Longbow Finance SA purchased a new stake in TKO Group Holdings, Inc. (NYSE:TKO - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 31,549 shares of the company's stock, valued at approximately $4,821,000.

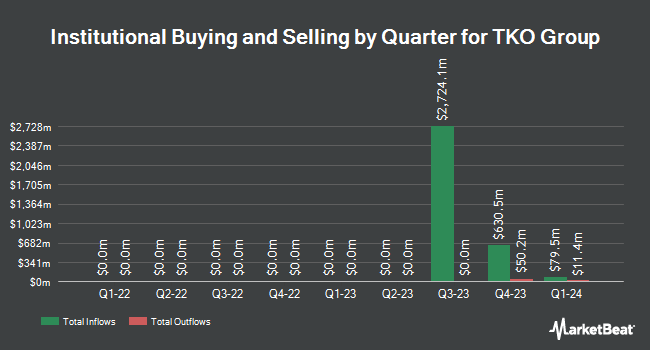

Other hedge funds and other institutional investors also recently modified their holdings of the company. Focus Partners Advisor Solutions LLC boosted its holdings in shares of TKO Group by 3.6% during the 4th quarter. Focus Partners Advisor Solutions LLC now owns 1,835 shares of the company's stock valued at $261,000 after acquiring an additional 63 shares in the last quarter. Bessemer Group Inc. boosted its holdings in shares of TKO Group by 0.3% during the 4th quarter. Bessemer Group Inc. now owns 26,174 shares of the company's stock valued at $3,720,000 after acquiring an additional 78 shares in the last quarter. Simon Quick Advisors LLC boosted its holdings in shares of TKO Group by 1.1% during the 1st quarter. Simon Quick Advisors LLC now owns 7,558 shares of the company's stock valued at $1,155,000 after acquiring an additional 82 shares in the last quarter. Coldstream Capital Management Inc. boosted its holdings in shares of TKO Group by 2.9% during the 4th quarter. Coldstream Capital Management Inc. now owns 3,160 shares of the company's stock valued at $449,000 after acquiring an additional 90 shares in the last quarter. Finally, Utah Retirement Systems boosted its holdings in shares of TKO Group by 2.4% during the 4th quarter. Utah Retirement Systems now owns 4,300 shares of the company's stock valued at $611,000 after acquiring an additional 100 shares in the last quarter. Institutional investors own 89.79% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts recently weighed in on the company. Sanford C. Bernstein assumed coverage on TKO Group in a report on Wednesday, June 4th. They set an "outperform" rating and a $190.00 price objective on the stock. The Goldman Sachs Group lifted their target price on TKO Group from $170.00 to $188.00 and gave the stock a "buy" rating in a report on Monday, May 12th. JPMorgan Chase & Co. lifted their target price on TKO Group from $158.00 to $182.00 and gave the stock an "overweight" rating in a report on Wednesday, May 21st. Susquehanna initiated coverage on TKO Group in a report on Monday, April 28th. They set a "positive" rating and a $180.00 target price on the stock. Finally, Guggenheim lifted their target price on TKO Group from $175.00 to $190.00 and gave the stock a "buy" rating in a report on Friday, May 9th. Three investment analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $171.33.

Get Our Latest Stock Report on TKO Group

Insider Buying and Selling at TKO Group

In related news, major shareholder Lake West Voteco L.L.C Silver bought 1,579,080 shares of the company's stock in a transaction on Tuesday, June 3rd. The shares were purchased at an average price of $158.32 per share, for a total transaction of $249,999,945.60. Following the completion of the transaction, the insider directly owned 4,158,517 shares in the company, valued at approximately $658,376,411.44. The trade was a 61.22% increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Peter C. B. Bynoe bought 980 shares of the company's stock in a transaction on Thursday, June 5th. The shares were bought at an average price of $169.59 per share, for a total transaction of $166,198.20. Following the transaction, the director owned 2,747 shares of the company's stock, valued at approximately $465,863.73. This represents a 55.46% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last ninety days, insiders sold 73,725 shares of company stock valued at $12,501,561. Company insiders own 53.80% of the company's stock.

TKO Group Stock Up 0.0%

TKO stock traded up $0.02 during trading on Monday, reaching $170.07. 281,351 shares of the stock were exchanged, compared to its average volume of 1,301,894. The firm's 50 day moving average is $168.55 and its 200 day moving average is $159.24. TKO Group Holdings, Inc. has a twelve month low of $102.46 and a twelve month high of $182.60. The company has a current ratio of 1.25, a quick ratio of 1.25 and a debt-to-equity ratio of 0.29. The firm has a market cap of $33.66 billion, a P/E ratio of 86.33 and a beta of 0.73.

TKO Group (NYSE:TKO - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported $0.69 earnings per share for the quarter, topping analysts' consensus estimates of $0.55 by $0.14. TKO Group had a return on equity of 2.52% and a net margin of 4.98%. The business had revenue of $1.27 billion for the quarter, compared to the consensus estimate of $1.07 billion. During the same period in the prior year, the business earned ($1.26) EPS. The firm's revenue for the quarter was up 3.8% on a year-over-year basis. As a group, research analysts forecast that TKO Group Holdings, Inc. will post 3.88 EPS for the current year.

TKO Group Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, June 30th. Shareholders of record on Friday, June 13th were issued a dividend of $0.38 per share. This represents a $1.52 annualized dividend and a yield of 0.89%. The ex-dividend date of this dividend was Friday, June 13th. TKO Group's dividend payout ratio (DPR) is 77.16%.

TKO Group Profile

(

Free Report)

TKO Group Holdings, Inc operates as a sports and entertainment company. The company produces and licenses live events, television programs, and long-form and short-form content, reality series, and other filmed entertainment on digital and linear channels and via pay-per-view. It is involved in the merchandising of video games, apparel, equipment, trading cards, memorabilia, digital goods, and toys, as well as sale of travel packages and tickets.

Recommended Stories

Before you consider TKO Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TKO Group wasn't on the list.

While TKO Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report