Wedmont Private Capital purchased a new stake in shares of Dell Technologies Inc. (NYSE:DELL - Free Report) in the 2nd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 2,461 shares of the technology company's stock, valued at approximately $312,000.

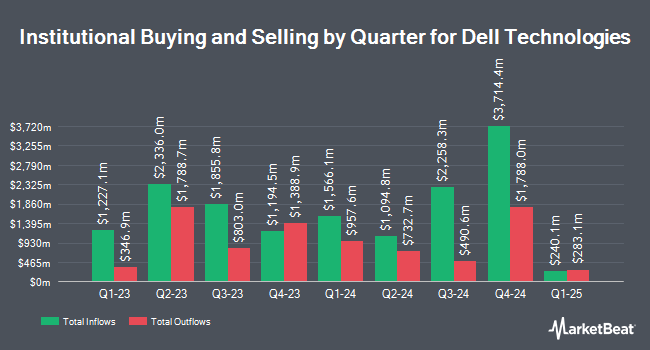

Other institutional investors have also added to or reduced their stakes in the company. Sumitomo Mitsui DS Asset Management Company Ltd raised its stake in Dell Technologies by 11.7% in the second quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 40,779 shares of the technology company's stock worth $5,000,000 after buying an additional 4,261 shares in the last quarter. KMG Fiduciary Partners LLC boosted its holdings in Dell Technologies by 5.6% in the second quarter. KMG Fiduciary Partners LLC now owns 27,466 shares of the technology company's stock worth $3,367,000 after purchasing an additional 1,452 shares during the last quarter. Focus Financial Network Inc. boosted its stake in shares of Dell Technologies by 8.0% during the 2nd quarter. Focus Financial Network Inc. now owns 2,689 shares of the technology company's stock worth $330,000 after acquiring an additional 199 shares during the last quarter. Sivia Capital Partners LLC purchased a new position in shares of Dell Technologies during the 2nd quarter valued at $328,000. Finally, Lineweaver Wealth Advisors LLC lifted its stake in shares of Dell Technologies by 15.2% during the 2nd quarter. Lineweaver Wealth Advisors LLC now owns 17,723 shares of the technology company's stock valued at $2,173,000 after buying an additional 2,342 shares in the last quarter. 76.37% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Dell Technologies

In other Dell Technologies news, Director Iv (Gp) L.L.C. Slta sold 600,000 shares of the company's stock in a transaction that occurred on Monday, September 15th. The stock was sold at an average price of $127.00, for a total value of $76,200,000.00. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, Director William D. Green sold 50,000 shares of the stock in a transaction that occurred on Monday, August 11th. The shares were sold at an average price of $140.00, for a total value of $7,000,000.00. Following the transaction, the director owned 45,045 shares of the company's stock, valued at approximately $6,306,300. This trade represents a 52.61% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 12,693,392 shares of company stock worth $1,568,257,000 in the last quarter. Company insiders own 42.00% of the company's stock.

Wall Street Analyst Weigh In

DELL has been the topic of a number of research reports. Barclays boosted their target price on shares of Dell Technologies from $131.00 to $133.00 and gave the stock an "equal weight" rating in a report on Wednesday, September 17th. Morgan Stanley upped their price target on shares of Dell Technologies from $135.00 to $144.00 and gave the stock an "overweight" rating in a research report on Thursday, August 21st. Raymond James Financial upped their price target on shares of Dell Technologies from $150.00 to $152.00 and gave the stock an "outperform" rating in a research report on Friday, August 29th. Sanford C. Bernstein started coverage on shares of Dell Technologies in a report on Monday, September 15th. They issued an "outperform" rating and a $175.00 price objective on the stock. Finally, Fox Advisors downgraded shares of Dell Technologies from an "overweight" rating to an "equal weight" rating in a report on Friday, August 29th. Sixteen analysts have rated the stock with a Buy rating and six have assigned a Hold rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $147.67.

Check Out Our Latest Stock Report on DELL

Dell Technologies Price Performance

Shares of Dell Technologies stock opened at $132.20 on Monday. The stock has a market capitalization of $88.89 billion, a price-to-earnings ratio of 19.44, a PEG ratio of 0.90 and a beta of 1.01. The firm's fifty day simple moving average is $129.71 and its 200-day simple moving average is $112.16. Dell Technologies Inc. has a 12 month low of $66.25 and a 12 month high of $147.66.

Dell Technologies (NYSE:DELL - Get Free Report) last issued its earnings results on Thursday, August 28th. The technology company reported $2.32 EPS for the quarter, topping the consensus estimate of $2.29 by $0.03. Dell Technologies had a net margin of 4.73% and a negative return on equity of 236.21%. The company had revenue of $29.78 billion for the quarter, compared to analyst estimates of $29.14 billion. During the same period in the previous year, the firm earned $1.89 EPS. The business's revenue was up 19.0% on a year-over-year basis. Dell Technologies has set its Q3 2026 guidance at 2.450-2.450 EPS. FY 2026 guidance at 9.550-9.550 EPS. Analysts anticipate that Dell Technologies Inc. will post 6.93 earnings per share for the current year.

Dell Technologies Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 31st. Investors of record on Tuesday, October 21st will be given a dividend of $0.525 per share. This represents a $2.10 dividend on an annualized basis and a yield of 1.6%. The ex-dividend date of this dividend is Tuesday, October 21st. Dell Technologies's dividend payout ratio is 30.88%.

Dell Technologies Company Profile

(

Free Report)

Dell Technologies Inc designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally. The company operates through two segments, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dell Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dell Technologies wasn't on the list.

While Dell Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.