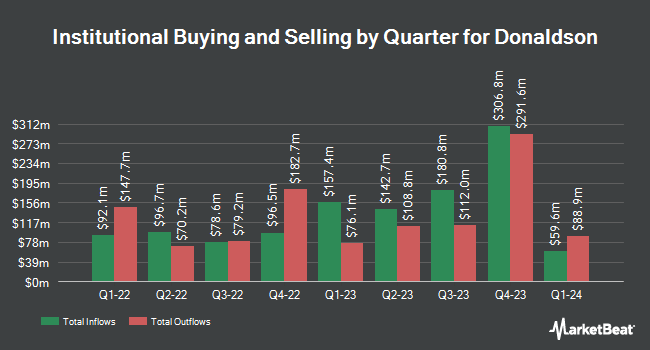

EntryPoint Capital LLC acquired a new position in Donaldson Company, Inc. (NYSE:DCI - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 8,158 shares of the industrial products company's stock, valued at approximately $547,000.

Several other hedge funds have also recently made changes to their positions in DCI. Colonial Trust Co SC bought a new position in shares of Donaldson in the 4th quarter worth about $25,000. Cullen Frost Bankers Inc. bought a new stake in Donaldson in the 1st quarter valued at about $29,000. Brooklyn Investment Group increased its position in Donaldson by 113.9% in the 1st quarter. Brooklyn Investment Group now owns 601 shares of the industrial products company's stock valued at $40,000 after buying an additional 320 shares in the last quarter. Johnson Financial Group Inc. increased its position in Donaldson by 48.8% in the 4th quarter. Johnson Financial Group Inc. now owns 595 shares of the industrial products company's stock valued at $42,000 after buying an additional 195 shares in the last quarter. Finally, Wood Tarver Financial Group LLC bought a new stake in Donaldson in the 4th quarter valued at about $42,000. 82.81% of the stock is owned by institutional investors.

Donaldson Stock Performance

Shares of NYSE DCI traded up $1.8450 during midday trading on Friday, reaching $75.7350. The company's stock had a trading volume of 636,298 shares, compared to its average volume of 509,533. The company has a debt-to-equity ratio of 0.44, a current ratio of 1.94 and a quick ratio of 1.24. The stock has a market capitalization of $8.82 billion, a P/E ratio of 25.41, a PEG ratio of 1.80 and a beta of 0.99. The firm has a 50 day moving average price of $71.32 and a 200-day moving average price of $68.88. Donaldson Company, Inc. has a 12-month low of $57.45 and a 12-month high of $78.95.

Donaldson (NYSE:DCI - Get Free Report) last posted its quarterly earnings results on Tuesday, June 3rd. The industrial products company reported $0.99 EPS for the quarter, topping analysts' consensus estimates of $0.95 by $0.04. The company had revenue of $940.10 million for the quarter, compared to analysts' expectations of $936.02 million. Donaldson had a net margin of 9.94% and a return on equity of 28.86%. Donaldson's revenue was up 1.3% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.92 EPS. Donaldson has set its FY 2025 guidance at 3.640-3.700 EPS. As a group, equities analysts predict that Donaldson Company, Inc. will post 3.64 earnings per share for the current year.

Donaldson Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, August 27th. Shareholders of record on Tuesday, August 12th will be issued a dividend of $0.30 per share. The ex-dividend date of this dividend is Tuesday, August 12th. This represents a $1.20 dividend on an annualized basis and a yield of 1.6%. Donaldson's payout ratio is presently 40.27%.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on DCI shares. Morgan Stanley reiterated an "underweight" rating and set a $69.00 price target (up previously from $65.00) on shares of Donaldson in a research note on Friday, June 6th. Robert W. Baird lifted their price target on Donaldson from $76.00 to $78.00 and gave the company an "outperform" rating in a research note on Wednesday, June 4th. Finally, Wall Street Zen downgraded Donaldson from a "buy" rating to a "hold" rating in a research note on Saturday, July 5th. One research analyst has rated the stock with a Buy rating, one has assigned a Hold rating and one has given a Sell rating to the stock. Based on data from MarketBeat.com, Donaldson currently has an average rating of "Hold" and an average price target of $70.00.

Check Out Our Latest Research Report on DCI

Donaldson Profile

(

Free Report)

Donaldson Company, Inc manufactures and sells filtration systems and replacement parts worldwide. The company operates through three segments: Mobile Solutions, Industrial Solutions, and Life Sciences. Its Mobile Solutions segment provides replacement filters for air and liquid filtration applications, such as air filtration systems; liquid filtration systems for fuel, lube, and hydraulic applications; exhaust and emissions systems and sensors; indicators; and monitoring systems.

Read More

Before you consider Donaldson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Donaldson wasn't on the list.

While Donaldson currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.