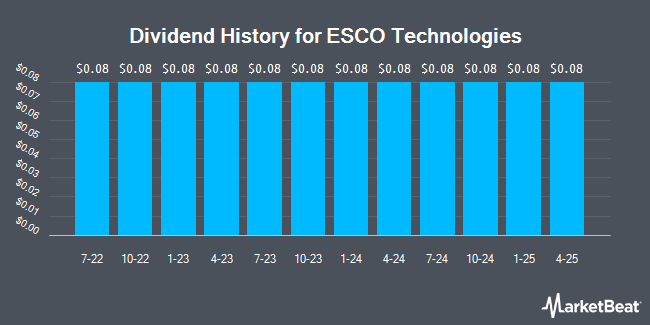

ESCO Technologies Inc. (NYSE:ESE - Get Free Report) announced a quarterly dividend on Monday, August 11th, Wall Street Journal reports. Stockholders of record on Thursday, October 2nd will be given a dividend of 0.08 per share by the scientific and technical instruments company on Thursday, October 16th. This represents a c) annualized dividend and a dividend yield of 0.2%. The ex-dividend date is Thursday, October 2nd.

ESCO Technologies has a payout ratio of 4.6% indicating that its dividend is sufficiently covered by earnings. Research analysts expect ESCO Technologies to earn $5.64 per share next year, which means the company should continue to be able to cover its $0.32 annual dividend with an expected future payout ratio of 5.7%.

ESCO Technologies Stock Down 2.0%

Shares of NYSE:ESE traded down $3.70 during mid-day trading on Friday, hitting $184.47. 229,889 shares of the company traded hands, compared to its average volume of 180,943. The stock has a market cap of $4.76 billion, a P/E ratio of 41.55 and a beta of 1.23. The company has a current ratio of 1.52, a quick ratio of 1.04 and a debt-to-equity ratio of 0.38. ESCO Technologies has a 12-month low of $113.30 and a 12-month high of $201.72. The stock has a 50-day moving average price of $190.43 and a two-hundred day moving average price of $171.28.

ESCO Technologies (NYSE:ESE - Get Free Report) last announced its earnings results on Thursday, August 7th. The scientific and technical instruments company reported $1.60 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.65 by ($0.05). The company had revenue of $296.34 million for the quarter, compared to analysts' expectations of $320.23 million. ESCO Technologies had a net margin of 10.37% and a return on equity of 11.19%. The firm's quarterly revenue was up 13.6% on a year-over-year basis. During the same period in the previous year, the firm earned $1.16 EPS. On average, equities research analysts forecast that ESCO Technologies will post 5.65 earnings per share for the current year.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of ESE. Harbor Investment Advisory LLC purchased a new position in shares of ESCO Technologies during the 2nd quarter valued at $38,000. Osterweis Capital Management Inc. purchased a new position in shares of ESCO Technologies during the 2nd quarter valued at $39,000. Opal Wealth Advisors LLC purchased a new position in shares of ESCO Technologies during the 1st quarter valued at $35,000. CX Institutional purchased a new position in shares of ESCO Technologies during the 1st quarter valued at $36,000. Finally, Maseco LLP bought a new stake in shares of ESCO Technologies during the 2nd quarter valued at $45,000. Hedge funds and other institutional investors own 95.70% of the company's stock.

ESCO Technologies Company Profile

(

Get Free Report)

ESCO Technologies Inc produces and supplies engineered products and systems for industrial and commercial markets worldwide. It operates through three segments: Aerospace & Defense, Utility Solutions Group, and RF Test & Measurement. The Aerospace & Defense segment designs and manufactures filtration products, including hydraulic filter elements and fluid control devices used in commercial aerospace applications; filter mechanisms used in micro-propulsion devices for satellites; and custom designed filters for manned aircraft and submarines.

See Also

Before you consider ESCO Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESCO Technologies wasn't on the list.

While ESCO Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.