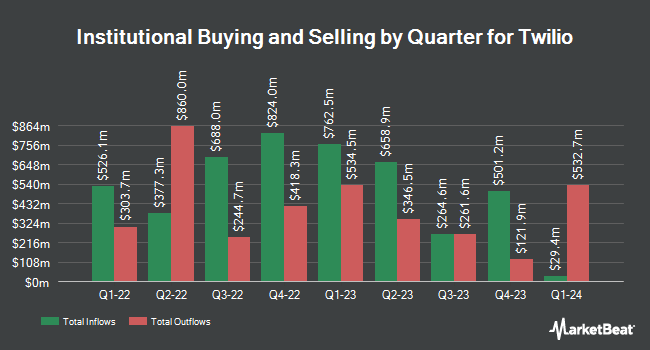

CloudAlpha Capital Management Limited Hong Kong acquired a new position in shares of Twilio Inc. (NYSE:TWLO - Free Report) in the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 55,477 shares of the technology company's stock, valued at approximately $5,432,000. Twilio comprises about 0.4% of CloudAlpha Capital Management Limited Hong Kong's investment portfolio, making the stock its 24th biggest position.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. LRI Investments LLC purchased a new position in Twilio during the first quarter worth $25,000. Financial Gravity Asset Management Inc. purchased a new position in Twilio during the first quarter worth $28,000. Cloud Capital Management LLC purchased a new position in Twilio during the first quarter worth $34,000. UMB Bank n.a. purchased a new position in Twilio during the first quarter worth $37,000. Finally, CX Institutional purchased a new position in Twilio during the first quarter worth $39,000. 84.27% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on TWLO. UBS Group dropped their price target on Twilio from $175.00 to $150.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. The Goldman Sachs Group upped their target price on Twilio from $130.00 to $145.00 and gave the company a "buy" rating in a research note on Friday, May 2nd. Scotiabank upped their target price on Twilio from $130.00 to $135.00 and gave the company a "sector outperform" rating in a research note on Friday, May 2nd. Wells Fargo & Company dropped their target price on Twilio from $160.00 to $120.00 and set an "overweight" rating for the company in a research note on Tuesday, April 22nd. Finally, Mizuho dropped their target price on Twilio from $165.00 to $125.00 and set an "outperform" rating for the company in a research note on Tuesday, April 15th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating, seventeen have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $127.22.

View Our Latest Report on TWLO

Insider Activity at Twilio

In related news, CFO Aidan Viggiano sold 8,297 shares of the stock in a transaction dated Thursday, July 3rd. The stock was sold at an average price of $117.05, for a total value of $971,163.85. Following the completion of the transaction, the chief financial officer owned 147,823 shares of the company's stock, valued at approximately $17,302,682.15. This represents a 5.31% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, CEO Khozema Shipchandler sold 20,008 shares of the stock in a transaction dated Monday, June 30th. The shares were sold at an average price of $124.53, for a total value of $2,491,596.24. Following the completion of the transaction, the chief executive officer directly owned 260,581 shares of the company's stock, valued at $32,450,151.93. This represents a 7.13% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 55,888 shares of company stock valued at $6,753,409. Insiders own 0.21% of the company's stock.

Twilio Stock Down 0.5%

Shares of NYSE TWLO traded down $0.68 on Friday, hitting $130.99. The company had a trading volume of 2,017,268 shares, compared to its average volume of 2,552,000. Twilio Inc. has a 12-month low of $56.16 and a 12-month high of $151.95. The business has a 50 day moving average of $120.26 and a two-hundred day moving average of $113.42. The company has a quick ratio of 4.78, a current ratio of 4.78 and a debt-to-equity ratio of 0.12. The firm has a market capitalization of $20.00 billion, a P/E ratio of -623.78, a PEG ratio of 4.08 and a beta of 1.30.

Twilio (NYSE:TWLO - Get Free Report) last issued its earnings results on Thursday, May 1st. The technology company reported $1.14 earnings per share for the quarter, topping the consensus estimate of $0.92 by $0.22. Twilio had a positive return on equity of 2.25% and a negative net margin of 0.74%. The company had revenue of $1.17 billion during the quarter, compared to the consensus estimate of $1.14 billion. During the same quarter in the prior year, the business earned $0.80 earnings per share. The company's revenue was up 12.0% compared to the same quarter last year. As a group, equities research analysts forecast that Twilio Inc. will post 1.44 earnings per share for the current fiscal year.

Twilio Company Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Featured Articles

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.