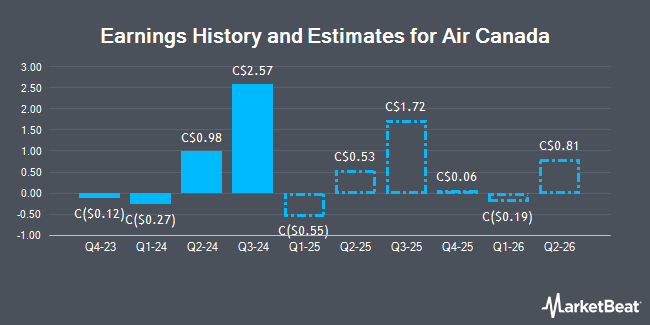

Air Canada (TSE:AC - Free Report) - Stock analysts at Cormark dropped their Q3 2025 earnings per share (EPS) estimates for Air Canada in a research report issued to clients and investors on Wednesday, July 30th. Cormark analyst D. Ocampo now forecasts that the company will earn $1.77 per share for the quarter, down from their prior forecast of $1.79. The consensus estimate for Air Canada's current full-year earnings is $2.58 per share. Cormark also issued estimates for Air Canada's FY2026 earnings at $2.32 EPS and FY2027 earnings at $2.24 EPS.

Other equities analysts also recently issued research reports about the stock. ATB Capital lifted their price target on shares of Air Canada from C$31.00 to C$32.00 and gave the company an "outperform" rating in a report on Wednesday. Scotiabank lifted their price target on shares of Air Canada from C$24.00 to C$27.00 and gave the stock an "outperform" rating in a research note on Wednesday. CIBC dropped their price objective on Air Canada from C$24.00 to C$21.00 in a report on Thursday, April 10th. Royal Bank Of Canada upgraded Air Canada from a "sector perform" rating to an "outperform" rating and upped their target price for the stock from C$16.00 to C$25.00 in a report on Monday, May 12th. Finally, National Bankshares lifted their price target on shares of Air Canada from C$24.00 to C$26.00 and gave the stock an "outperform" rating in a report on Wednesday, July 16th. One research analyst has rated the stock with a sell rating, one has given a hold rating, nine have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, Air Canada currently has an average rating of "Moderate Buy" and an average price target of C$25.63.

View Our Latest Stock Analysis on Air Canada

Air Canada Stock Performance

Shares of Air Canada stock traded down C$0.24 during trading on Thursday, hitting C$19.06. 3,044,175 shares of the company's stock traded hands, compared to its average volume of 3,487,817. The company has a debt-to-equity ratio of 400.00, a current ratio of 0.92 and a quick ratio of 1.06. Air Canada has a 1 year low of C$12.69 and a 1 year high of C$26.18. The stock has a market capitalization of C$6.80 billion, a P/E ratio of 2.68, a PEG ratio of 0.02 and a beta of 2.39. The business has a 50-day simple moving average of C$20.27 and a 200-day simple moving average of C$17.78.

Air Canada Company Profile

(

Get Free Report)

Air Canada is Canada's largest airline, generally serving nearly 50 million passengers each year together with its regional partners. Air Canada is a sixth freedom airline, similar to Gulf carriers, which flies many U.S. nationals on long-haul trips with a layover in Canada. In 2019, the company generated CAD 19 billion in total revenue.

Featured Stories

Before you consider Air Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air Canada wasn't on the list.

While Air Canada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.