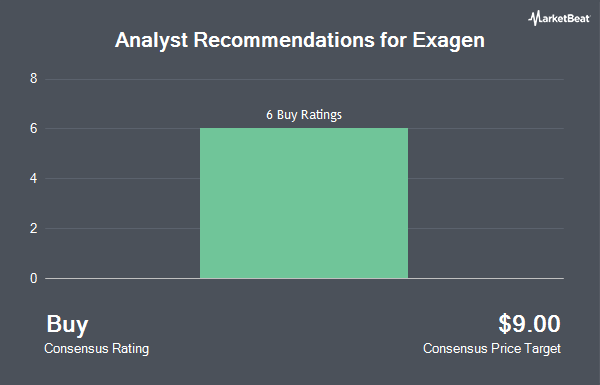

Shares of Exagen Inc. (NASDAQ:XGN - Get Free Report) have received an average rating of "Buy" from the eight ratings firms that are currently covering the company, Marketbeat reports. Eight analysts have rated the stock with a buy recommendation. The average twelve-month price objective among analysts that have issued a report on the stock in the last year is $12.00.

A number of brokerages have commented on XGN. Canaccord Genuity Group boosted their target price on shares of Exagen from $8.00 to $11.00 and gave the stock a "buy" rating in a report on Wednesday, July 30th. Craig Hallum assumed coverage on shares of Exagen in a research report on Wednesday, July 23rd. They set a "buy" rating and a $12.00 price target for the company. B. Riley assumed coverage on shares of Exagen in a research report on Thursday. They set a "buy" rating and a $15.00 price target for the company. Cantor Fitzgerald reissued an "overweight" rating and set a $10.00 price target on shares of Exagen in a research report on Wednesday, July 30th. Finally, KeyCorp raised shares of Exagen from a "sector weight" rating to an "overweight" rating and set a $12.00 price target for the company in a research report on Wednesday, July 30th.

Read Our Latest Stock Analysis on XGN

Exagen Stock Down 4.4%

NASDAQ XGN traded down $0.43 on Thursday, reaching $9.31. 169,021 shares of the stock traded hands, compared to its average volume of 204,500. Exagen has a 12 month low of $2.38 and a 12 month high of $10.34. The company has a fifty day moving average price of $8.75 and a 200-day moving average price of $6.64. The company has a market cap of $204.82 million, a price-to-earnings ratio of -10.46 and a beta of 1.60. The company has a debt-to-equity ratio of 1.06, a quick ratio of 4.95 and a current ratio of 4.95.

Exagen (NASDAQ:XGN - Get Free Report) last released its quarterly earnings results on Tuesday, July 29th. The company reported ($0.18) EPS for the quarter, hitting the consensus estimate of ($0.18). The firm had revenue of $17.20 million during the quarter, compared to analyst estimates of $16.25 million. Exagen had a negative return on equity of 130.38% and a negative net margin of 28.85%. Exagen has set its FY 2025 guidance at EPS. As a group, research analysts forecast that Exagen will post -0.88 EPS for the current fiscal year.

Institutional Trading of Exagen

A number of institutional investors have recently made changes to their positions in the business. Toronto Dominion Bank acquired a new stake in shares of Exagen in the 4th quarter worth $3,655,000. Balyasny Asset Management L.P. acquired a new stake in shares of Exagen in the 2nd quarter worth $5,017,000. Kennedy Capital Management LLC boosted its position in shares of Exagen by 5.3% in the 2nd quarter. Kennedy Capital Management LLC now owns 310,721 shares of the company's stock worth $2,169,000 after purchasing an additional 15,568 shares in the last quarter. Russell Investments Group Ltd. acquired a new stake in shares of Exagen in the 2nd quarter worth $1,540,000. Finally, FourWorld Capital Management LLC acquired a new stake in shares of Exagen in the 2nd quarter worth $1,456,000. Institutional investors and hedge funds own 75.25% of the company's stock.

About Exagen

(

Get Free Report)

Exagen Inc develops and commercializes various testing products under the AVISE brand in the United States. The company enables healthcare providers to care for patients through the diagnosis, prognosis, and monitoring of autoimmune and autoimmune-related diseases, including systemic lupus erythematosus (SLE) and rheumatoid arthritis (RA).

See Also

Before you consider Exagen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exagen wasn't on the list.

While Exagen currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.