Gabelli Funds LLC acquired a new stake in shares of Dun & Bradstreet Holdings, Inc. (NYSE:DNB - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 519,327 shares of the business services provider's stock, valued at approximately $4,643,000. Gabelli Funds LLC owned 0.12% of Dun & Bradstreet at the end of the most recent reporting period.

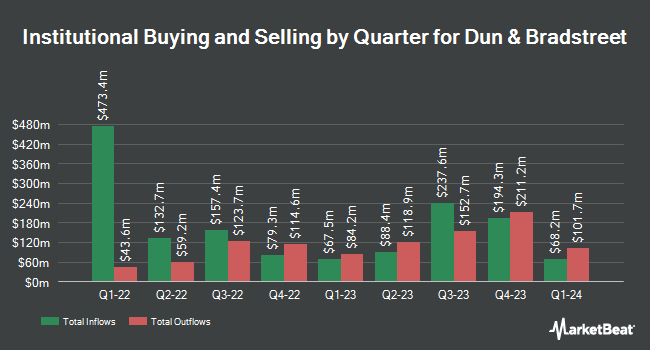

Several other hedge funds and other institutional investors have also recently modified their holdings of DNB. Caitong International Asset Management Co. Ltd purchased a new stake in Dun & Bradstreet in the first quarter worth about $68,000. Longfellow Investment Management Co. LLC purchased a new position in Dun & Bradstreet in the 1st quarter worth approximately $73,000. Oak Thistle LLC purchased a new position in Dun & Bradstreet in the 1st quarter worth approximately $93,000. Summit Securities Group LLC bought a new position in shares of Dun & Bradstreet during the first quarter worth $93,000. Finally, Neo Ivy Capital Management purchased a new position in Dun & Bradstreet during the fourth quarter valued at $96,000. 86.68% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have commented on DNB. Raymond James Financial cut shares of Dun & Bradstreet from a "strong-buy" rating to a "market perform" rating in a research note on Friday, June 13th. Wall Street Zen started coverage on Dun & Bradstreet in a research report on Wednesday, May 21st. They issued a "hold" rating on the stock. Six analysts have rated the stock with a Hold rating, Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $11.63.

Read Our Latest Stock Report on Dun & Bradstreet

Insider Buying and Selling

In other news, Chairman William P. Foley II sold 2,500,000 shares of the company's stock in a transaction that occurred on Thursday, August 14th. The stock was sold at an average price of $9.09, for a total transaction of $22,725,000.00. Following the transaction, the chairman owned 3,109,644 shares of the company's stock, valued at approximately $28,266,663.96. This represents a 44.57% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 10.44% of the company's stock.

Dun & Bradstreet Trading Up 0.5%

DNB traded up $0.05 during trading on Tuesday, reaching $9.16. The company had a trading volume of 17,828,715 shares, compared to its average volume of 3,879,425. The company has a quick ratio of 0.61, a current ratio of 0.61 and a debt-to-equity ratio of 1.04. Dun & Bradstreet Holdings, Inc. has a 52 week low of $7.78 and a 52 week high of $12.94. The stock has a market cap of $4.08 billion, a P/E ratio of -101.72 and a beta of 1.12. The business has a 50 day simple moving average of $9.11 and a 200-day simple moving average of $8.99.

Dun & Bradstreet Company Profile

(

Free Report)

Dun & Bradstreet Holdings, Inc engages in providing business decisioning data and analytics solutions. The firm is involved in providing information with its solutions to support its clients with critical business operations. It offers end-to-end solutions to clients in the small business, finance, sales & marketing, third party risk & compliance, and public sectors.

Read More

Before you consider Dun & Bradstreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dun & Bradstreet wasn't on the list.

While Dun & Bradstreet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.