Vident Advisory LLC purchased a new position in shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) during the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 5,038 shares of the consumer goods maker's stock, valued at approximately $310,000.

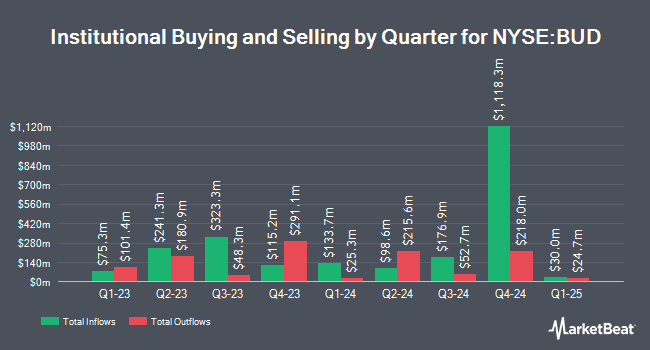

Other large investors also recently added to or reduced their stakes in the company. ABC Arbitrage SA acquired a new position in Anheuser-Busch InBev SA/NV during the 1st quarter valued at about $1,731,000. Sequoia Financial Advisors LLC lifted its position in Anheuser-Busch InBev SA/NV by 224.7% during the 1st quarter. Sequoia Financial Advisors LLC now owns 25,254 shares of the consumer goods maker's stock valued at $1,555,000 after purchasing an additional 17,476 shares during the period. Merit Financial Group LLC lifted its position in Anheuser-Busch InBev SA/NV by 31.7% during the 1st quarter. Merit Financial Group LLC now owns 14,635 shares of the consumer goods maker's stock valued at $901,000 after purchasing an additional 3,526 shares during the period. Pinnacle Financial Partners Inc acquired a new position in Anheuser-Busch InBev SA/NV during the 1st quarter valued at about $2,341,000. Finally, Penserra Capital Management LLC lifted its position in Anheuser-Busch InBev SA/NV by 24.7% during the 1st quarter. Penserra Capital Management LLC now owns 2,553 shares of the consumer goods maker's stock valued at $157,000 after purchasing an additional 506 shares during the period. 5.53% of the stock is currently owned by institutional investors and hedge funds.

Anheuser-Busch InBev SA/NV Stock Performance

Shares of BUD stock opened at $59.43 on Tuesday. The company has a debt-to-equity ratio of 0.79, a current ratio of 0.64 and a quick ratio of 0.48. The stock has a market cap of $106.80 billion, a PE ratio of 16.69, a price-to-earnings-growth ratio of 1.70 and a beta of 0.79. The stock has a 50-day moving average of $64.28 and a 200-day moving average of $65.03. Anheuser-Busch InBev SA/NV has a one year low of $45.94 and a one year high of $72.13.

Anheuser-Busch InBev SA/NV (NYSE:BUD - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The consumer goods maker reported $0.98 EPS for the quarter, beating analysts' consensus estimates of $0.94 by $0.04. Anheuser-Busch InBev SA/NV had a return on equity of 16.21% and a net margin of 12.16%.The company's revenue for the quarter was down 2.1% on a year-over-year basis. During the same period in the previous year, the firm posted $0.90 earnings per share. As a group, sell-side analysts expect that Anheuser-Busch InBev SA/NV will post 3.37 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research firms have issued reports on BUD. Wall Street Zen downgraded shares of Anheuser-Busch InBev SA/NV from a "buy" rating to a "hold" rating in a research report on Sunday, May 18th. The Goldman Sachs Group upgraded shares of Anheuser-Busch InBev SA/NV from a "neutral" rating to a "buy" rating and upped their target price for the company from $70.10 to $88.00 in a research report on Monday, May 12th. Finally, BNP Paribas upgraded shares of Anheuser-Busch InBev SA/NV from a "hold" rating to a "strong-buy" rating in a research report on Friday, May 30th. Three equities research analysts have rated the stock with a Strong Buy rating, six have issued a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus price target of $71.50.

Read Our Latest Report on BUD

Anheuser-Busch InBev SA/NV Profile

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.