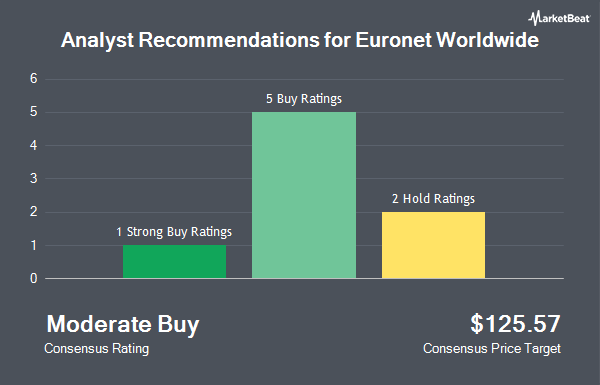

Euronet Worldwide, Inc. (NASDAQ:EEFT - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the nine brokerages that are currently covering the firm, MarketBeat Ratings reports. Three research analysts have rated the stock with a hold recommendation, five have assigned a buy recommendation and one has issued a strong buy recommendation on the company. The average twelve-month target price among analysts that have issued ratings on the stock in the last year is $121.1667.

EEFT has been the topic of several recent analyst reports. DA Davidson reiterated a "buy" rating and set a $130.00 target price on shares of Euronet Worldwide in a research note on Friday, September 12th. Weiss Ratings reiterated a "hold (c)" rating on shares of Euronet Worldwide in a research note on Saturday, September 27th. Oppenheimer increased their target price on Euronet Worldwide from $135.00 to $137.00 and gave the company an "outperform" rating in a research note on Wednesday, July 2nd. Finally, Keefe, Bruyette & Woods cut their target price on Euronet Worldwide from $110.00 to $100.00 and set a "market perform" rating on the stock in a research note on Wednesday.

Check Out Our Latest Research Report on EEFT

Euronet Worldwide Stock Performance

Shares of EEFT opened at $88.03 on Friday. The business's fifty day simple moving average is $92.51 and its two-hundred day simple moving average is $99.74. The company has a current ratio of 1.15, a quick ratio of 1.15 and a debt-to-equity ratio of 0.74. Euronet Worldwide has a 12 month low of $85.24 and a 12 month high of $114.25. The company has a market cap of $3.61 billion, a price-to-earnings ratio of 12.08, a P/E/G ratio of 0.71 and a beta of 1.21.

Euronet Worldwide (NASDAQ:EEFT - Get Free Report) last issued its earnings results on Thursday, July 31st. The business services provider reported $2.56 EPS for the quarter, missing the consensus estimate of $2.66 by ($0.10). Euronet Worldwide had a net margin of 8.06% and a return on equity of 26.62%. The business had revenue of $1.07 billion for the quarter, compared to analysts' expectations of $1.08 billion. During the same quarter in the prior year, the business posted $2.25 earnings per share. The business's revenue for the quarter was up 8.9% on a year-over-year basis. Euronet Worldwide has set its FY 2025 guidance at 9.640-9.990 EPS. Research analysts anticipate that Euronet Worldwide will post 9.11 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Euronet Worldwide

Several hedge funds and other institutional investors have recently modified their holdings of EEFT. AQR Capital Management LLC lifted its holdings in shares of Euronet Worldwide by 131.9% during the 2nd quarter. AQR Capital Management LLC now owns 1,308,267 shares of the business services provider's stock valued at $132,632,000 after buying an additional 744,040 shares during the period. Norges Bank bought a new position in shares of Euronet Worldwide during the 2nd quarter valued at $48,417,000. American Century Companies Inc. lifted its holdings in shares of Euronet Worldwide by 20.4% during the 2nd quarter. American Century Companies Inc. now owns 1,342,733 shares of the business services provider's stock valued at $136,126,000 after buying an additional 227,597 shares during the period. Voss Capital LP lifted its holdings in shares of Euronet Worldwide by 30.9% during the 1st quarter. Voss Capital LP now owns 824,589 shares of the business services provider's stock valued at $88,107,000 after buying an additional 194,589 shares during the period. Finally, Lazard Asset Management LLC lifted its holdings in shares of Euronet Worldwide by 162.8% during the 2nd quarter. Lazard Asset Management LLC now owns 267,754 shares of the business services provider's stock valued at $27,143,000 after buying an additional 165,885 shares during the period. 91.60% of the stock is owned by institutional investors.

About Euronet Worldwide

(

Get Free Report)

Euronet Worldwide, Inc provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide. It operates through three segments: Electronic Fund Transfer Processing, epay, and Money Transfer. The Electronic Fund Transfer Processing segment provides electronic payment solutions, including automated teller machine (ATM) cash withdrawal and deposit services, ATM network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit and prepaid card outsourcing, card issuing, and merchant acquiring services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Euronet Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Euronet Worldwide wasn't on the list.

While Euronet Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.