Analysts at Royal Bank Of Canada assumed coverage on shares of Figma (NYSE:FIG - Get Free Report) in a report released on Monday. The brokerage set a "sector perform" rating and a $75.00 price target on the stock. Royal Bank Of Canada's price target indicates a potential downside of 3.04% from the stock's previous close.

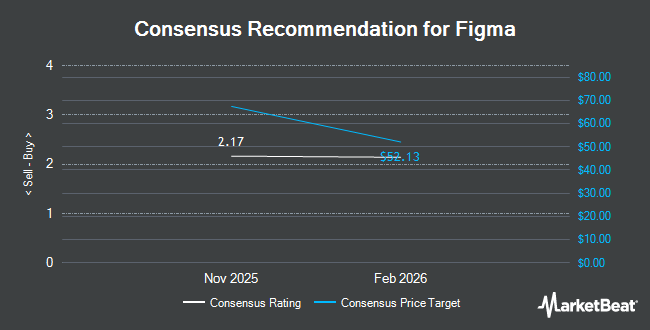

A number of other equities research analysts have also issued reports on FIG. JPMorgan Chase & Co. initiated coverage on Figma in a research note on Monday. They issued a "neutral" rating and a $65.00 target price on the stock. Piper Sandler initiated coverage on Figma in a research note on Wednesday, August 20th. They issued an "overweight" rating and a $85.00 target price on the stock. Wolfe Research assumed coverage on Figma in a research note on Monday. They issued a "peer perform" rating on the stock. Wall Street Zen upgraded shares of Figma to a "hold" rating in a report on Saturday, August 9th. Finally, The Goldman Sachs Group assumed coverage on shares of Figma in a report on Monday. They issued a "neutral" rating and a $48.00 target price on the stock. Three equities research analysts have rated the stock with a Buy rating and seven have assigned a Hold rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $74.29.

Get Our Latest Analysis on FIG

Figma Stock Performance

Figma stock opened at $77.35 on Monday. Figma has a 52 week low of $67.00 and a 52 week high of $142.92. The stock has a market capitalization of $37.71 billion and a P/E ratio of 104.53.

Insider Activity at Figma

In other Figma news, Director Daniel H. Rimer sold 3,293,276 shares of the stock in a transaction on Friday, August 1st. The stock was sold at an average price of $31.52, for a total transaction of $103,804,059.52. Following the transaction, the director owned 834,800 shares of the company's stock, valued at $26,312,896. This represents a 79.78% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this link. Also, major shareholder Greylock Xiv Gp Llc sold 3,074,755 shares of the stock in a transaction on Friday, August 1st. The stock was sold at an average price of $31.51, for a total value of $96,885,530.05. Following the transaction, the insider directly owned 2,921,029 shares in the company, valued at approximately $92,041,623.79. This represents a 51.28% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have bought 312,500 shares of company stock worth $10,312,500 and have sold 19,617,451 shares worth $618,294,215.

About Figma

(

Get Free Report)

Figma is where teams come together to turn ideas into the world's best digital products and experiences. Every day, billions of people around the world use apps, websites, and other digital experiences that are made in Figma. They're looking up directions on Google Maps; requesting rides with Uber; checking in for flights on JetBlue; streaming shows on Netflix; learning languages with Duolingo; asking questions of Claude; connecting on LinkedIn; buying goods on Mercado Libre; or booking stays and experiences with Airbnb.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Figma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Figma wasn't on the list.

While Figma currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.