Nuveen LLC purchased a new position in Intellia Therapeutics, Inc. (NASDAQ:NTLA - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 272,297 shares of the company's stock, valued at approximately $1,936,000. Nuveen LLC owned about 0.26% of Intellia Therapeutics as of its most recent SEC filing.

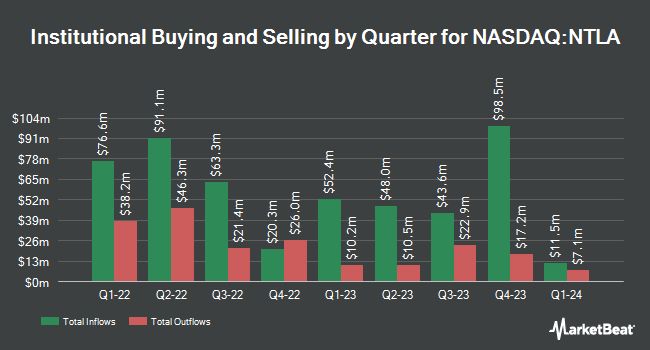

A number of other large investors have also added to or reduced their stakes in NTLA. GF Fund Management CO. LTD. bought a new stake in Intellia Therapeutics in the 4th quarter worth $25,000. Harbour Investments Inc. grew its position in shares of Intellia Therapeutics by 76.7% in the 1st quarter. Harbour Investments Inc. now owns 5,214 shares of the company's stock worth $37,000 after buying an additional 2,264 shares during the last quarter. 49 Wealth Management LLC bought a new stake in shares of Intellia Therapeutics in the 1st quarter worth approximately $74,000. Corton Capital Inc. bought a new stake in shares of Intellia Therapeutics in the 1st quarter worth approximately $92,000. Finally, Tower Research Capital LLC TRC grew its position in shares of Intellia Therapeutics by 28.5% in the 4th quarter. Tower Research Capital LLC TRC now owns 8,148 shares of the company's stock worth $95,000 after buying an additional 1,808 shares during the last quarter. Institutional investors own 88.77% of the company's stock.

Insider Buying and Selling

In other news, EVP Edward J. Dulac III sold 7,462 shares of the stock in a transaction on Wednesday, July 23rd. The stock was sold at an average price of $14.02, for a total transaction of $104,617.24. Following the transaction, the executive vice president directly owned 106,062 shares of the company's stock, valued at $1,486,989.24. This represents a 6.57% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, Director William J. Chase bought 100,000 shares of the stock in a transaction on Wednesday, August 20th. The stock was purchased at an average cost of $10.03 per share, for a total transaction of $1,003,000.00. Following the acquisition, the director owned 134,693 shares of the company's stock, valued at $1,350,970.79. This trade represents a 288.24% increase in their position. The disclosure for this purchase can be found here. In the last 90 days, insiders have sold 12,534 shares of company stock worth $153,837. 3.10% of the stock is owned by insiders.

Intellia Therapeutics Stock Performance

Shares of NASDAQ:NTLA traded up $0.05 during midday trading on Tuesday, reaching $11.40. 3,457,498 shares of the company's stock traded hands, compared to its average volume of 4,083,261. The company has a market cap of $1.22 billion, a price-to-earnings ratio of -2.43 and a beta of 2.28. Intellia Therapeutics, Inc. has a one year low of $5.90 and a one year high of $23.76. The stock has a 50 day moving average of $11.32 and a 200 day moving average of $9.58.

Intellia Therapeutics (NASDAQ:NTLA - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported ($0.99) earnings per share (EPS) for the quarter, beating the consensus estimate of ($1.03) by $0.04. The business had revenue of $14.25 million for the quarter, compared to analysts' expectations of $12.26 million. Intellia Therapeutics had a negative net margin of 908.48% and a negative return on equity of 57.48%. The business's revenue for the quarter was up 104.3% compared to the same quarter last year. During the same quarter in the prior year, the business earned ($1.52) EPS. Sell-side analysts predict that Intellia Therapeutics, Inc. will post -5.07 EPS for the current fiscal year.

Analyst Ratings Changes

NTLA has been the topic of several recent analyst reports. Wedbush reiterated a "neutral" rating and issued a $7.00 price target on shares of Intellia Therapeutics in a report on Monday, June 16th. Royal Bank Of Canada cut their target price on shares of Intellia Therapeutics from $25.00 to $21.00 and set an "outperform" rating on the stock in a research note on Friday, August 8th. Guggenheim reaffirmed a "buy" rating and set a $14.00 target price on shares of Intellia Therapeutics in a research note on Wednesday, August 13th. Citigroup cut their price objective on Intellia Therapeutics from $14.00 to $10.00 and set a "neutral" rating on the stock in a research report on Friday, May 9th. Finally, HC Wainwright dropped their price target on Intellia Therapeutics from $30.00 to $25.00 and set a "buy" rating on the stock in a research report on Friday, August 8th. Twelve research analysts have rated the stock with a Buy rating, six have assigned a Hold rating and one has given a Sell rating to the company. Based on data from MarketBeat, Intellia Therapeutics presently has a consensus rating of "Moderate Buy" and an average price target of $29.05.

Get Our Latest Research Report on NTLA

Intellia Therapeutics Profile

(

Free Report)

Intellia Therapeutics, Inc, a genome editing company, focuses on the development of curative therapeutics. The company's in vivo programs include NTLA-2001, which is in Phase 1 clinical trial for the treatment of transthyretin amyloidosis; NTLA-2002 for the treatment of hereditary angioedema; and NTLA-3001 for alpha-1 antitrypsin deficiency associated lung disease.

Featured Stories

Before you consider Intellia Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intellia Therapeutics wasn't on the list.

While Intellia Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.