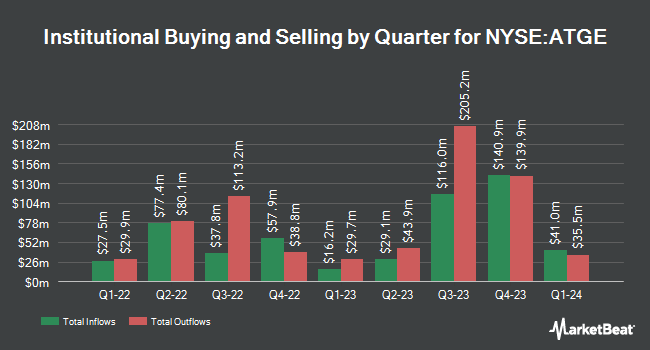

Candriam S.C.A. raised its position in shares of Adtalem Global Education Inc. (NYSE:ATGE - Free Report) by 255.8% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 60,488 shares of the company's stock after acquiring an additional 43,488 shares during the quarter. Candriam S.C.A. owned approximately 0.16% of Adtalem Global Education worth $6,088,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Fifth Third Bancorp boosted its stake in Adtalem Global Education by 56.8% in the first quarter. Fifth Third Bancorp now owns 287 shares of the company's stock valued at $29,000 after acquiring an additional 104 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank grew its stake in shares of Adtalem Global Education by 1.1% during the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 11,880 shares of the company's stock valued at $1,196,000 after purchasing an additional 129 shares during the last quarter. US Bancorp DE raised its holdings in shares of Adtalem Global Education by 3.9% during the first quarter. US Bancorp DE now owns 3,414 shares of the company's stock worth $344,000 after acquiring an additional 129 shares during the period. Xponance Inc. boosted its holdings in shares of Adtalem Global Education by 5.2% during the 1st quarter. Xponance Inc. now owns 3,040 shares of the company's stock worth $306,000 after buying an additional 151 shares during the period. Finally, Vontobel Holding Ltd. increased its position in Adtalem Global Education by 6.4% during the 1st quarter. Vontobel Holding Ltd. now owns 2,559 shares of the company's stock worth $258,000 after purchasing an additional 155 shares in the last quarter. 98.84% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Adtalem Global Education news, Director Lisa W. Wardell sold 12,900 shares of the stock in a transaction on Thursday, August 21st. The shares were sold at an average price of $132.90, for a total transaction of $1,714,410.00. Following the completion of the sale, the director owned 92,477 shares of the company's stock, valued at $12,290,193.30. This represents a 12.24% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director William W. Burke sold 2,291 shares of the business's stock in a transaction on Thursday, June 5th. The stock was sold at an average price of $128.35, for a total transaction of $294,049.85. Following the completion of the transaction, the director directly owned 9,368 shares in the company, valued at $1,202,382.80. This trade represents a 19.65% decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently weighed in on the stock. BMO Capital Markets boosted their price objective on shares of Adtalem Global Education from $115.00 to $132.00 and gave the stock an "outperform" rating in a report on Monday, May 12th. Barrington Research lifted their target price on Adtalem Global Education from $140.00 to $150.00 and gave the stock an "outperform" rating in a report on Friday, August 8th. Finally, Zacks Research lowered Adtalem Global Education from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 19th. Three equities research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $139.00.

Read Our Latest Research Report on ATGE

Adtalem Global Education Price Performance

Shares of Adtalem Global Education stock traded up $0.25 during midday trading on Wednesday, reaching $136.15. The company had a trading volume of 83,430 shares, compared to its average volume of 468,847. Adtalem Global Education Inc. has a 1-year low of $68.60 and a 1-year high of $140.12. The company has a market capitalization of $4.90 billion, a price-to-earnings ratio of 22.03, a price-to-earnings-growth ratio of 1.17 and a beta of 0.88. The company has a current ratio of 0.82, a quick ratio of 0.82 and a debt-to-equity ratio of 0.39. The stock has a fifty day simple moving average of $122.10 and a 200 day simple moving average of $114.37.

Adtalem Global Education (NYSE:ATGE - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported $1.66 earnings per share for the quarter, beating the consensus estimate of $1.51 by $0.15. Adtalem Global Education had a net margin of 13.26% and a return on equity of 17.95%. The firm had revenue of $457.11 million for the quarter, compared to analysts' expectations of $440.93 million. During the same period in the prior year, the firm earned $1.37 EPS. The business's revenue was up 11.5% on a year-over-year basis. Adtalem Global Education has set its FY 2026 guidance at 7.600-7.900 EPS. As a group, equities research analysts forecast that Adtalem Global Education Inc. will post 6.2 earnings per share for the current year.

Adtalem Global Education announced that its board has initiated a stock repurchase program on Tuesday, May 6th that allows the company to buyback $150.00 million in outstanding shares. This buyback authorization allows the company to repurchase up to 3.6% of its stock through open market purchases. Stock buyback programs are generally a sign that the company's leadership believes its shares are undervalued.

About Adtalem Global Education

(

Free Report)

Adtalem Global Education Inc provides workforce solutions worldwide. It operates through three segments, Chamberlain, Walden, and Medical and Veterinary. The Chamberlain segment offers degree and non-degree programs in the nursing and health professions postsecondary education industry. This segment operates Chamberlain University.

See Also

Before you consider Adtalem Global Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adtalem Global Education wasn't on the list.

While Adtalem Global Education currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.