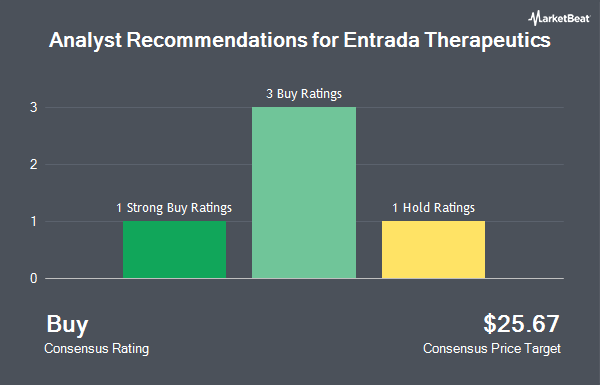

Shares of Entrada Therapeutics, Inc. (NASDAQ:TRDA - Get Free Report) have received an average recommendation of "Buy" from the five analysts that are currently covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. The average 12 month target price among analysts that have updated their coverage on the stock in the last year is $25.6667.

TRDA has been the subject of several research analyst reports. Zacks Research raised shares of Entrada Therapeutics to a "hold" rating in a report on Friday, August 8th. HC Wainwright reaffirmed a "buy" rating and set a $20.00 target price on shares of Entrada Therapeutics in a report on Tuesday, May 20th. Finally, Wall Street Zen downgraded shares of Entrada Therapeutics from a "hold" rating to a "sell" rating in a report on Saturday, August 9th.

Read Our Latest Research Report on TRDA

Entrada Therapeutics Stock Performance

Shares of TRDA stock traded down $0.31 during midday trading on Friday, hitting $5.31. 253,100 shares of the company were exchanged, compared to its average volume of 152,438. The firm has a market capitalization of $201.98 million, a P/E ratio of -2.98 and a beta of -0.12. The firm's 50 day moving average price is $6.45 and its two-hundred day moving average price is $8.59. Entrada Therapeutics has a 52 week low of $4.93 and a 52 week high of $21.79.

Entrada Therapeutics (NASDAQ:TRDA - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported ($1.04) EPS for the quarter, missing the consensus estimate of ($0.86) by ($0.18). The company had revenue of $1.98 million for the quarter, compared to the consensus estimate of $8.17 million. Entrada Therapeutics had a negative return on equity of 17.81% and a negative net margin of 92.30%. Analysts expect that Entrada Therapeutics will post 1.12 EPS for the current year.

Insider Transactions at Entrada Therapeutics

In other Entrada Therapeutics news, major shareholder Ventures V. L.P. 5Am sold 6,935 shares of the business's stock in a transaction dated Wednesday, July 9th. The shares were sold at an average price of $7.50, for a total value of $52,012.50. Following the completion of the sale, the insider owned 1,093,313 shares of the company's stock, valued at $8,199,847.50. The trade was a 0.63% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Director Kush Parmar sold 27,000 shares of the business's stock in a transaction dated Wednesday, July 9th. The shares were sold at an average price of $7.50, for a total transaction of $202,500.00. Following the completion of the sale, the director directly owned 1,093,313 shares of the company's stock, valued at $8,199,847.50. This represents a 2.41% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 254,000 shares of company stock valued at $1,782,000 in the last three months. Insiders own 8.11% of the company's stock.

Institutional Trading of Entrada Therapeutics

A number of institutional investors have recently bought and sold shares of the business. Public Employees Retirement System of Ohio boosted its holdings in Entrada Therapeutics by 6.2% in the 4th quarter. Public Employees Retirement System of Ohio now owns 17,259 shares of the company's stock valued at $298,000 after purchasing an additional 1,000 shares during the period. WCG Wealth Advisors LLC boosted its holdings in Entrada Therapeutics by 6.2% in the 4th quarter. WCG Wealth Advisors LLC now owns 24,030 shares of the company's stock valued at $415,000 after purchasing an additional 1,406 shares during the period. Martingale Asset Management L P boosted its holdings in Entrada Therapeutics by 4.0% in the 1st quarter. Martingale Asset Management L P now owns 40,163 shares of the company's stock valued at $363,000 after purchasing an additional 1,540 shares during the period. Bank of America Corp DE boosted its holdings in Entrada Therapeutics by 4.9% in the 4th quarter. Bank of America Corp DE now owns 35,721 shares of the company's stock valued at $618,000 after purchasing an additional 1,660 shares during the period. Finally, MetLife Investment Management LLC boosted its holdings in Entrada Therapeutics by 11.9% in the 4th quarter. MetLife Investment Management LLC now owns 16,329 shares of the company's stock valued at $282,000 after purchasing an additional 1,731 shares during the period. Institutional investors own 86.39% of the company's stock.

Entrada Therapeutics Company Profile

(

Get Free Report)

Entrada Therapeutics, Inc, a clinical-stage biotechnology company, develops endosomal escape vehicle (EEV) therapeutics for the treatment of multiple neuromuscular diseases. Its EEV platform develops a portfolio of oligonucleotide, antibody, and enzyme-based programs. Its therapeutic candidates, which include ENTR-601-44, which is in Phase I clinical trial for the treatment of Duchenne muscular dystrophy; and ENTR-701, which is in Phase 1/2 clinical trial for the treatment of myotonic dystrophy type 1.

See Also

Before you consider Entrada Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Entrada Therapeutics wasn't on the list.

While Entrada Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.