Invesco Ltd. decreased its holdings in shares of Abercrombie & Fitch Company (NYSE:ANF - Free Report) by 42.4% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 854,887 shares of the apparel retailer's stock after selling 629,756 shares during the quarter. Invesco Ltd. owned approximately 1.79% of Abercrombie & Fitch worth $65,288,000 as of its most recent SEC filing.

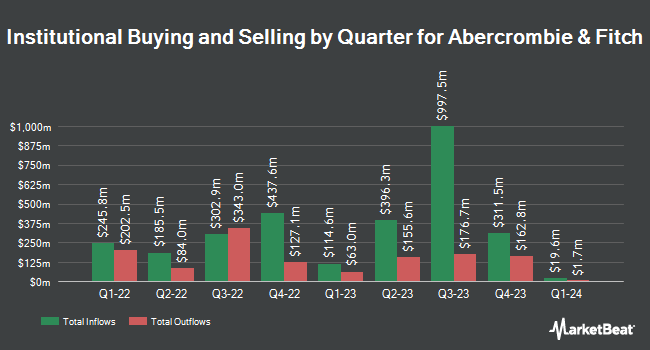

Several other hedge funds and other institutional investors have also modified their holdings of the stock. Covestor Ltd boosted its holdings in Abercrombie & Fitch by 21.9% in the 1st quarter. Covestor Ltd now owns 1,456 shares of the apparel retailer's stock valued at $111,000 after purchasing an additional 262 shares during the period. Connor Clark & Lunn Investment Management Ltd. bought a new position in Abercrombie & Fitch in the 1st quarter valued at approximately $8,851,000. Citigroup Inc. boosted its holdings in shares of Abercrombie & Fitch by 51.0% during the 1st quarter. Citigroup Inc. now owns 100,242 shares of the apparel retailer's stock valued at $7,655,000 after acquiring an additional 33,850 shares in the last quarter. Ruffer LLP bought a new stake in shares of Abercrombie & Fitch during the first quarter worth about $2,049,000. Finally, Bank of Nova Scotia raised its stake in shares of Abercrombie & Fitch by 430.8% during the first quarter. Bank of Nova Scotia now owns 9,713 shares of the apparel retailer's stock valued at $742,000 after acquiring an additional 7,883 shares during the last quarter.

Analysts Set New Price Targets

ANF has been the subject of a number of analyst reports. UBS Group reiterated a "buy" rating on shares of Abercrombie & Fitch in a report on Wednesday, May 28th. Telsey Advisory Group restated an "outperform" rating and issued a $125.00 target price on shares of Abercrombie & Fitch in a research report on Wednesday. JPMorgan Chase & Co. raised their price target on Abercrombie & Fitch from $141.00 to $151.00 and gave the stock an "overweight" rating in a research note on Monday, July 28th. Morgan Stanley raised their price objective on shares of Abercrombie & Fitch from $78.00 to $82.00 and gave the company an "equal weight" rating in a research note on Thursday, May 29th. Finally, Jefferies Financial Group cut their price target on Abercrombie & Fitch from $170.00 to $135.00 and set a "buy" rating for the company in a report on Wednesday, May 21st. Five investment analysts have rated the stock with a Buy rating and three have given a Hold rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $112.75.

View Our Latest Stock Report on ANF

Abercrombie & Fitch Stock Down 3.3%

Shares of NYSE:ANF traded down $3.0940 during trading on Wednesday, reaching $91.7860. 1,236,097 shares of the company's stock traded hands, compared to its average volume of 2,425,740. The company has a 50-day simple moving average of $90.06 and a 200-day simple moving average of $85.80. Abercrombie & Fitch Company has a fifty-two week low of $65.40 and a fifty-two week high of $171.47. The firm has a market cap of $4.37 billion, a PE ratio of 9.02 and a beta of 1.54.

Abercrombie & Fitch (NYSE:ANF - Get Free Report) last released its quarterly earnings results on Wednesday, May 28th. The apparel retailer reported $1.59 EPS for the quarter, beating the consensus estimate of $1.35 by $0.24. The firm had revenue of $1.10 billion for the quarter, compared to analyst estimates of $1.08 billion. Abercrombie & Fitch had a net margin of 10.60% and a return on equity of 42.32%. The business's revenue for the quarter was up 7.5% compared to the same quarter last year. During the same quarter in the previous year, the company earned $2.14 EPS. Abercrombie & Fitch has set its FY 2025 guidance at 9.500-10.500 EPS. Q2 2025 guidance at 2.100-2.300 EPS. On average, equities research analysts forecast that Abercrombie & Fitch Company will post 10.62 EPS for the current year.

Abercrombie & Fitch Profile

(

Free Report)

Abercrombie & Fitch Co engages in the retail of apparel, personal care products, and accessories. The firm operates through following geographical segments: Americas, EMEA and APAC. The Americas segment includes operations in North America and South America. The EMEA segment includes operations in Europe, the Middle East and Africa.

Featured Articles

Before you consider Abercrombie & Fitch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abercrombie & Fitch wasn't on the list.

While Abercrombie & Fitch currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.