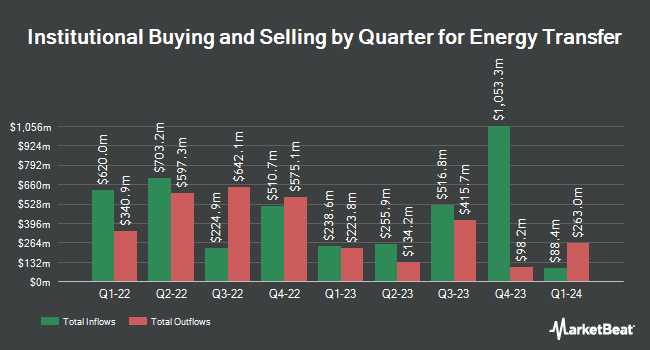

Commerce Bank bought a new position in shares of Energy Transfer LP (NYSE:ET - Free Report) during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 4,981,530 shares of the pipeline company's stock, valued at approximately $92,607,000. Commerce Bank owned 0.15% of Energy Transfer as of its most recent filing with the Securities and Exchange Commission (SEC).

Other large investors have also recently made changes to their positions in the company. Capital A Wealth Management LLC acquired a new stake in shares of Energy Transfer in the fourth quarter valued at approximately $26,000. Fourth Dimension Wealth LLC acquired a new stake in shares of Energy Transfer in the fourth quarter valued at approximately $29,000. HWG Holdings LP acquired a new stake in shares of Energy Transfer in the first quarter valued at approximately $38,000. N.E.W. Advisory Services LLC acquired a new stake in shares of Energy Transfer in the first quarter valued at approximately $40,000. Finally, Vermillion Wealth Management Inc. acquired a new stake in shares of Energy Transfer in the fourth quarter valued at approximately $46,000. 38.22% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Energy Transfer news, Director James Richard Perry sold 1,369 shares of the stock in a transaction on Friday, June 13th. The stock was sold at an average price of $18.48, for a total value of $25,299.12. Following the sale, the director directly owned 24,523 shares of the company's stock, valued at $453,185.04. This trade represents a 5.29% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 3.28% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on ET shares. Mizuho increased their price target on Energy Transfer from $22.00 to $23.00 and gave the stock an "outperform" rating in a report on Tuesday, May 20th. Cowen started coverage on Energy Transfer in a report on Monday, July 7th. They set a "buy" rating for the company. TD Cowen started coverage on Energy Transfer in a report on Monday, July 7th. They set a "buy" rating and a $22.00 price target for the company. JPMorgan Chase & Co. decreased their price target on Energy Transfer from $25.00 to $23.00 and set an "overweight" rating for the company in a report on Monday, May 19th. Finally, Wells Fargo & Company reduced their target price on Energy Transfer from $22.00 to $21.00 and set an "overweight" rating for the company in a report on Wednesday, May 7th. One analyst has rated the stock with a hold rating and twelve have given a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $22.58.

View Our Latest Report on ET

Energy Transfer Stock Performance

Shares of ET stock traded down $0.24 on Friday, hitting $17.80. 16,558,657 shares of the stock traded hands, compared to its average volume of 11,686,092. The company has a debt-to-equity ratio of 1.41, a current ratio of 1.12 and a quick ratio of 0.92. The company has a market capitalization of $61.09 billion, a PE ratio of 13.48, a PEG ratio of 0.94 and a beta of 0.79. Energy Transfer LP has a 1-year low of $14.60 and a 1-year high of $21.45. The company's fifty day moving average is $17.79 and its 200 day moving average is $18.23.

Energy Transfer (NYSE:ET - Get Free Report) last posted its quarterly earnings results on Tuesday, May 6th. The pipeline company reported $0.36 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.33 by $0.03. Energy Transfer had a return on equity of 11.47% and a net margin of 5.88%. The business had revenue of $21.02 billion for the quarter, compared to analyst estimates of $22.28 billion. During the same period in the prior year, the company posted $0.32 EPS. The business's revenue was down 2.8% compared to the same quarter last year. On average, equities research analysts predict that Energy Transfer LP will post 1.46 earnings per share for the current fiscal year.

Energy Transfer Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, August 19th. Shareholders of record on Friday, August 8th will be given a $0.33 dividend. This is a boost from Energy Transfer's previous quarterly dividend of $0.33. This represents a $1.32 annualized dividend and a yield of 7.4%. The ex-dividend date of this dividend is Friday, August 8th. Energy Transfer's dividend payout ratio is 100.00%.

About Energy Transfer

(

Free Report)

Energy Transfer LP provides energy-related services. The company owns and operates natural gas transportation pipeline, and natural gas storage facilities in Texas and Oklahoma; and approximately 20,090 miles of interstate natural gas pipeline. It also sells natural gas to electric utilities, independent power plants, local distribution and other marketing companies, and industrial end-users.

Featured Articles

Before you consider Energy Transfer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Transfer wasn't on the list.

While Energy Transfer currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.