including arranging loans with independent third-party lenders and assisting in the preparation of loan applications and loan documents; and bank programs, such as marketing services and loan servicing for near-prime unsecured consumer installment loan.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Enova International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enova International wasn't on the list.

While Enova International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.