Baader Bank Aktiengesellschaft acquired a new stake in NIO Inc. (NYSE:NIO - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 76,879 shares of the company's stock, valued at approximately $293,000.

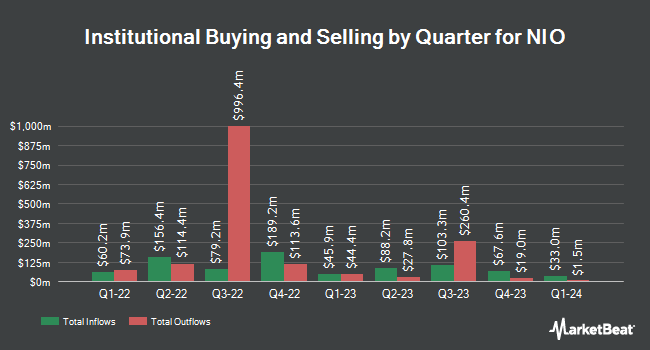

Other institutional investors and hedge funds have also recently bought and sold shares of the company. SG Americas Securities LLC lifted its stake in NIO by 83.3% during the first quarter. SG Americas Securities LLC now owns 2,109,761 shares of the company's stock worth $8,038,000 after purchasing an additional 958,750 shares during the last quarter. Trexquant Investment LP bought a new stake in NIO during the fourth quarter worth $3,305,000. Raymond James Financial Inc. bought a new stake in NIO during the fourth quarter worth $1,776,000. Arizona PSPRS Trust bought a new position in shares of NIO in the 4th quarter valued at $1,330,000. Finally, Bridgewater Associates LP lifted its stake in shares of NIO by 28.6% in the 4th quarter. Bridgewater Associates LP now owns 1,185,674 shares of the company's stock valued at $5,170,000 after acquiring an additional 263,338 shares during the last quarter. Institutional investors own 48.55% of the company's stock.

NIO Price Performance

Shares of NIO traded down $0.41 during mid-day trading on Monday, reaching $4.61. 54,818,577 shares of the stock traded hands, compared to its average volume of 51,361,215. The firm has a fifty day moving average price of $3.88 and a 200 day moving average price of $4.05. The company has a market cap of $9.61 billion, a price-to-earnings ratio of -2.84 and a beta of 1.41. The company has a current ratio of 0.84, a quick ratio of 0.69 and a debt-to-equity ratio of 1.89. NIO Inc. has a 1 year low of $3.02 and a 1 year high of $7.71.

NIO (NYSE:NIO - Get Free Report) last released its quarterly earnings results on Tuesday, June 3rd. The company reported ($0.45) EPS for the quarter, missing analysts' consensus estimates of ($0.22) by ($0.23). The firm had revenue of $1.66 billion for the quarter, compared to analysts' expectations of $12.46 billion. NIO had a negative net margin of 35.51% and a negative return on equity of 286.45%. The firm's revenue for the quarter was up 21.5% on a year-over-year basis. During the same quarter last year, the firm earned ($2.39) earnings per share. As a group, equities research analysts predict that NIO Inc. will post -1.43 earnings per share for the current year.

Analyst Ratings Changes

NIO has been the subject of a number of research reports. Morgan Stanley reiterated a "buy" rating on shares of NIO in a research note on Monday, July 14th. The Goldman Sachs Group raised shares of NIO from a "sell" rating to a "neutral" rating and raised their price objective for the stock from $3.70 to $3.80 in a research report on Tuesday, June 17th. Citigroup reissued a "buy" rating on shares of NIO in a research note on Monday, April 28th. Mizuho dropped their price target on shares of NIO from $4.00 to $3.50 and set a "neutral" rating on the stock in a research report on Tuesday, June 3rd. Finally, Barclays dropped their price target on shares of NIO from $4.00 to $3.00 and set an "underweight" rating on the stock in a research report on Wednesday, June 4th. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and an average target price of $4.74.

Get Our Latest Stock Analysis on NIO

NIO Company Profile

(

Free Report)

NIO Inc designs, manufactures, and sells electric vehicles in the People's Republic of China. The company is also involved in the manufacture of e-powertrain, battery packs, and components; and racing management, technology development, and sales and after-sales management activities. In addition, it offers power solutions for battery charging needs; and other value-added services.

Further Reading

Before you consider NIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NIO wasn't on the list.

While NIO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.