Gallacher Capital Management LLC acquired a new position in shares of Super Group (SGHC) Limited (NYSE:SGHC - Free Report) during the 2nd quarter, according to its most recent 13F filing with the SEC. The firm acquired 60,577 shares of the company's stock, valued at approximately $665,000.

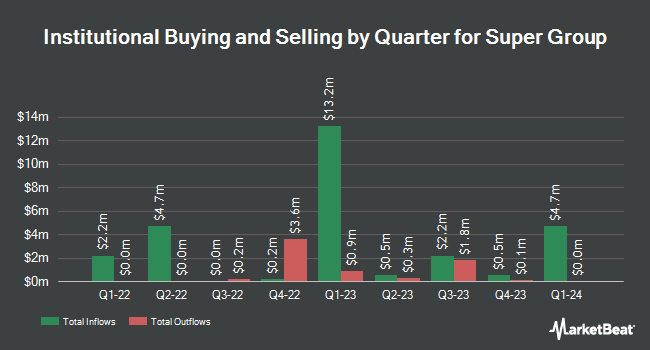

A number of other institutional investors and hedge funds have also made changes to their positions in the stock. American Century Companies Inc. increased its holdings in shares of Super Group (SGHC) by 11.2% in the 1st quarter. American Century Companies Inc. now owns 4,841,016 shares of the company's stock valued at $31,176,000 after acquiring an additional 487,895 shares during the period. Millennium Management LLC increased its holdings in shares of Super Group (SGHC) by 127.2% in the 1st quarter. Millennium Management LLC now owns 2,737,329 shares of the company's stock valued at $17,628,000 after acquiring an additional 1,532,666 shares during the period. Acadian Asset Management LLC grew its stake in Super Group (SGHC) by 66.7% during the 1st quarter. Acadian Asset Management LLC now owns 1,148,713 shares of the company's stock worth $7,379,000 after buying an additional 459,485 shares during the last quarter. Northern Trust Corp grew its stake in Super Group (SGHC) by 7.2% during the 4th quarter. Northern Trust Corp now owns 967,038 shares of the company's stock worth $6,025,000 after buying an additional 65,168 shares during the last quarter. Finally, Nuveen LLC purchased a new position in Super Group (SGHC) during the 1st quarter worth $4,608,000. 5.09% of the stock is currently owned by hedge funds and other institutional investors.

Super Group (SGHC) Trading Down 1.1%

Shares of Super Group (SGHC) stock traded down $0.13 during trading hours on Friday, reaching $11.56. 1,496,779 shares of the company's stock were exchanged, compared to its average volume of 1,432,005. The firm has a market capitalization of $5.82 billion, a price-to-earnings ratio of 43.79 and a beta of 1.09. The company has a fifty day moving average of $11.63 and a 200-day moving average of $9.47. Super Group has a 52-week low of $3.44 and a 52-week high of $13.71.

Super Group (SGHC) (NYSE:SGHC - Get Free Report) last released its quarterly earnings data on Thursday, September 4th. The company reported $0.11 EPS for the quarter, missing analysts' consensus estimates of $0.13 by ($0.02). Super Group (SGHC) had a return on equity of 36.68% and a net margin of 6.42%.The firm had revenue of $579.00 million for the quarter, compared to analyst estimates of $503.00 million. On average, equities research analysts anticipate that Super Group will post 0.29 earnings per share for the current fiscal year.

Super Group (SGHC) Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Shareholders of record on Thursday, September 18th will be given a $0.04 dividend. This represents a $0.16 dividend on an annualized basis and a yield of 1.4%. The ex-dividend date of this dividend is Thursday, September 18th. Super Group (SGHC)'s dividend payout ratio is presently 61.54%.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on SGHC shares. BTIG Research reissued a "buy" rating and issued a $14.00 price objective on shares of Super Group (SGHC) in a report on Thursday. Macquarie initiated coverage on Super Group (SGHC) in a research report on Monday. They issued an "outperform" rating and a $17.00 price objective for the company. Benchmark raised their price target on Super Group (SGHC) from $16.00 to $18.00 and gave the stock a "buy" rating in a research report on Thursday. UBS Group set a $18.00 price target on shares of Super Group (SGHC) in a report on Thursday. Finally, Citigroup initiated coverage on Super Group (SGHC) in a research note on Monday, July 14th. They issued an "outperform" rating on the stock. Two equities research analysts have rated the stock with a Strong Buy rating and eight have assigned a Buy rating to the company. According to data from MarketBeat, Super Group (SGHC) presently has an average rating of "Buy" and an average target price of $15.30.

Get Our Latest Analysis on SGHC

Super Group (SGHC) Company Profile

(

Free Report)

Super Group (SGHC) Limited operates as an online sports betting and gaming operator. It offers Betway, an online sports betting brand; and Spin, a multi-brand online casino offering. Super Group (SGHC) Limited is based in Saint Peter Port, Guernsey.

Featured Stories

Before you consider Super Group (SGHC), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Group (SGHC) wasn't on the list.

While Super Group (SGHC) currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.