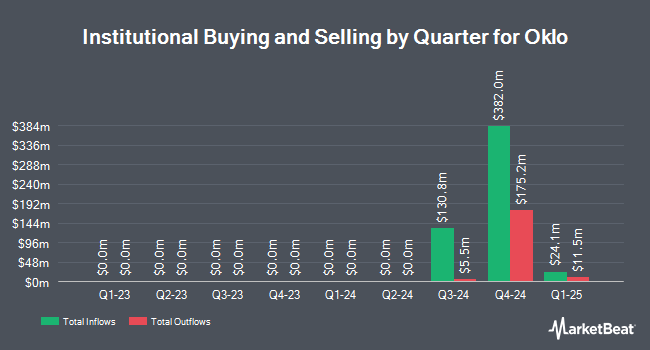

Union Bancaire Privee UBP SA purchased a new position in Oklo Inc. (NYSE:OKLO - Free Report) in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 52,500 shares of the company's stock, valued at approximately $2,939,000.

Several other institutional investors also recently bought and sold shares of the business. Millennium Management LLC grew its stake in Oklo by 4,974.1% in the 1st quarter. Millennium Management LLC now owns 582,002 shares of the company's stock valued at $12,589,000 after acquiring an additional 570,532 shares during the period. CloudAlpha Capital Management Limited Hong Kong acquired a new stake in shares of Oklo in the first quarter valued at about $11,674,000. Jump Financial LLC acquired a new stake in shares of Oklo in the first quarter valued at about $6,929,000. Raymond James Financial Inc. grew its position in shares of Oklo by 202.6% in the first quarter. Raymond James Financial Inc. now owns 314,794 shares of the company's stock valued at $6,809,000 after purchasing an additional 210,755 shares during the period. Finally, Headlands Technologies LLC grew its position in shares of Oklo by 2,120.2% in the first quarter. Headlands Technologies LLC now owns 218,820 shares of the company's stock valued at $4,733,000 after purchasing an additional 208,964 shares during the period. 85.03% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on the company. BNP Paribas upgraded Oklo to a "strong sell" rating in a report on Friday, July 25th. Cantor Fitzgerald set a $73.00 target price on shares of Oklo and gave the stock an "overweight" rating in a research note on Tuesday, July 15th. Daiwa America upgraded Oklo from a "hold" rating to a "strong-buy" rating in a report on Sunday, July 27th. Barclays set a $146.00 price target on shares of Oklo in a research report on Monday. Finally, Bank of America reissued a "neutral" rating and set a $117.00 price target (up previously from $92.00) on shares of Oklo in a research report on Tuesday. One equities research analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating, seven have given a Hold rating and two have assigned a Sell rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $83.77.

Check Out Our Latest Analysis on OKLO

Insiders Place Their Bets

In related news, insider William Carroll Murphy Goodwin sold 41,387 shares of the stock in a transaction dated Friday, September 5th. The stock was sold at an average price of $70.09, for a total transaction of $2,900,814.83. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Michael Stuart Klein sold 50,000 shares of the stock in a transaction dated Monday, September 22nd. The stock was sold at an average price of $133.76, for a total transaction of $6,688,000.00. Following the sale, the director directly owned 150,000 shares in the company, valued at $20,064,000. This represents a 25.00% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 191,387 shares of company stock worth $19,020,580 over the last ninety days. Corporate insiders own 18.90% of the company's stock.

Oklo Stock Down 4.2%

Shares of Oklo stock opened at $111.58 on Wednesday. Oklo Inc. has a 52 week low of $7.90 and a 52 week high of $144.49. The business's fifty day simple moving average is $84.08 and its 200-day simple moving average is $55.55. The firm has a market cap of $16.47 billion, a PE ratio of -265.66 and a beta of 0.59.

Oklo (NYSE:OKLO - Get Free Report) last issued its quarterly earnings data on Monday, August 11th. The company reported ($0.18) EPS for the quarter, missing the consensus estimate of ($0.12) by ($0.06). As a group, equities analysts expect that Oklo Inc. will post -8.2 earnings per share for the current year.

About Oklo

(

Free Report)

Oklo Inc designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States. It also provides used nuclear fuel recycling services. The company was founded in 2013 and is based in Santa Clara, California.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oklo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oklo wasn't on the list.

While Oklo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.