Aberdeen Group plc lifted its position in shares of VICI Properties Inc. (NYSE:VICI - Free Report) by 6.6% in the 2nd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,166,573 shares of the company's stock after buying an additional 71,822 shares during the quarter. Aberdeen Group plc owned approximately 0.11% of VICI Properties worth $37,488,000 at the end of the most recent quarter.

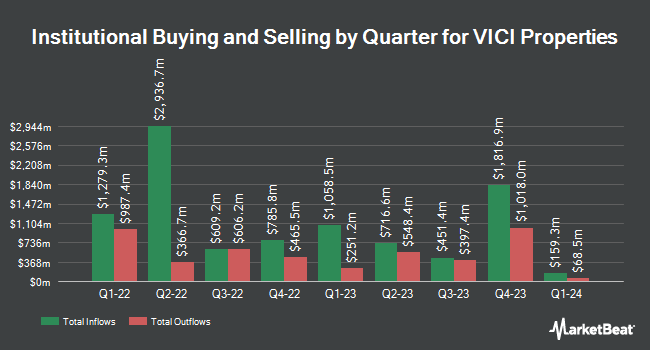

Several other hedge funds and other institutional investors have also made changes to their positions in VICI. Chesley Taft & Associates LLC increased its position in VICI Properties by 3.6% during the 2nd quarter. Chesley Taft & Associates LLC now owns 9,321 shares of the company's stock worth $304,000 after purchasing an additional 324 shares in the last quarter. Wright Investors Service Inc. grew its holdings in shares of VICI Properties by 0.4% during the 2nd quarter. Wright Investors Service Inc. now owns 74,517 shares of the company's stock worth $2,429,000 after purchasing an additional 330 shares during the period. Provident Investment Management Inc. grew its holdings in shares of VICI Properties by 1.5% during the 1st quarter. Provident Investment Management Inc. now owns 23,785 shares of the company's stock worth $776,000 after purchasing an additional 350 shares during the period. Cullen Frost Bankers Inc. boosted its stake in shares of VICI Properties by 8.5% during the 1st quarter. Cullen Frost Bankers Inc. now owns 4,593 shares of the company's stock valued at $150,000 after buying an additional 359 shares during the last quarter. Finally, Moran Wealth Management LLC boosted its stake in shares of VICI Properties by 0.9% during the 1st quarter. Moran Wealth Management LLC now owns 40,578 shares of the company's stock valued at $1,324,000 after buying an additional 360 shares during the last quarter. Institutional investors and hedge funds own 97.71% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on the company. Wells Fargo & Company upped their price target on VICI Properties from $35.00 to $36.00 and gave the company an "overweight" rating in a research report on Wednesday, August 27th. Citigroup reissued a "market outperform" rating on shares of VICI Properties in a research report on Tuesday, July 22nd. Scotiabank upped their price objective on VICI Properties from $35.00 to $36.00 and gave the stock an "outperform" rating in a research note on Thursday, August 28th. Evercore ISI upped their price objective on VICI Properties from $37.00 to $38.00 and gave the stock an "outperform" rating in a research note on Monday, September 15th. Finally, Morgan Stanley upped their price objective on VICI Properties from $33.00 to $35.00 and gave the stock an "equal weight" rating in a research note on Tuesday, July 8th. Thirteen equities research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $36.00.

Get Our Latest Stock Report on VICI Properties

VICI Properties Price Performance

Shares of VICI opened at $30.97 on Monday. The company has a market cap of $33.03 billion, a P/E ratio of 11.87, a PEG ratio of 3.09 and a beta of 0.72. The stock has a fifty day moving average price of $32.78 and a 200 day moving average price of $32.36. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.74 and a quick ratio of 1.74. VICI Properties Inc. has a 12 month low of $27.98 and a 12 month high of $34.03.

VICI Properties (NYSE:VICI - Get Free Report) last issued its quarterly earnings data on Wednesday, July 30th. The company reported $0.60 EPS for the quarter, hitting analysts' consensus estimates of $0.60. VICI Properties had a return on equity of 10.21% and a net margin of 70.20%.The firm had revenue of $1 billion during the quarter, compared to the consensus estimate of $991.59 million. During the same period in the prior year, the business earned $0.57 EPS. The firm's revenue was up 4.6% on a year-over-year basis. VICI Properties has set its FY 2025 guidance at 2.350-2.370 EPS. On average, research analysts forecast that VICI Properties Inc. will post 2.31 earnings per share for the current year.

VICI Properties Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 9th. Stockholders of record on Thursday, September 18th were paid a $0.45 dividend. The ex-dividend date of this dividend was Thursday, September 18th. This is a positive change from VICI Properties's previous quarterly dividend of $0.43. This represents a $1.80 annualized dividend and a dividend yield of 5.8%. VICI Properties's dividend payout ratio (DPR) is currently 68.97%.

VICI Properties Company Profile

(

Free Report)

VICI Properties Inc is an S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider VICI Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VICI Properties wasn't on the list.

While VICI Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.