Fastenal (NASDAQ:FAST - Get Free Report) will likely be issuing its Q3 2025 results before the market opens on Monday, October 13th. Analysts expect the company to announce earnings of $0.30 per share and revenue of $2.1291 billion for the quarter. Investors are encouraged to explore the company's upcoming Q3 2025 earningoverview page for the latest details on the call scheduled for Monday, October 13, 2025 at 10:00 AM ET.

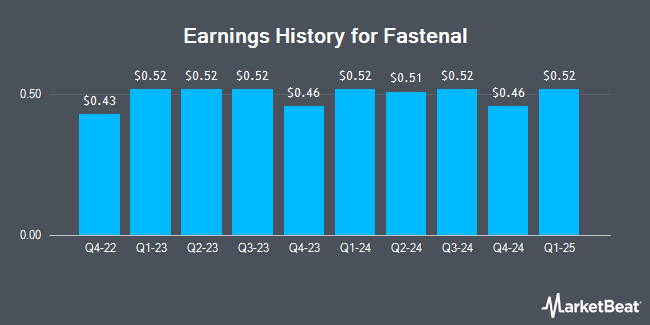

Fastenal (NASDAQ:FAST - Get Free Report) last released its quarterly earnings data on Monday, July 14th. The company reported $0.29 EPS for the quarter, topping analysts' consensus estimates of $0.28 by $0.01. The company had revenue of $2.08 billion for the quarter, compared to the consensus estimate of $2.07 billion. Fastenal had a return on equity of 32.33% and a net margin of 15.30%.The company's quarterly revenue was up 8.6% compared to the same quarter last year. During the same period last year, the business posted $0.25 EPS. On average, analysts expect Fastenal to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Fastenal Stock Performance

Fastenal stock opened at $47.88 on Monday. The stock's 50-day moving average is $48.18 and its 200-day moving average is $43.64. The company has a market cap of $54.95 billion, a price-to-earnings ratio of 46.04, a price-to-earnings-growth ratio of 4.34 and a beta of 0.94. The company has a debt-to-equity ratio of 0.03, a current ratio of 4.22 and a quick ratio of 2.12. Fastenal has a 12 month low of $34.69 and a 12 month high of $50.63.

Fastenal Cuts Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Stockholders of record on Tuesday, July 29th were issued a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a dividend yield of 1.8%. The ex-dividend date was Tuesday, July 29th. Fastenal's dividend payout ratio (DPR) is 84.62%.

Insiders Place Their Bets

In other news, CFO Sheryl Ann Lisowski sold 21,052 shares of the business's stock in a transaction on Thursday, July 17th. The stock was sold at an average price of $45.21, for a total value of $951,760.92. Following the sale, the chief financial officer owned 10,192 shares of the company's stock, valued at approximately $460,780.32. The trade was a 67.38% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, EVP John Lewis Soderberg sold 34,612 shares of the business's stock in a transaction on Friday, August 8th. The stock was sold at an average price of $48.03, for a total value of $1,662,414.36. The disclosure for this sale can be found here. Insiders sold 111,230 shares of company stock worth $5,288,364 over the last 90 days. Insiders own 0.37% of the company's stock.

Institutional Trading of Fastenal

A number of hedge funds and other institutional investors have recently modified their holdings of FAST. Bank of America Corp DE raised its stake in shares of Fastenal by 106.1% in the 2nd quarter. Bank of America Corp DE now owns 15,431,393 shares of the company's stock worth $648,118,000 after buying an additional 7,943,217 shares in the last quarter. Raymond James Financial Inc. raised its stake in shares of Fastenal by 112.1% in the 2nd quarter. Raymond James Financial Inc. now owns 2,771,861 shares of the company's stock worth $116,418,000 after buying an additional 1,464,781 shares in the last quarter. California State Teachers Retirement System raised its stake in shares of Fastenal by 92.3% in the 2nd quarter. California State Teachers Retirement System now owns 1,802,941 shares of the company's stock worth $75,724,000 after buying an additional 865,170 shares in the last quarter. CANADA LIFE ASSURANCE Co raised its stake in shares of Fastenal by 75.3% in the 2nd quarter. CANADA LIFE ASSURANCE Co now owns 1,791,974 shares of the company's stock worth $75,364,000 after buying an additional 769,601 shares in the last quarter. Finally, Sei Investments Co. raised its stake in shares of Fastenal by 251.0% in the 2nd quarter. Sei Investments Co. now owns 1,021,562 shares of the company's stock worth $42,906,000 after buying an additional 730,504 shares in the last quarter. Institutional investors own 81.38% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently commented on FAST shares. Wolfe Research restated a "positive" rating on shares of Fastenal in a report on Monday, July 14th. Robert W. Baird upgraded Fastenal from a "neutral" rating to an "outperform" rating and raised their target price for the company from $47.00 to $55.00 in a report on Thursday, August 7th. Loop Capital restated a "hold" rating on shares of Fastenal in a report on Tuesday, July 15th. Baird R W upgraded Fastenal from a "hold" rating to a "strong-buy" rating in a report on Thursday, August 7th. Finally, Northcoast Research initiated coverage on Fastenal in a report on Thursday, August 21st. They set a "neutral" rating on the stock. One analyst has rated the stock with a Strong Buy rating, five have given a Buy rating, eight have given a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $46.82.

Read Our Latest Stock Analysis on Fastenal

Fastenal Company Profile

(

Get Free Report)

Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, North America, and internationally. It offers fasteners, and related industrial and construction supplies under the Fastenal name. The company's fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers that are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fastenal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fastenal wasn't on the list.

While Fastenal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report