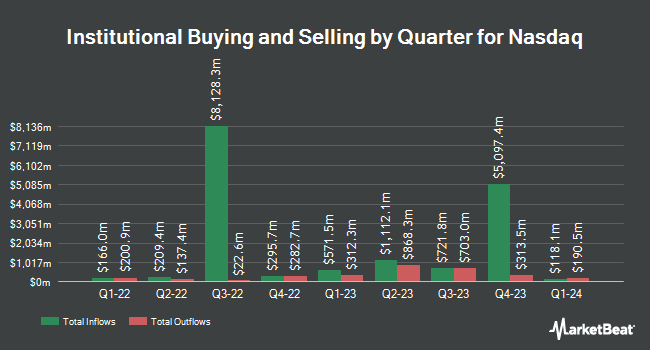

Neville Rodie & Shaw Inc. bought a new position in Nasdaq, Inc. (NASDAQ:NDAQ - Free Report) during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm bought 20,275 shares of the financial services provider's stock, valued at approximately $1,813,000.

Other institutional investors have also recently bought and sold shares of the company. Grove Bank & Trust raised its holdings in Nasdaq by 194.6% in the 1st quarter. Grove Bank & Trust now owns 327 shares of the financial services provider's stock worth $25,000 after acquiring an additional 216 shares during the period. Highline Wealth Partners LLC grew its position in Nasdaq by 1,509.5% in the 1st quarter. Highline Wealth Partners LLC now owns 338 shares of the financial services provider's stock worth $26,000 after purchasing an additional 317 shares during the last quarter. Opal Wealth Advisors LLC acquired a new stake in Nasdaq in the 1st quarter worth $26,000. First Command Advisory Services Inc. acquired a new stake in Nasdaq in the 1st quarter worth $30,000. Finally, AlphaQuest LLC acquired a new stake in Nasdaq in the 1st quarter worth $34,000. Institutional investors own 72.47% of the company's stock.

Insider Activity at Nasdaq

In related news, EVP Bradley J. Peterson sold 11,508 shares of Nasdaq stock in a transaction dated Wednesday, July 2nd. The shares were sold at an average price of $88.87, for a total transaction of $1,022,715.96. Following the completion of the transaction, the executive vice president directly owned 111,035 shares of the company's stock, valued at $9,867,680.45. This trade represents a 9.39% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, EVP Jeremy Skule sold 2,105 shares of Nasdaq stock in a transaction dated Friday, August 1st. The shares were sold at an average price of $95.49, for a total transaction of $201,006.45. Following the transaction, the executive vice president directly owned 92,551 shares of the company's stock, valued at $8,837,694.99. This represents a 2.22% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 24,409 shares of company stock valued at $2,223,599 in the last ninety days. Insiders own 0.70% of the company's stock.

Analyst Ratings Changes

Several analysts have issued reports on NDAQ shares. Morgan Stanley raised their price target on shares of Nasdaq from $75.00 to $86.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 15th. The Goldman Sachs Group restated a "buy" rating on shares of Nasdaq in a research report on Friday, July 25th. Deutsche Bank Aktiengesellschaft raised their price target on shares of Nasdaq from $97.00 to $105.00 and gave the stock a "buy" rating in a research report on Friday, July 25th. Citigroup restated a "neutral" rating on shares of Nasdaq in a research report on Wednesday, July 9th. Finally, Keefe, Bruyette & Woods raised their price target on shares of Nasdaq from $103.00 to $104.00 and gave the stock an "outperform" rating in a research report on Friday, July 25th. Fourteen analysts have rated the stock with a Buy rating and three have given a Hold rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $97.06.

Read Our Latest Stock Report on NDAQ

Nasdaq Price Performance

Shares of Nasdaq stock opened at $93.95 on Friday. The company has a debt-to-equity ratio of 0.73, a quick ratio of 0.96 and a current ratio of 0.96. The firm's 50-day simple moving average is $93.60 and its 200-day simple moving average is $84.16. Nasdaq, Inc. has a twelve month low of $64.84 and a twelve month high of $97.63. The firm has a market cap of $53.91 billion, a P/E ratio of 36.13, a price-to-earnings-growth ratio of 2.10 and a beta of 1.02.

Nasdaq (NASDAQ:NDAQ - Get Free Report) last issued its earnings results on Thursday, July 24th. The financial services provider reported $0.85 earnings per share for the quarter, beating the consensus estimate of $0.78 by $0.07. Nasdaq had a net margin of 18.59% and a return on equity of 15.90%. The business had revenue of $1.31 billion for the quarter, compared to analyst estimates of $1.26 billion. During the same period in the previous year, the business earned $0.69 EPS. The firm's revenue was up 12.7% on a year-over-year basis. As a group, research analysts expect that Nasdaq, Inc. will post 3.18 EPS for the current fiscal year.

Nasdaq Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Friday, September 12th will be issued a dividend of $0.27 per share. This represents a $1.08 annualized dividend and a yield of 1.1%. The ex-dividend date of this dividend is Friday, September 12th. Nasdaq's dividend payout ratio (DPR) is currently 41.54%.

Nasdaq Company Profile

(

Free Report)

Nasdaq, Inc operates as a technology company that serves capital markets and other industries worldwide. It operates in three segments: Capital Access Platforms, Financial Technology, and Market Services. The Capital Access Platforms segment sells and distributes historical and real-time market data; and develops and licenses Nasdaq-branded indices and financial products.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nasdaq, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nasdaq wasn't on the list.

While Nasdaq currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.