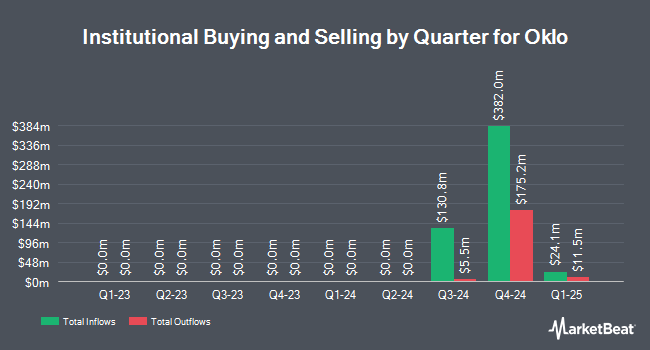

Wedbush Securities Inc. acquired a new position in shares of Oklo Inc. (NYSE:OKLO - Free Report) during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 12,085 shares of the company's stock, valued at approximately $261,000.

Several other institutional investors have also modified their holdings of the business. TD Waterhouse Canada Inc. acquired a new stake in shares of Oklo during the 4th quarter valued at $27,000. CoreCap Advisors LLC acquired a new position in Oklo during the fourth quarter worth $32,000. Covestor Ltd bought a new position in shares of Oklo in the fourth quarter worth about $34,000. KBC Group NV acquired a new stake in Oklo during the first quarter worth about $36,000. Finally, Graybill Wealth Management LTD. bought a new position in Oklo during the first quarter worth about $43,000. Institutional investors and hedge funds own 85.03% of the company's stock.

Oklo Stock Down 5.8%

Shares of OKLO traded down $4.38 during trading on Tuesday, reaching $71.12. The company's stock had a trading volume of 15,853,669 shares, compared to its average volume of 18,257,945. The company has a fifty day moving average of $57.10 and a two-hundred day moving average of $40.16. Oklo Inc. has a twelve month low of $5.35 and a twelve month high of $78.13. The company has a market cap of $9.92 billion, a price-to-earnings ratio of -13.15 and a beta of 0.57.

Oklo (NYSE:OKLO - Get Free Report) last announced its quarterly earnings results on Tuesday, May 13th. The company reported ($0.07) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.11) by $0.04. As a group, equities analysts forecast that Oklo Inc. will post -8.2 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of equities research analysts have recently issued reports on OKLO shares. BNP Paribas Exane initiated coverage on shares of Oklo in a report on Friday. They issued an "underperform" rating and a $14.00 target price on the stock. Wedbush set a $75.00 target price on shares of Oklo and gave the company an "outperform" rating in a report on Thursday, June 12th. Seaport Res Ptn raised shares of Oklo from a "hold" rating to a "strong-buy" rating in a research report on Monday, June 9th. William Blair started coverage on shares of Oklo in a research note on Wednesday, May 28th. They issued an "outperform" rating on the stock. Finally, Daiwa America upgraded shares of Oklo from a "hold" rating to a "strong-buy" rating in a research note on Sunday. Two equities research analysts have rated the stock with a sell rating, three have given a hold rating, six have issued a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $59.33.

Check Out Our Latest Stock Report on OKLO

Insider Activity

In related news, CEO Jacob Dewitte sold 300,000 shares of the stock in a transaction that occurred on Monday, June 30th. The stock was sold at an average price of $55.20, for a total transaction of $16,560,000.00. Following the completion of the sale, the chief executive officer owned 10,105,098 shares in the company, valued at $557,801,409.60. This represents a 2.88% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Michael Stuart Klein sold 50,000 shares of the stock in a transaction that occurred on Monday, June 23rd. The stock was sold at an average price of $54.85, for a total value of $2,742,500.00. Following the completion of the transaction, the director directly owned 200,000 shares of the company's stock, valued at approximately $10,970,000. The trade was a 20.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 600,000 shares of company stock valued at $35,066,500. 18.90% of the stock is currently owned by corporate insiders.

Oklo Company Profile

(

Free Report)

Oklo Inc designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States. It also provides used nuclear fuel recycling services. The company was founded in 2013 and is based in Santa Clara, California.

Further Reading

Before you consider Oklo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oklo wasn't on the list.

While Oklo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.