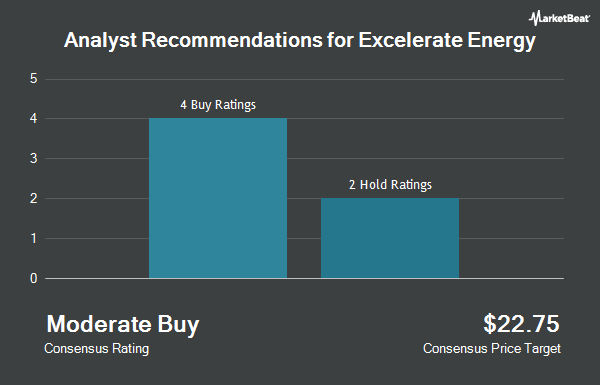

Shares of Excelerate Energy, Inc. (NYSE:EE - Get Free Report) have received a consensus rating of "Hold" from the seven research firms that are currently covering the stock, Marketbeat.com reports. Three analysts have rated the stock with a sell rating and four have given a buy rating to the company. The average 12 month price objective among analysts that have issued ratings on the stock in the last year is $32.2857.

EE has been the topic of several recent research reports. Wall Street Zen raised Excelerate Energy from a "hold" rating to a "buy" rating in a report on Saturday. Jefferies Financial Group started coverage on Excelerate Energy in a research note on Thursday, June 5th. They issued a "buy" rating and a $39.00 price objective on the stock.

Get Our Latest Report on Excelerate Energy

Institutional Trading of Excelerate Energy

Several large investors have recently made changes to their positions in the company. American Century Companies Inc. grew its holdings in shares of Excelerate Energy by 7.2% during the fourth quarter. American Century Companies Inc. now owns 32,190 shares of the company's stock valued at $974,000 after buying an additional 2,156 shares during the last quarter. KLP Kapitalforvaltning AS bought a new position in Excelerate Energy in the 4th quarter valued at about $212,000. JPMorgan Chase & Co. boosted its stake in Excelerate Energy by 113.2% during the 4th quarter. JPMorgan Chase & Co. now owns 106,707 shares of the company's stock valued at $3,228,000 after purchasing an additional 56,661 shares during the last quarter. Norges Bank bought a new stake in Excelerate Energy during the 4th quarter worth approximately $1,128,000. Finally, Pictet Asset Management Holding SA purchased a new stake in shares of Excelerate Energy in the fourth quarter worth approximately $174,000. 21.79% of the stock is currently owned by institutional investors and hedge funds.

Excelerate Energy Trading Down 1.0%

Shares of Excelerate Energy stock traded down $0.25 on Friday, hitting $24.74. The stock had a trading volume of 73,745 shares, compared to its average volume of 400,814. The stock has a 50 day moving average of $27.99 and a 200 day moving average of $28.28. The firm has a market capitalization of $2.82 billion, a P/E ratio of 16.87 and a beta of 1.38. Excelerate Energy has a twelve month low of $17.70 and a twelve month high of $32.99. The company has a debt-to-equity ratio of 0.31, a quick ratio of 3.34 and a current ratio of 3.34.

Excelerate Energy (NYSE:EE - Get Free Report) last issued its quarterly earnings results on Wednesday, May 7th. The company reported $0.49 EPS for the quarter, topping analysts' consensus estimates of $0.39 by $0.10. The company had revenue of $315.09 million for the quarter, compared to analyst estimates of $207.87 million. Excelerate Energy had a net margin of 3.93% and a return on equity of 2.20%. The business's revenue for the quarter was up 14.8% on a year-over-year basis. Sell-side analysts expect that Excelerate Energy will post 1.16 earnings per share for the current fiscal year.

Excelerate Energy Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Stockholders of record on Wednesday, August 20th will be given a dividend of $0.08 per share. This represents a $0.32 dividend on an annualized basis and a dividend yield of 1.3%. This is a boost from Excelerate Energy's previous quarterly dividend of $0.06. Excelerate Energy's dividend payout ratio is 16.33%.

About Excelerate Energy

(

Get Free Report)

Excelerate Energy, Inc provides flexible liquefied natural gas (LNG) solutions worldwide. The company offers regasification services, including floating storage and regasification units (FSRUs), infrastructure development, and LNG and natural gas supply, procurement, and distribution services; LNG terminal services; and natural gas supply to-power projects.

Featured Articles

Before you consider Excelerate Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Excelerate Energy wasn't on the list.

While Excelerate Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.