Fifth Third Bancorp (NASDAQ:FITB - Get Free Report) has been given a $60.00 price objective by research analysts at Morgan Stanley in a report issued on Tuesday, Marketbeat Ratings reports. The firm presently has an "overweight" rating on the financial services provider's stock. Morgan Stanley's price target indicates a potential upside of 37.02% from the stock's previous close.

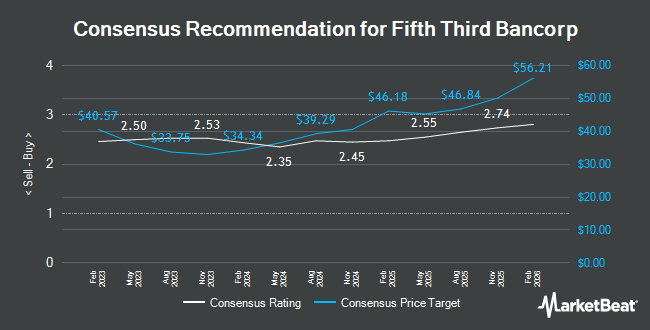

FITB has been the subject of a number of other research reports. Citigroup lifted their price objective on shares of Fifth Third Bancorp from $47.00 to $50.00 and gave the company a "neutral" rating in a report on Tuesday, September 23rd. Weiss Ratings reiterated a "buy (b-)" rating on shares of Fifth Third Bancorp in a report on Saturday, September 27th. DA Davidson upgraded shares of Fifth Third Bancorp from a "hold" rating to a "strong-buy" rating and lifted their price objective for the company from $42.00 to $47.00 in a report on Monday, June 9th. Truist Financial lifted their price objective on shares of Fifth Third Bancorp from $48.00 to $52.00 and gave the company a "buy" rating in a report on Friday, September 12th. Finally, Robert W. Baird lifted their price objective on shares of Fifth Third Bancorp from $48.00 to $50.00 and gave the company an "outperform" rating in a report on Thursday, October 2nd. Two investment analysts have rated the stock with a Strong Buy rating, fourteen have given a Buy rating and four have assigned a Hold rating to the stock. According to data from MarketBeat.com, Fifth Third Bancorp presently has a consensus rating of "Moderate Buy" and a consensus price target of $49.71.

View Our Latest Analysis on FITB

Fifth Third Bancorp Price Performance

Fifth Third Bancorp stock opened at $43.79 on Tuesday. The firm has a 50-day moving average price of $44.13 and a 200-day moving average price of $40.64. The firm has a market capitalization of $28.98 billion, a PE ratio of 13.60, a price-to-earnings-growth ratio of 1.42 and a beta of 0.95. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 0.76. Fifth Third Bancorp has a 12-month low of $32.25 and a 12-month high of $49.07.

Fifth Third Bancorp announced that its board has approved a stock repurchase plan on Monday, June 16th that allows the company to repurchase 100,000,000 shares. This repurchase authorization allows the financial services provider to buy shares of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's board believes its stock is undervalued.

Institutional Investors Weigh In On Fifth Third Bancorp

Large investors have recently modified their holdings of the business. Evolution Wealth Management Inc. bought a new stake in shares of Fifth Third Bancorp in the 2nd quarter valued at about $26,000. HWG Holdings LP acquired a new stake in Fifth Third Bancorp in the first quarter valued at approximately $27,000. Banque Transatlantique SA acquired a new stake in Fifth Third Bancorp in the first quarter valued at approximately $27,000. Activest Wealth Management boosted its stake in Fifth Third Bancorp by 1,043.3% in the second quarter. Activest Wealth Management now owns 686 shares of the financial services provider's stock valued at $28,000 after acquiring an additional 626 shares in the last quarter. Finally, Larson Financial Group LLC boosted its stake in Fifth Third Bancorp by 91.3% in the first quarter. Larson Financial Group LLC now owns 748 shares of the financial services provider's stock valued at $29,000 after acquiring an additional 357 shares in the last quarter. Institutional investors own 83.79% of the company's stock.

Fifth Third Bancorp Company Profile

(

Get Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Further Reading

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.