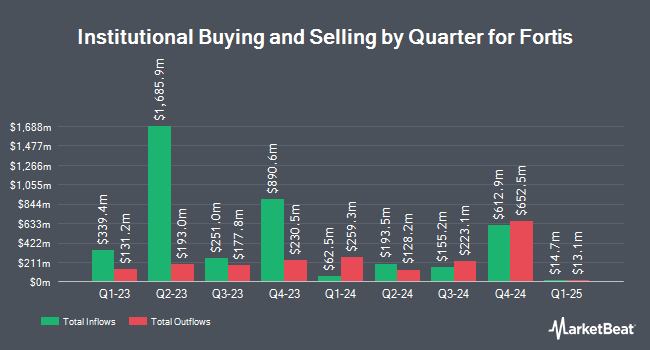

111 Capital cut its holdings in shares of Fortis (NYSE:FTS - Free Report) by 43.4% during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 30,583 shares of the utilities provider's stock after selling 23,414 shares during the period. 111 Capital's holdings in Fortis were worth $1,461,000 at the end of the most recent quarter.

Other hedge funds have also recently added to or reduced their stakes in the company. Goldman Sachs Group Inc. lifted its position in shares of Fortis by 218.6% during the first quarter. Goldman Sachs Group Inc. now owns 3,648,592 shares of the utilities provider's stock worth $166,303,000 after purchasing an additional 2,503,531 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its holdings in Fortis by 52.0% during the 1st quarter. Connor Clark & Lunn Investment Management Ltd. now owns 4,922,870 shares of the utilities provider's stock worth $224,278,000 after buying an additional 1,683,377 shares in the last quarter. Caisse DE Depot ET Placement DU Quebec bought a new position in Fortis in the 1st quarter valued at $54,838,000. TD Asset Management Inc increased its stake in shares of Fortis by 4.9% in the 1st quarter. TD Asset Management Inc now owns 12,870,736 shares of the utilities provider's stock valued at $586,192,000 after buying an additional 604,615 shares during the period. Finally, Vanguard Group Inc. raised its position in shares of Fortis by 2.5% during the first quarter. Vanguard Group Inc. now owns 22,265,742 shares of the utilities provider's stock worth $1,014,227,000 after acquiring an additional 542,749 shares during the last quarter. Institutional investors own 57.77% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts recently issued reports on the company. Zacks Research cut Fortis from a "strong-buy" rating to a "hold" rating in a report on Monday, August 18th. Raymond James Financial reiterated an "outperform" rating on shares of Fortis in a research report on Tuesday, August 5th. National Bankshares restated a "sector perform" rating on shares of Fortis in a report on Tuesday, August 5th. Desjardins raised shares of Fortis from a "hold" rating to a "buy" rating in a research note on Tuesday, August 5th. Finally, TD Securities reaffirmed a "buy" rating on shares of Fortis in a report on Tuesday, August 5th. One research analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and five have assigned a Hold rating to the company. According to MarketBeat, Fortis currently has a consensus rating of "Moderate Buy" and a consensus price target of $72.00.

Read Our Latest Stock Analysis on FTS

Fortis Stock Performance

Shares of NYSE:FTS opened at $50.26 on Friday. The firm's 50 day simple moving average is $49.82 and its 200 day simple moving average is $48.18. Fortis has a fifty-two week low of $40.32 and a fifty-two week high of $51.45. The company has a market capitalization of $25.32 billion, a price-to-earnings ratio of 20.68, a P/E/G ratio of 3.91 and a beta of 0.50. The company has a debt-to-equity ratio of 1.30, a current ratio of 0.58 and a quick ratio of 0.47.

Fortis (NYSE:FTS - Get Free Report) last issued its earnings results on Friday, August 1st. The utilities provider reported $0.55 EPS for the quarter, beating the consensus estimate of $0.51 by $0.04. The firm had revenue of $2.03 billion during the quarter, compared to the consensus estimate of $1.91 billion. Fortis had a net margin of 14.48% and a return on equity of 7.24%. During the same quarter in the prior year, the firm earned $0.67 earnings per share. As a group, sell-side analysts forecast that Fortis will post 2.35 earnings per share for the current year.

Fortis Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, September 1st. Shareholders of record on Tuesday, August 19th were issued a dividend of $0.4448 per share. This is a boost from Fortis's previous quarterly dividend of $0.43. This represents a $1.78 annualized dividend and a yield of 3.5%. The ex-dividend date was Tuesday, August 19th. Fortis's dividend payout ratio is presently 72.84%.

Fortis Profile

(

Free Report)

Fortis Inc operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries. It generates, transmits, and distributes electricity to approximately 447,000 retail customers in southeastern Arizona; and 103,000 retail customers in Arizona's Mohave and Santa Cruz counties with an aggregate capacity of 3,408 megawatts (MW), including 68 MW of solar capacity and 250 MV of wind capacity.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fortis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortis wasn't on the list.

While Fortis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.