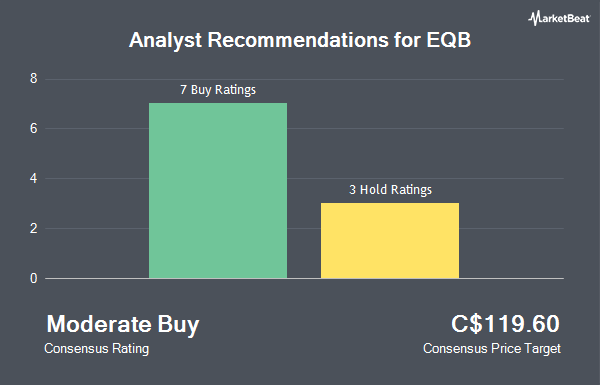

Shares of EQB Inc. (TSE:EQB - Get Free Report) have been given a consensus rating of "Moderate Buy" by the ten research firms that are covering the company, Marketbeat Ratings reports. Three research analysts have rated the stock with a hold recommendation and seven have issued a buy recommendation on the company. The average 12-month price target among analysts that have issued ratings on the stock in the last year is C$119.60.

Several brokerages have weighed in on EQB. Jefferies Financial Group lowered their target price on shares of EQB from C$126.00 to C$107.00 in a research note on Monday, April 21st. National Bankshares dropped their target price on EQB from C$117.00 to C$111.00 and set a "sector perform" rating on the stock in a research note on Thursday, May 22nd. Finally, CIBC reduced their target price on EQB from C$130.00 to C$126.00 in a research report on Thursday, May 22nd.

Check Out Our Latest Report on EQB

EQB Price Performance

Shares of TSE:EQB traded down C$0.28 during trading hours on Thursday, hitting C$101.63. The company's stock had a trading volume of 49,156 shares, compared to its average volume of 85,288. The firm's fifty day moving average price is C$99.12 and its 200 day moving average price is C$98.53. EQB has a 52 week low of C$85.14 and a 52 week high of C$114.22. The company has a market capitalization of C$3.93 billion, a price-to-earnings ratio of 15.84, a P/E/G ratio of 0.34 and a beta of 1.59.

EQB Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Monday, June 30th were given a $0.53 dividend. This represents a $2.12 dividend on an annualized basis and a dividend yield of 2.1%. This is a boost from EQB's previous quarterly dividend of $0.51. The ex-dividend date was Friday, June 13th. EQB's dividend payout ratio (DPR) is currently 29.31%.

EQB Company Profile

(

Get Free Report)

EQB Inc formerly Equitable Group Inc trades on the Toronto Stock Exchange TSX: EQB and EQB.PR.C and serves over 360000 Canadians through its wholly owned subsidiary Equitable Bank Canadas Challenger Bank. Equitable Bank has grown to become the countrys eighth largest independent Schedule I bank with a clear mandate to drive real change in Canadian banking to enrich peoples lives.

Recommended Stories

Before you consider EQB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EQB wasn't on the list.

While EQB currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.