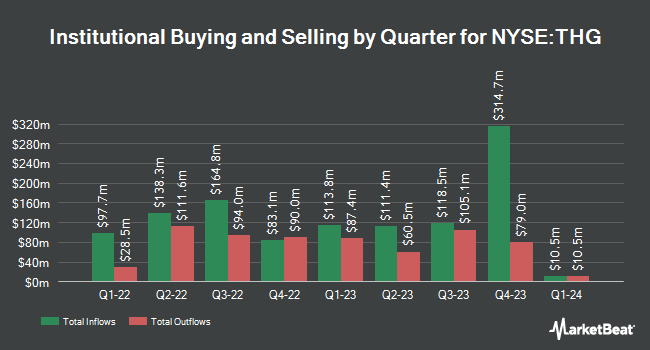

Nuveen LLC purchased a new stake in The Hanover Insurance Group, Inc. (NYSE:THG - Free Report) in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 62,558 shares of the insurance provider's stock, valued at approximately $10,882,000. Nuveen LLC owned about 0.17% of The Hanover Insurance Group at the end of the most recent reporting period.

A number of other large investors have also recently added to or reduced their stakes in the company. Vanguard Group Inc. lifted its stake in The Hanover Insurance Group by 0.6% in the first quarter. Vanguard Group Inc. now owns 3,635,173 shares of the insurance provider's stock valued at $632,338,000 after acquiring an additional 21,221 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its stake in The Hanover Insurance Group by 5.9% in the first quarter. Charles Schwab Investment Management Inc. now owns 389,634 shares of the insurance provider's stock valued at $67,777,000 after acquiring an additional 21,588 shares during the last quarter. Northern Trust Corp lifted its stake in The Hanover Insurance Group by 40.7% in the fourth quarter. Northern Trust Corp now owns 383,670 shares of the insurance provider's stock valued at $59,338,000 after acquiring an additional 110,944 shares during the last quarter. Vaughan Nelson Investment Management L.P. acquired a new stake in The Hanover Insurance Group in the first quarter valued at $64,340,000. Finally, Jacobs Levy Equity Management Inc. lifted its stake in The Hanover Insurance Group by 1.6% in the fourth quarter. Jacobs Levy Equity Management Inc. now owns 324,761 shares of the insurance provider's stock valued at $50,228,000 after acquiring an additional 5,245 shares during the last quarter. Institutional investors and hedge funds own 86.61% of the company's stock.

Wall Street Analyst Weigh In

THG has been the topic of several research analyst reports. Wall Street Zen raised shares of The Hanover Insurance Group from a "hold" rating to a "buy" rating in a research report on Wednesday, April 30th. Keefe, Bruyette & Woods raised shares of The Hanover Insurance Group from a "market perform" rating to an "outperform" rating and set a $188.00 price objective on the stock in a research report on Wednesday, July 9th. Morgan Stanley increased their price objective on shares of The Hanover Insurance Group from $170.00 to $185.00 and gave the company an "equal weight" rating in a research report on Friday, August 1st. JMP Securities set a $205.00 price objective on shares of The Hanover Insurance Group in a research report on Thursday, July 31st. Finally, Citigroup reissued an "outperform" rating on shares of The Hanover Insurance Group in a research report on Thursday, July 31st. Six equities research analysts have rated the stock with a Buy rating and four have given a Hold rating to the stock. According to MarketBeat.com, The Hanover Insurance Group currently has an average rating of "Moderate Buy" and an average price target of $185.13.

Check Out Our Latest Stock Analysis on The Hanover Insurance Group

The Hanover Insurance Group Stock Performance

NYSE:THG traded down $1.25 during mid-day trading on Thursday, reaching $173.40. 130,252 shares of the company's stock were exchanged, compared to its average volume of 235,136. The Hanover Insurance Group, Inc. has a one year low of $139.37 and a one year high of $178.68. The firm has a market capitalization of $6.20 billion, a PE ratio of 11.42 and a beta of 0.45. The business's fifty day simple moving average is $168.23 and its two-hundred day simple moving average is $167.05. The company has a debt-to-equity ratio of 0.11, a quick ratio of 0.37 and a current ratio of 0.37.

The Hanover Insurance Group (NYSE:THG - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The insurance provider reported $4.35 EPS for the quarter, topping analysts' consensus estimates of $3.07 by $1.28. The Hanover Insurance Group had a net margin of 8.67% and a return on equity of 20.24%. The business had revenue of $1.58 billion for the quarter, compared to analyst estimates of $1.60 billion. During the same period last year, the firm earned $1.88 earnings per share. The Hanover Insurance Group's revenue for the quarter was up 3.1% compared to the same quarter last year. Analysts anticipate that The Hanover Insurance Group, Inc. will post 14.37 earnings per share for the current fiscal year.

The Hanover Insurance Group Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, June 27th. Stockholders of record on Friday, June 13th were given a dividend of $0.90 per share. This represents a $3.60 dividend on an annualized basis and a dividend yield of 2.1%. The ex-dividend date was Friday, June 13th. The Hanover Insurance Group's dividend payout ratio is presently 23.70%.

The Hanover Insurance Group Company Profile

(

Free Report)

The Hanover Insurance Group, Inc, through its subsidiaries, provides various property and casualty insurance products and services in the United States. The company operates through four segments: Core Commercial, Specialty, Personal Lines, and Other. The Commercial Lines segment offers commercial multiple peril, commercial automobile, workers' compensation, and other commercial lines coverage.

Featured Articles

Before you consider The Hanover Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hanover Insurance Group wasn't on the list.

While The Hanover Insurance Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.