Strs Ohio acquired a new position in IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 14,000 shares of the company's stock, valued at approximately $5,879,000.

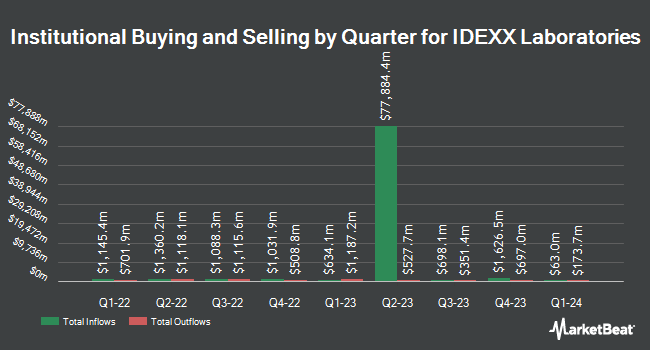

A number of other large investors have also added to or reduced their stakes in IDXX. Royal Bank of Canada raised its holdings in IDEXX Laboratories by 9.7% in the fourth quarter. Royal Bank of Canada now owns 481,140 shares of the company's stock worth $198,923,000 after purchasing an additional 42,364 shares in the last quarter. Tema Etfs LLC acquired a new position in shares of IDEXX Laboratories during the fourth quarter valued at about $304,000. Tang Capital Management LLC acquired a new position in shares of IDEXX Laboratories during the fourth quarter valued at about $2,067,000. Strategic Global Advisors LLC increased its holdings in shares of IDEXX Laboratories by 4.0% during the fourth quarter. Strategic Global Advisors LLC now owns 9,888 shares of the company's stock valued at $4,088,000 after acquiring an additional 384 shares in the last quarter. Finally, Tidal Investments LLC increased its holdings in IDEXX Laboratories by 83.7% in the 4th quarter. Tidal Investments LLC now owns 11,591 shares of the company's stock worth $4,792,000 after buying an additional 5,281 shares during the period. 87.84% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts recently weighed in on IDXX shares. Morgan Stanley increased their price target on shares of IDEXX Laboratories from $722.00 to $765.00 and gave the stock an "overweight" rating in a report on Friday, August 15th. Wall Street Zen upgraded IDEXX Laboratories from a "hold" rating to a "buy" rating in a research report on Saturday, July 12th. Leerink Partners increased their price objective on IDEXX Laboratories from $580.00 to $600.00 and gave the company an "outperform" rating in a research note on Thursday, July 17th. Piper Sandler reiterated a "neutral" rating and issued a $700.00 price objective (up from $510.00) on shares of IDEXX Laboratories in a research report on Monday, August 11th. Finally, JPMorgan Chase & Co. lifted their target price on shares of IDEXX Laboratories from $550.00 to $675.00 and gave the company an "overweight" rating in a report on Monday, August 4th. One research analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating and three have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, IDEXX Laboratories has an average rating of "Moderate Buy" and an average target price of $649.44.

Get Our Latest Stock Report on IDXX

IDEXX Laboratories Stock Performance

Shares of NASDAQ:IDXX traded up $1.66 during trading on Tuesday, reaching $645.65. The company had a trading volume of 404,494 shares, compared to its average volume of 368,687. The stock's fifty day moving average price is $607.69 and its 200 day moving average price is $516.54. IDEXX Laboratories, Inc. has a fifty-two week low of $356.14 and a fifty-two week high of $688.12. The firm has a market capitalization of $51.65 billion, a price-to-earnings ratio of 53.76, a price-to-earnings-growth ratio of 4.17 and a beta of 1.56. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.11 and a quick ratio of 0.79.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The company reported $3.63 earnings per share for the quarter, topping analysts' consensus estimates of $3.28 by $0.35. The firm had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.06 billion. IDEXX Laboratories had a return on equity of 64.42% and a net margin of 24.41%.IDEXX Laboratories's quarterly revenue was up 10.6% on a year-over-year basis. During the same quarter in the prior year, the company posted $2.44 earnings per share. IDEXX Laboratories has set its FY 2025 guidance at 12.400-12.760 EPS. As a group, equities research analysts predict that IDEXX Laboratories, Inc. will post 11.93 EPS for the current year.

Insiders Place Their Bets

In related news, EVP Michael G. Erickson sold 406 shares of the company's stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $649.96, for a total value of $263,883.76. Following the completion of the transaction, the executive vice president directly owned 11,287 shares in the company, valued at approximately $7,336,098.52. This represents a 3.47% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, EVP Michael Lane sold 8,411 shares of the company's stock in a transaction on Wednesday, August 6th. The shares were sold at an average price of $627.74, for a total value of $5,279,921.14. Following the completion of the transaction, the executive vice president owned 7,132 shares of the company's stock, valued at $4,477,041.68. The trade was a 54.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 54,057 shares of company stock valued at $34,293,468. Insiders own 0.98% of the company's stock.

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Featured Articles

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.