Essex Investment Management Co. LLC purchased a new position in shares of Potbelly Corporation (NASDAQ:PBPB - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm purchased 221,902 shares of the company's stock, valued at approximately $2,110,000. Essex Investment Management Co. LLC owned about 0.74% of Potbelly as of its most recent SEC filing.

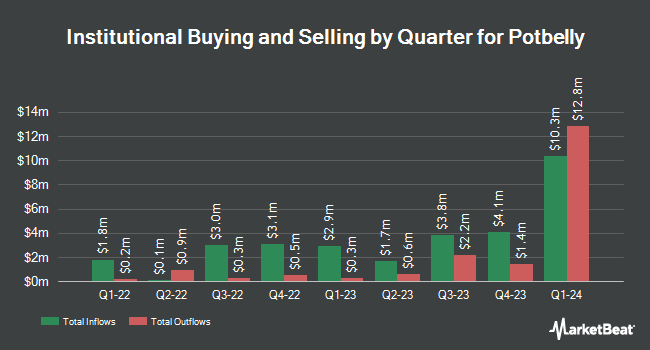

Other large investors also recently modified their holdings of the company. Marshall Wace LLP boosted its holdings in Potbelly by 758.4% in the 4th quarter. Marshall Wace LLP now owns 195,775 shares of the company's stock worth $1,844,000 after buying an additional 172,969 shares during the period. American Century Companies Inc. boosted its holdings in Potbelly by 139.3% in the 4th quarter. American Century Companies Inc. now owns 147,147 shares of the company's stock worth $1,386,000 after buying an additional 85,651 shares during the period. Portolan Capital Management LLC boosted its holdings in Potbelly by 9.3% in the 4th quarter. Portolan Capital Management LLC now owns 986,277 shares of the company's stock worth $9,291,000 after buying an additional 83,748 shares during the period. Legato Capital Management LLC bought a new position in Potbelly in the 1st quarter worth approximately $626,000. Finally, Cubist Systematic Strategies LLC bought a new position in Potbelly in the 4th quarter worth approximately $471,000. Hedge funds and other institutional investors own 72.60% of the company's stock.

Potbelly Price Performance

NASDAQ:PBPB traded down $0.66 during trading hours on Friday, hitting $11.37. The stock had a trading volume of 141,605 shares, compared to its average volume of 253,930. The company has a 50 day simple moving average of $11.74 and a two-hundred day simple moving average of $10.79. The company has a debt-to-equity ratio of 0.08, a current ratio of 0.53 and a quick ratio of 0.48. Potbelly Corporation has a one year low of $6.28 and a one year high of $13.48. The firm has a market capitalization of $343.03 million, a price-to-earnings ratio of 8.12 and a beta of 1.69.

Wall Street Analyst Weigh In

Several research analysts recently commented on the stock. Wall Street Zen downgraded shares of Potbelly from a "buy" rating to a "hold" rating in a report on Friday, May 16th. Benchmark raised their price objective on shares of Potbelly from $16.00 to $17.00 and gave the stock a "buy" rating in a report on Wednesday, June 18th.

Get Our Latest Analysis on Potbelly

Potbelly Profile

(

Free Report)

Potbelly Corporation, through its subsidiaries, owns, operates, and franchises Potbelly sandwich shops in the United States. The company was formerly known as Potbelly Sandwich Works, Inc and changed its name to Potbelly Corporation in 2002. Potbelly Corporation was founded in 1977 and is headquartered in Chicago, Illinois.

Further Reading

Before you consider Potbelly, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Potbelly wasn't on the list.

While Potbelly currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.