Axiom Investors LLC DE acquired a new stake in Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 298,395 shares of the technology company's stock, valued at approximately $68,010,000. Axiom Investors LLC DE owned about 0.27% of Check Point Software Technologies as of its most recent filing with the Securities & Exchange Commission.

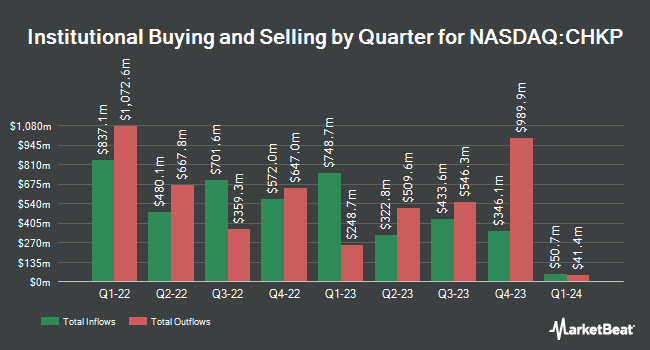

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. SVB Wealth LLC bought a new stake in Check Point Software Technologies in the first quarter valued at approximately $74,000. Northwestern Mutual Wealth Management Co. raised its holdings in shares of Check Point Software Technologies by 7.0% during the first quarter. Northwestern Mutual Wealth Management Co. now owns 26,418 shares of the technology company's stock valued at $6,021,000 after acquiring an additional 1,723 shares in the last quarter. Groupe la Francaise bought a new position in shares of Check Point Software Technologies during the first quarter valued at approximately $158,000. 1832 Asset Management L.P. raised its holdings in shares of Check Point Software Technologies by 782.7% during the first quarter. 1832 Asset Management L.P. now owns 191,625 shares of the technology company's stock valued at $43,675,000 after acquiring an additional 169,915 shares in the last quarter. Finally, Ameriprise Financial Inc. raised its holdings in shares of Check Point Software Technologies by 28.1% during the first quarter. Ameriprise Financial Inc. now owns 1,830,874 shares of the technology company's stock valued at $417,280,000 after acquiring an additional 401,150 shares in the last quarter. Institutional investors own 98.51% of the company's stock.

Analyst Ratings Changes

CHKP has been the subject of a number of recent analyst reports. Citigroup decreased their target price on Check Point Software Technologies from $230.00 to $200.00 and set a "neutral" rating for the company in a report on Monday, August 18th. Jefferies Financial Group decreased their target price on Check Point Software Technologies from $260.00 to $230.00 and set a "buy" rating for the company in a report on Thursday, July 31st. UBS Group decreased their price objective on Check Point Software Technologies from $220.00 to $210.00 and set a "neutral" rating for the company in a report on Thursday, July 31st. Royal Bank Of Canada decreased their price objective on Check Point Software Technologies from $224.00 to $207.00 and set a "sector perform" rating for the company in a report on Thursday, July 31st. Finally, Barclays set a $215.00 target price on Check Point Software Technologies and gave the stock an "equal weight" rating in a research note on Thursday, July 31st. One analyst has rated the stock with a Strong Buy rating, eleven have assigned a Buy rating and fifteen have given a Hold rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $227.58.

View Our Latest Stock Report on CHKP

Check Point Software Technologies Price Performance

Shares of Check Point Software Technologies stock traded down $1.35 during trading on Friday, hitting $195.19. 519,751 shares of the company's stock traded hands, compared to its average volume of 664,860. Check Point Software Technologies Ltd. has a 1 year low of $169.01 and a 1 year high of $234.35. The stock has a market capitalization of $21.47 billion, a P/E ratio of 25.42, a PEG ratio of 2.95 and a beta of 0.60. The business has a 50-day simple moving average of $200.24 and a 200-day simple moving average of $214.00.

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The technology company reported $2.37 EPS for the quarter, beating the consensus estimate of $2.36 by $0.01. The company had revenue of $665.20 million for the quarter, compared to analysts' expectations of $663.10 million. Check Point Software Technologies had a return on equity of 33.21% and a net margin of 32.48%.Check Point Software Technologies's revenue was up 6.0% compared to the same quarter last year. During the same period last year, the firm posted $2.17 earnings per share. Check Point Software Technologies has set its FY 2025 guidance at 9.600-10.200 EPS. Q3 2025 guidance at 2.400-2.500 EPS. On average, equities analysts predict that Check Point Software Technologies Ltd. will post 8.61 earnings per share for the current fiscal year.

Check Point Software Technologies Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Featured Articles

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.