Letko Brosseau & Associates Inc. acquired a new position in Adobe Inc. (NASDAQ:ADBE - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm acquired 160,141 shares of the software company's stock, valued at approximately $61,419,000.

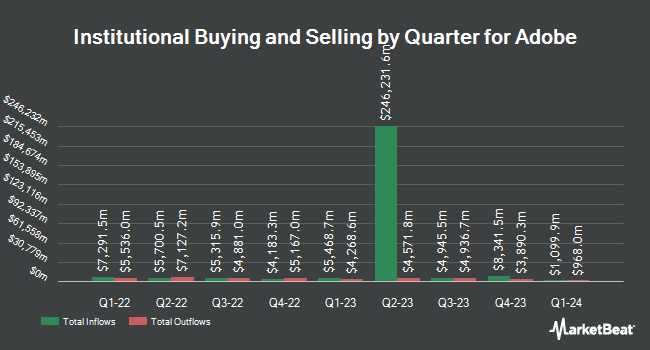

Other institutional investors and hedge funds have also bought and sold shares of the company. North Star Asset Management Inc. raised its stake in Adobe by 2.4% during the first quarter. North Star Asset Management Inc. now owns 91,046 shares of the software company's stock valued at $34,919,000 after buying an additional 2,170 shares during the last quarter. GS Investments Inc. raised its stake in Adobe by 0.3% during the first quarter. GS Investments Inc. now owns 7,563 shares of the software company's stock valued at $2,901,000 after buying an additional 26 shares during the last quarter. FSB Premier Wealth Management Inc. raised its stake in Adobe by 56.5% during the first quarter. FSB Premier Wealth Management Inc. now owns 1,091 shares of the software company's stock valued at $418,000 after buying an additional 394 shares during the last quarter. Modera Wealth Management LLC raised its stake in Adobe by 1.7% during the first quarter. Modera Wealth Management LLC now owns 21,472 shares of the software company's stock valued at $8,235,000 after buying an additional 356 shares during the last quarter. Finally, SlateStone Wealth LLC raised its stake in Adobe by 8.9% during the first quarter. SlateStone Wealth LLC now owns 7,895 shares of the software company's stock valued at $3,028,000 after buying an additional 647 shares during the last quarter. Hedge funds and other institutional investors own 81.79% of the company's stock.

Adobe Trading Down 2.8%

ADBE stock traded down $9.89 during midday trading on Friday, reaching $347.80. 4,305,938 shares of the company traded hands, compared to its average volume of 3,775,404. Adobe Inc. has a 52-week low of $332.01 and a 52-week high of $587.75. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.99 and a current ratio of 0.99. The business has a 50 day moving average of $386.92 and a 200-day moving average of $399.51. The firm has a market capitalization of $147.54 billion, a price-to-earnings ratio of 22.25, a P/E/G ratio of 1.73 and a beta of 1.51.

Adobe (NASDAQ:ADBE - Get Free Report) last issued its quarterly earnings data on Thursday, June 12th. The software company reported $5.06 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $4.97 by $0.09. Adobe had a return on equity of 53.68% and a net margin of 30.39%. The business had revenue of $5.87 billion for the quarter, compared to the consensus estimate of $5.80 billion. During the same period in the prior year, the business posted $4.48 earnings per share. The company's quarterly revenue was up 10.6% compared to the same quarter last year. As a group, sell-side analysts expect that Adobe Inc. will post 16.65 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts have issued reports on ADBE shares. Morgan Stanley lowered their price objective on Adobe from $600.00 to $510.00 and set an "overweight" rating for the company in a research note on Wednesday, April 16th. Wall Street Zen raised Adobe from a "hold" rating to a "buy" rating in a report on Saturday, July 26th. Evercore ISI reissued an "outperform" rating and issued a $475.00 target price on shares of Adobe in a report on Friday, June 13th. Rothschild & Co Redburn lowered Adobe from a "neutral" rating to a "sell" rating and set a $280.00 target price for the company. in a report on Wednesday, July 2nd. Finally, Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $480.00 price objective on shares of Adobe in a report on Thursday, June 5th. Two analysts have rated the stock with a sell rating, eight have given a hold rating, sixteen have assigned a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, Adobe presently has an average rating of "Moderate Buy" and a consensus price target of $473.88.

View Our Latest Research Report on Adobe

Adobe Profile

(

Free Report)

Adobe Inc, together with its subsidiaries, operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products, services, and solutions that enable individuals, teams, and enterprises to create, publish, and promote content; and Document Cloud, a unified cloud-based document services platform.

See Also

Before you consider Adobe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adobe wasn't on the list.

While Adobe currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.