Strs Ohio purchased a new stake in shares of Village Super Market, Inc. (NASDAQ:VLGEA - Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 15,100 shares of the company's stock, valued at approximately $574,000. Strs Ohio owned approximately 0.10% of Village Super Market at the end of the most recent quarter.

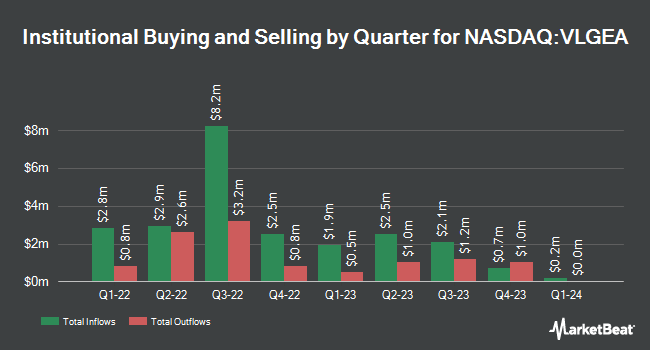

Several other institutional investors also recently bought and sold shares of VLGEA. Abound Wealth Management purchased a new position in Village Super Market during the first quarter valued at approximately $57,000. GAMMA Investing LLC increased its position in shares of Village Super Market by 8,860.7% in the first quarter. GAMMA Investing LLC now owns 2,509 shares of the company's stock valued at $95,000 after buying an additional 2,481 shares in the last quarter. BNP Paribas Financial Markets increased its position in shares of Village Super Market by 239.9% in the fourth quarter. BNP Paribas Financial Markets now owns 5,945 shares of the company's stock valued at $190,000 after buying an additional 4,196 shares in the last quarter. Deutsche Bank AG increased its position in shares of Village Super Market by 129.2% in the fourth quarter. Deutsche Bank AG now owns 6,270 shares of the company's stock valued at $200,000 after buying an additional 3,534 shares in the last quarter. Finally, Trexquant Investment LP purchased a new stake in shares of Village Super Market in the first quarter valued at approximately $202,000. 39.02% of the stock is currently owned by hedge funds and other institutional investors.

Village Super Market Trading Down 0.1%

Shares of VLGEA stock traded down $0.06 on Tuesday, hitting $37.62. The stock had a trading volume of 14,384 shares, compared to its average volume of 46,062. The company has a debt-to-equity ratio of 0.15, a current ratio of 1.06 and a quick ratio of 0.78. The firm has a market capitalization of $555.20 million, a P/E ratio of 9.93 and a beta of 0.53. Village Super Market, Inc. has a 1 year low of $28.33 and a 1 year high of $40.15. The company's 50 day moving average price is $36.48 and its 200-day moving average price is $36.53.

Village Super Market Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 23rd. Shareholders of record on Thursday, October 2nd will be issued a dividend of $0.25 per share. The ex-dividend date is Thursday, October 2nd. This represents a $1.00 annualized dividend and a yield of 2.7%. Village Super Market's dividend payout ratio is 26.39%.

Wall Street Analyst Weigh In

Separately, Wall Street Zen lowered Village Super Market from a "strong-buy" rating to a "buy" rating in a research note on Saturday, August 9th.

View Our Latest Report on VLGEA

About Village Super Market

(

Free Report)

Village Super Market, Inc operates a chain of supermarkets in the United States. The company offers grocery, meat, produce, dairy, deli, seafood, prepared foods, and bakery and frozen foods. It also provides non-food products, including health and beauty care, general merchandise, liquor, and pharmacy products through retail and online stores.

Featured Articles

Before you consider Village Super Market, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Village Super Market wasn't on the list.

While Village Super Market currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.