Aberdeen Group plc increased its stake in shares of MGM Resorts International (NYSE:MGM - Free Report) by 118.7% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 158,412 shares of the company's stock after acquiring an additional 85,973 shares during the period. Aberdeen Group plc owned about 0.06% of MGM Resorts International worth $4,703,000 as of its most recent SEC filing.

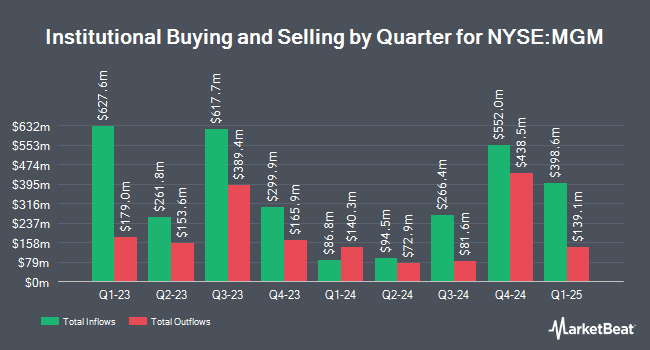

A number of other hedge funds and other institutional investors have also made changes to their positions in the stock. Davis Selected Advisers raised its holdings in shares of MGM Resorts International by 4.5% during the first quarter. Davis Selected Advisers now owns 20,815,057 shares of the company's stock worth $616,958,000 after acquiring an additional 894,344 shares during the period. Invesco Ltd. raised its holdings in shares of MGM Resorts International by 7.7% during the first quarter. Invesco Ltd. now owns 6,233,213 shares of the company's stock worth $184,752,000 after acquiring an additional 447,870 shares during the period. Southeastern Asset Management Inc. TN raised its holdings in shares of MGM Resorts International by 9.6% during the fourth quarter. Southeastern Asset Management Inc. TN now owns 2,409,147 shares of the company's stock worth $83,477,000 after acquiring an additional 211,245 shares during the period. Northern Trust Corp increased its stake in MGM Resorts International by 15.1% in the 4th quarter. Northern Trust Corp now owns 2,315,748 shares of the company's stock valued at $80,241,000 after buying an additional 303,711 shares during the last quarter. Finally, Eminence Capital LP acquired a new stake in MGM Resorts International in the 4th quarter valued at $72,408,000. 68.11% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

MGM has been the topic of several recent research reports. Wall Street Zen upgraded shares of MGM Resorts International from a "sell" rating to a "hold" rating in a research note on Thursday, May 22nd. UBS Group lifted their price target on shares of MGM Resorts International from $37.00 to $42.00 and gave the company a "neutral" rating in a research note on Tuesday, July 8th. The Goldman Sachs Group initiated coverage on shares of MGM Resorts International in a research note on Monday, July 7th. They issued a "sell" rating and a $34.00 price target on the stock. Susquehanna lifted their price target on shares of MGM Resorts International from $50.00 to $60.00 and gave the company a "positive" rating in a research note on Tuesday, July 29th. Finally, Citigroup upgraded shares of MGM Resorts International from a "hold" rating to a "strong-buy" rating and lifted their price target for the company from $55.00 to $57.00 in a research note on Wednesday, July 9th. One investment analyst has rated the stock with a Strong Buy rating, fourteen have given a Buy rating, eight have assigned a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, MGM Resorts International has an average rating of "Moderate Buy" and a consensus price target of $48.72.

Get Our Latest Research Report on MGM

MGM Resorts International Stock Performance

Shares of MGM traded up $0.37 during midday trading on Tuesday, reaching $38.49. The stock had a trading volume of 4,598,075 shares, compared to its average volume of 4,842,062. The firm has a 50 day simple moving average of $36.42 and a 200-day simple moving average of $33.67. MGM Resorts International has a one year low of $25.30 and a one year high of $42.53. The firm has a market cap of $10.48 billion, a PE ratio of 21.15, a P/E/G ratio of 1.80 and a beta of 1.81. The company has a current ratio of 1.22, a quick ratio of 1.18 and a debt-to-equity ratio of 1.67.

MGM Resorts International (NYSE:MGM - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The company reported $0.79 EPS for the quarter, beating analysts' consensus estimates of $0.58 by $0.21. MGM Resorts International had a net margin of 3.13% and a return on equity of 19.39%. The company had revenue of $4.40 billion during the quarter, compared to the consensus estimate of $4.28 billion. During the same quarter last year, the firm posted $0.86 EPS. The company's quarterly revenue was up 1.8% on a year-over-year basis. As a group, sell-side analysts anticipate that MGM Resorts International will post 2.21 EPS for the current year.

MGM Resorts International announced that its Board of Directors has approved a stock repurchase program on Wednesday, April 30th that authorizes the company to buyback $2.00 billion in shares. This buyback authorization authorizes the company to reacquire up to 22.4% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board believes its stock is undervalued.

Insider Activity at MGM Resorts International

In related news, Director Keith A. Meister sold 60,000 shares of MGM Resorts International stock in a transaction dated Friday, June 13th. The shares were sold at an average price of $32.09, for a total transaction of $1,925,400.00. Following the completion of the sale, the director owned 5,627,478 shares of the company's stock, valued at approximately $180,585,769.02. The trade was a 1.05% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Insiders own 3.06% of the company's stock.

MGM Resorts International Company Profile

(

Free Report)

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

Further Reading

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.