DSG Capital Advisors LLC bought a new stake in The TJX Companies, Inc. (NYSE:TJX - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund bought 39,015 shares of the apparel and home fashions retailer's stock, valued at approximately $4,713,000.

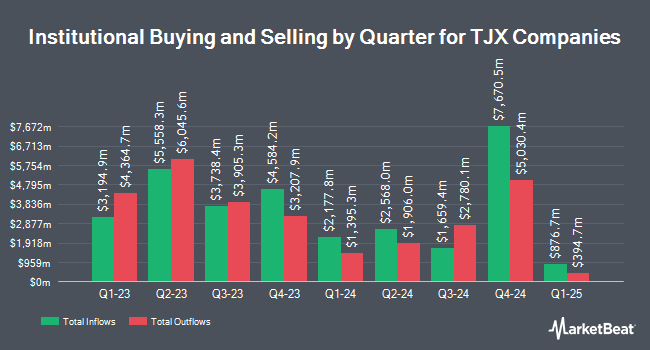

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Shell Asset Management Co. raised its holdings in TJX Companies by 16.5% during the 4th quarter. Shell Asset Management Co. now owns 29,168 shares of the apparel and home fashions retailer's stock worth $3,524,000 after purchasing an additional 4,128 shares during the last quarter. Pathstone Holdings LLC raised its holdings in TJX Companies by 10.1% during the 4th quarter. Pathstone Holdings LLC now owns 736,616 shares of the apparel and home fashions retailer's stock worth $88,992,000 after purchasing an additional 67,853 shares during the last quarter. Ethic Inc. raised its holdings in TJX Companies by 21.1% during the 4th quarter. Ethic Inc. now owns 167,169 shares of the apparel and home fashions retailer's stock worth $20,196,000 after purchasing an additional 29,158 shares during the last quarter. Fiduciary Trust Co raised its holdings in TJX Companies by 5.2% during the 4th quarter. Fiduciary Trust Co now owns 2,891,186 shares of the apparel and home fashions retailer's stock worth $349,284,000 after purchasing an additional 144,113 shares during the last quarter. Finally, Congress Asset Management Co. raised its holdings in TJX Companies by 1.1% during the 4th quarter. Congress Asset Management Co. now owns 1,228,840 shares of the apparel and home fashions retailer's stock worth $148,456,000 after purchasing an additional 13,036 shares during the last quarter. Institutional investors and hedge funds own 91.09% of the company's stock.

Insider Transactions at TJX Companies

In other news, CEO Ernie Herrman sold 23,428 shares of the firm's stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of $123.03, for a total transaction of $2,882,346.84. Following the completion of the transaction, the chief executive officer now directly owns 484,189 shares in the company, valued at $59,569,772.67. This trade represents a 4.62% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 0.13% of the stock is owned by corporate insiders.

TJX Companies Trading Up 0.6%

Shares of TJX traded up $0.82 during mid-day trading on Thursday, reaching $127.04. 6,410,593 shares of the company were exchanged, compared to its average volume of 5,340,237. The TJX Companies, Inc. has a 52 week low of $101.80 and a 52 week high of $135.85. The company has a debt-to-equity ratio of 0.35, a quick ratio of 0.50 and a current ratio of 1.19. The stock has a market capitalization of $141.92 billion, a PE ratio of 29.89, a PEG ratio of 2.75 and a beta of 0.94. The business has a 50 day simple moving average of $126.74 and a two-hundred day simple moving average of $123.79.

TJX Companies (NYSE:TJX - Get Free Report) last issued its quarterly earnings data on Wednesday, May 21st. The apparel and home fashions retailer reported $0.92 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.90 by $0.02. TJX Companies had a return on equity of 61.82% and a net margin of 8.63%. The company had revenue of $13.11 billion during the quarter, compared to the consensus estimate of $13.01 billion. During the same period last year, the company earned $0.93 earnings per share. The firm's revenue was up 5.1% compared to the same quarter last year. On average, analysts predict that The TJX Companies, Inc. will post 4.18 earnings per share for the current fiscal year.

TJX Companies Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, June 5th. Stockholders of record on Thursday, May 15th will be given a dividend of $0.425 per share. This represents a $1.70 dividend on an annualized basis and a dividend yield of 1.34%. This is an increase from TJX Companies's previous quarterly dividend of $0.38. The ex-dividend date is Thursday, May 15th. TJX Companies's dividend payout ratio (DPR) is 40.00%.

Wall Street Analysts Forecast Growth

Several brokerages have weighed in on TJX. UBS Group reissued a "buy" rating and set a $164.00 price objective (up from $154.00) on shares of TJX Companies in a report on Thursday, May 22nd. TD Securities upped their price target on TJX Companies from $140.00 to $142.00 and gave the company a "buy" rating in a research note on Tuesday, May 20th. Telsey Advisory Group reiterated an "outperform" rating and issued a $145.00 price objective on shares of TJX Companies in a research report on Wednesday, May 21st. Cowen reiterated a "buy" rating on shares of TJX Companies in a research report on Tuesday, May 20th. Finally, JPMorgan Chase & Co. boosted their price objective on TJX Companies from $127.00 to $130.00 and gave the company an "overweight" rating in a research report on Monday, May 19th. One investment analyst has rated the stock with a hold rating and eighteen have issued a buy rating to the company's stock. According to MarketBeat, TJX Companies has an average rating of "Moderate Buy" and an average target price of $140.65.

Check Out Our Latest Stock Analysis on TJX

TJX Companies Company Profile

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Featured Stories

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report