Polianta Ltd acquired a new stake in Strategy Inc (NASDAQ:MSTR - Free Report) during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund acquired 3,400 shares of the software maker's stock, valued at approximately $1,374,000.

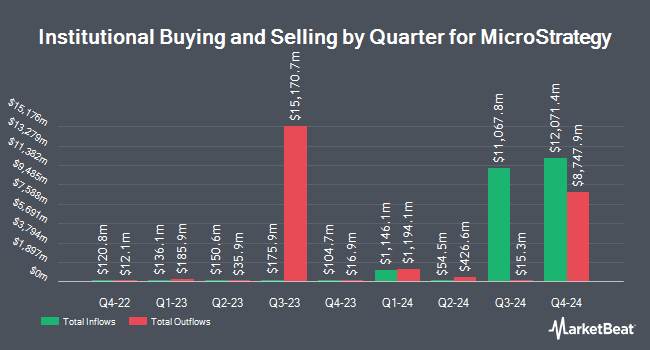

Other institutional investors and hedge funds have also recently modified their holdings of the company. First United Bank & Trust purchased a new stake in shares of Strategy in the 1st quarter valued at $29,000. Arlington Trust Co LLC increased its holdings in Strategy by 86.3% during the 2nd quarter. Arlington Trust Co LLC now owns 149 shares of the software maker's stock worth $60,000 after purchasing an additional 69 shares during the period. Hexagon Capital Partners LLC increased its holdings in Strategy by 7,750.0% during the 1st quarter. Hexagon Capital Partners LLC now owns 157 shares of the software maker's stock worth $45,000 after purchasing an additional 155 shares during the period. Vermillion Wealth Management Inc. purchased a new stake in Strategy during the 4th quarter worth about $54,000. Finally, Dogwood Wealth Management LLC purchased a new stake in Strategy during the 4th quarter worth about $57,000. Hedge funds and other institutional investors own 59.84% of the company's stock.

Insider Transactions at Strategy

In other news, Director Gregg Winiarski bought 10,000 shares of the firm's stock in a transaction that occurred on Friday, August 8th. The stock was purchased at an average cost of $97.65 per share, with a total value of $976,500.00. Following the transaction, the director directly owned 10,000 shares in the company, valued at $976,500. This trade represents a ∞ increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Peter L. Briger, Jr. bought 220,000 shares of the firm's stock in a transaction that occurred on Tuesday, July 29th. The stock was purchased at an average cost of $90.00 per share, with a total value of $19,800,000.00. Following the completion of the transaction, the director owned 220,000 shares in the company, valued at approximately $19,800,000. This trade represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last quarter, insiders acquired 265,474 shares of company stock worth $24,056,259 and sold 142,150 shares worth $59,289,351. Company insiders own 8.46% of the company's stock.

Strategy Stock Performance

Shares of NASDAQ MSTR traded down $4.37 during trading hours on Friday, reaching $344.75. The stock had a trading volume of 17,669,417 shares, compared to its average volume of 10,064,784. The firm has a market cap of $97.75 billion, a price-to-earnings ratio of 30.35 and a beta of 3.82. The company has a current ratio of 0.68, a quick ratio of 0.68 and a debt-to-equity ratio of 0.17. Strategy Inc has a fifty-two week low of $141.64 and a fifty-two week high of $543.00. The firm has a 50-day moving average of $371.79 and a 200-day moving average of $358.83.

Strategy (NASDAQ:MSTR - Get Free Report) last announced its earnings results on Thursday, July 31st. The software maker reported $32.60 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.12) by $32.72. The firm had revenue of $114.49 million during the quarter, compared to analysts' expectations of $112.68 million. Strategy had a return on equity of 18.83% and a net margin of 1,036.61%.The business's revenue was up 2.7% on a year-over-year basis. During the same period in the prior year, the firm earned ($5.74) EPS. Strategy has set its FY 2025 guidance at 80.000-80.000 EPS.

Wall Street Analysts Forecast Growth

Several brokerages have weighed in on MSTR. Cowen restated a "buy" rating on shares of Strategy in a report on Wednesday, August 13th. Mizuho upped their price target on Strategy from $563.00 to $586.00 and gave the stock an "outperform" rating in a report on Monday, August 11th. TD Cowen cut their price target on Strategy from $640.00 to $620.00 and set a "buy" rating on the stock in a report on Tuesday. Benchmark restated a "buy" rating on shares of Strategy in a report on Wednesday, August 13th. Finally, Cantor Fitzgerald restated an "overweight" rating on shares of Strategy in a report on Wednesday, August 13th. One analyst has rated the stock with a Strong Buy rating, eleven have assigned a Buy rating, one has assigned a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat, Strategy currently has a consensus rating of "Moderate Buy" and an average target price of $547.50.

Read Our Latest Analysis on MSTR

Strategy Company Profile

(

Free Report)

Strategy Incorporated, formerly known as MicroStrategy, provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers Strategy ONE, a platform that allows non-technical users to access novel and actionable insights for decision-making, and Strategy Cloud for Government, which provides always-on threat monitoring designed to meet the strict technical and regulatory standards of governments and financial institutions.

Featured Stories

Before you consider Strategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Strategy wasn't on the list.

While Strategy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.