Apollo Global Management (NYSE:APO - Get Free Report) had its target price increased by Evercore ISI from $155.00 to $160.00 in a note issued to investors on Wednesday,Benzinga reports. The brokerage presently has an "outperform" rating on the financial services provider's stock. Evercore ISI's price objective points to a potential upside of 8.71% from the stock's previous close.

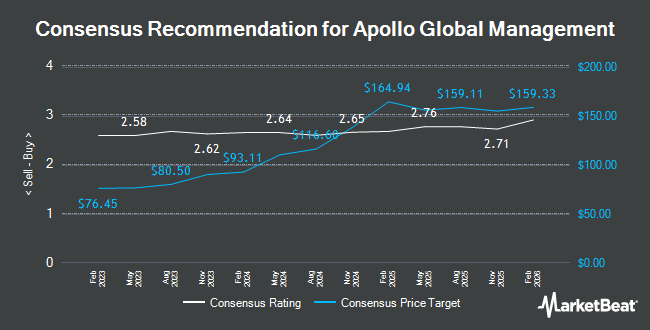

A number of other equities research analysts have also commented on the company. Raymond James Financial began coverage on Apollo Global Management in a research report on Thursday, April 10th. They set a "strong-buy" rating and a $173.00 price target on the stock. TD Cowen reduced their price objective on shares of Apollo Global Management from $214.00 to $144.00 and set a "buy" rating on the stock in a research note on Wednesday, April 9th. Cowen restated a "buy" rating on shares of Apollo Global Management in a report on Monday, May 5th. UBS Group cut their price target on shares of Apollo Global Management from $170.00 to $155.00 and set a "neutral" rating for the company in a report on Thursday, May 1st. Finally, Wells Fargo & Company upped their target price on Apollo Global Management from $160.00 to $173.00 and gave the stock an "overweight" rating in a report on Friday, July 11th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating, seventeen have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, Apollo Global Management presently has a consensus rating of "Moderate Buy" and a consensus target price of $161.26.

Get Our Latest Stock Analysis on Apollo Global Management

Apollo Global Management Stock Performance

APO opened at $147.19 on Wednesday. The firm has a market cap of $84.12 billion, a PE ratio of 25.78, a P/E/G ratio of 1.60 and a beta of 1.62. The business has a fifty day simple moving average of $141.10 and a 200-day simple moving average of $141.93. The company has a quick ratio of 1.36, a current ratio of 1.36 and a debt-to-equity ratio of 0.34. Apollo Global Management has a fifty-two week low of $102.14 and a fifty-two week high of $189.49.

Hedge Funds Weigh In On Apollo Global Management

A number of institutional investors have recently modified their holdings of APO. Peapack Gladstone Financial Corp acquired a new stake in shares of Apollo Global Management during the fourth quarter worth $226,000. Cerity Partners LLC increased its position in shares of Apollo Global Management by 2.1% in the 4th quarter. Cerity Partners LLC now owns 200,915 shares of the financial services provider's stock valued at $32,839,000 after purchasing an additional 4,193 shares during the last quarter. Rathbones Group PLC purchased a new position in shares of Apollo Global Management in the 4th quarter valued at $248,000. FIL Ltd boosted its stake in Apollo Global Management by 38.9% during the 4th quarter. FIL Ltd now owns 490,217 shares of the financial services provider's stock worth $80,964,000 after purchasing an additional 137,352 shares during the period. Finally, Shelton Capital Management purchased a new position in Apollo Global Management during the fourth quarter worth about $411,000. 77.06% of the stock is owned by hedge funds and other institutional investors.

About Apollo Global Management

(

Get Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.