Ascent Group LLC purchased a new stake in PLDT Inc. (NYSE:PHI - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 14,640 shares of the technology company's stock, valued at approximately $320,000.

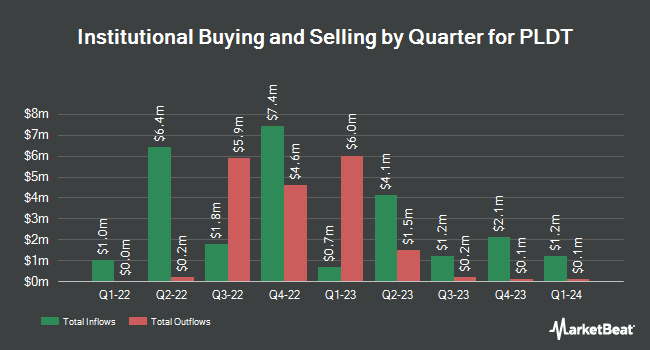

A number of other large investors also recently added to or reduced their stakes in the stock. BNP Paribas Financial Markets increased its stake in shares of PLDT by 49.4% during the fourth quarter. BNP Paribas Financial Markets now owns 4,396 shares of the technology company's stock worth $97,000 after purchasing an additional 1,453 shares in the last quarter. Northern Trust Corp boosted its holdings in PLDT by 1,189.5% in the 4th quarter. Northern Trust Corp now owns 138,992 shares of the technology company's stock worth $3,079,000 after buying an additional 128,213 shares during the last quarter. GAMMA Investing LLC increased its stake in PLDT by 3,217.4% during the 1st quarter. GAMMA Investing LLC now owns 48,136 shares of the technology company's stock worth $1,053,000 after buying an additional 46,685 shares in the last quarter. Robeco Institutional Asset Management B.V. increased its position in shares of PLDT by 14.8% during the first quarter. Robeco Institutional Asset Management B.V. now owns 120,974 shares of the technology company's stock worth $2,646,000 after purchasing an additional 15,610 shares in the last quarter. Finally, US Bancorp DE raised its stake in PLDT by 12.8% in the 1st quarter. US Bancorp DE now owns 20,140 shares of the technology company's stock valued at $440,000 after purchasing an additional 2,279 shares during the last quarter. 2.26% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

PHI has been the topic of several research reports. Wall Street Zen downgraded shares of PLDT from a "buy" rating to a "hold" rating in a research note on Friday, June 6th. UBS Group lowered shares of PLDT from a "buy" rating to a "neutral" rating in a research note on Wednesday, August 27th. Finally, Zacks Research upgraded PLDT to a "strong sell" rating in a report on Tuesday, August 12th. One investment analyst has rated the stock with a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat.com, PLDT has an average rating of "Reduce".

Read Our Latest Stock Report on PHI

PLDT Trading Up 0.9%

Shares of PHI stock traded up $0.17 during trading on Wednesday, hitting $19.83. 14,792 shares of the stock traded hands, compared to its average volume of 76,044. PLDT Inc. has a 52-week low of $19.22 and a 52-week high of $27.93. The firm has a market capitalization of $4.28 billion, a P/E ratio of 7.66, a price-to-earnings-growth ratio of 1.72 and a beta of 0.66. The firm's fifty day moving average price is $21.81 and its 200-day moving average price is $22.40. The company has a debt-to-equity ratio of 2.16, a current ratio of 0.37 and a quick ratio of 0.35.

PLDT Increases Dividend

The firm also recently announced a semi-annual dividend, which will be paid on Wednesday, September 24th. Shareholders of record on Wednesday, August 27th will be given a $0.8414 dividend. This is an increase from PLDT's previous semi-annual dividend of $0.81. This represents a yield of 530.0%. The ex-dividend date is Wednesday, August 27th. PLDT's dividend payout ratio (DPR) is presently 47.10%.

About PLDT

(

Free Report)

PLDT Inc provides telecommunications and digital services in the Philippines. The company operates through three segments: Wireless, Fixed Line, and Others. It offers cellular mobile, Internet broadband distribution, operations support, software development, and satellite information and messaging services; and sells Wi-Fi access equipment.

Featured Stories

Before you consider PLDT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PLDT wasn't on the list.

While PLDT currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.