Equities research analysts at Jefferies Financial Group initiated coverage on shares of Ermenegildo Zegna (NYSE:ZGN - Get Free Report) in a research note issued to investors on Tuesday, MarketBeat.com reports. The brokerage set a "buy" rating and a $12.90 price target on the stock. Jefferies Financial Group's target price would indicate a potential upside of 33.06% from the company's current price.

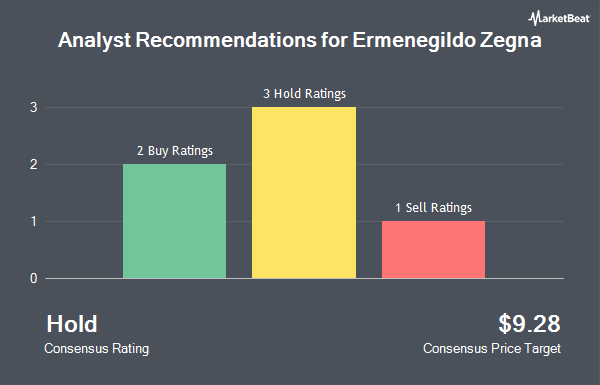

Other equities analysts have also recently issued reports about the company. UBS Group upgraded Ermenegildo Zegna to a "hold" rating in a research note on Monday, September 8th. Weiss Ratings reaffirmed a "hold (c)" rating on shares of Ermenegildo Zegna in a research report on Wednesday, October 8th. Bank of America raised their target price on Ermenegildo Zegna from $9.50 to $10.00 and gave the company a "buy" rating in a research report on Tuesday, September 23rd. JPMorgan Chase & Co. started coverage on Ermenegildo Zegna in a research report on Monday, September 15th. They set an "overweight" rating and a $11.00 target price for the company. Finally, Oddo Bhf set a $11.50 target price on Ermenegildo Zegna in a research report on Wednesday, September 17th. One equities research analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating, four have issued a Hold rating and one has issued a Sell rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $10.43.

View Our Latest Analysis on Ermenegildo Zegna

Ermenegildo Zegna Price Performance

Shares of NYSE:ZGN opened at $9.70 on Tuesday. The company has a current ratio of 1.42, a quick ratio of 0.79 and a debt-to-equity ratio of 0.18. The stock's fifty day simple moving average is $8.89 and its two-hundred day simple moving average is $8.46. Ermenegildo Zegna has a 1-year low of $6.05 and a 1-year high of $10.38. The stock has a market cap of $3.95 billion, a PE ratio of 18.29, a price-to-earnings-growth ratio of 2.48 and a beta of 0.75.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in ZGN. Osborne Partners Capital Management LLC bought a new position in Ermenegildo Zegna in the 1st quarter worth about $4,984,000. Envestnet Asset Management Inc. bought a new stake in shares of Ermenegildo Zegna during the 1st quarter valued at about $959,000. Bank Julius Baer & Co. Ltd Zurich bought a new stake in shares of Ermenegildo Zegna during the 1st quarter valued at about $229,000. Federated Hermes Inc. bought a new stake in shares of Ermenegildo Zegna during the 1st quarter valued at about $1,036,000. Finally, Entropy Technologies LP boosted its position in shares of Ermenegildo Zegna by 95.2% during the 1st quarter. Entropy Technologies LP now owns 19,892 shares of the company's stock valued at $147,000 after acquiring an additional 9,700 shares during the last quarter. Institutional investors own 12.91% of the company's stock.

About Ermenegildo Zegna

(

Get Free Report)

Ermenegildo Zegna N.V., together with its subsidiaries, designs, manufactures, markets, and distributes luxury menswear, footwear, leather goods, and other accessories under the Zegna and the Thom Browne brands. It provides luxury leisurewear for men; formal suits, tuxedos, shirts, blazers, formal overcoats, and accessories; leather accessories comprising shoes, bags, belts, and small leather accessories; and fragrances.

Recommended Stories

Before you consider Ermenegildo Zegna, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ermenegildo Zegna wasn't on the list.

While Ermenegildo Zegna currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.