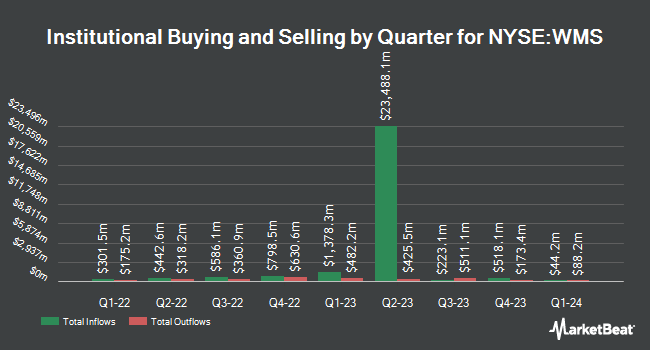

TD Asset Management Inc grew its stake in shares of Advanced Drainage Systems, Inc. (NYSE:WMS - Free Report) by 10.2% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 459,986 shares of the construction company's stock after purchasing an additional 42,666 shares during the period. TD Asset Management Inc owned approximately 0.59% of Advanced Drainage Systems worth $49,977,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors have also recently made changes to their positions in the company. Applied Finance Capital Management LLC increased its position in shares of Advanced Drainage Systems by 8.7% during the first quarter. Applied Finance Capital Management LLC now owns 1,896 shares of the construction company's stock worth $206,000 after acquiring an additional 152 shares in the last quarter. Phoenix Financial Ltd. increased its position in shares of Advanced Drainage Systems by 5.2% during the first quarter. Phoenix Financial Ltd. now owns 2,463 shares of the construction company's stock worth $269,000 after acquiring an additional 121 shares in the last quarter. Cetera Investment Advisers increased its position in shares of Advanced Drainage Systems by 11.3% during the first quarter. Cetera Investment Advisers now owns 15,345 shares of the construction company's stock worth $1,667,000 after acquiring an additional 1,554 shares in the last quarter. Universal Beteiligungs und Servicegesellschaft mbH bought a new stake in shares of Advanced Drainage Systems during the first quarter worth about $7,675,000. Finally, Allianz Asset Management GmbH increased its position in shares of Advanced Drainage Systems by 2.6% during the first quarter. Allianz Asset Management GmbH now owns 560,688 shares of the construction company's stock worth $60,919,000 after acquiring an additional 14,472 shares in the last quarter. Institutional investors and hedge funds own 89.83% of the company's stock.

Advanced Drainage Systems Stock Down 1.6%

Advanced Drainage Systems stock traded down $1.93 during trading hours on Wednesday, hitting $116.98. The stock had a trading volume of 575,801 shares, compared to its average volume of 683,750. The company has a quick ratio of 2.10, a current ratio of 3.33 and a debt-to-equity ratio of 0.90. The stock has a market capitalization of $9.08 billion, a P/E ratio of 20.31, a price-to-earnings-growth ratio of 1.73 and a beta of 1.24. Advanced Drainage Systems, Inc. has a 12-month low of $93.92 and a 12-month high of $179.57. The stock's 50-day moving average price is $114.97 and its 200-day moving average price is $114.57.

Advanced Drainage Systems (NYSE:WMS - Get Free Report) last issued its earnings results on Thursday, May 15th. The construction company reported $1.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.09 by ($0.06). The firm had revenue of $615.76 million during the quarter, compared to analysts' expectations of $653.22 million. Advanced Drainage Systems had a return on equity of 32.33% and a net margin of 15.50%. The firm's quarterly revenue was down 5.8% on a year-over-year basis. During the same period last year, the firm posted $1.23 earnings per share. Equities research analysts anticipate that Advanced Drainage Systems, Inc. will post 6.1 EPS for the current fiscal year.

Advanced Drainage Systems Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, June 16th. Stockholders of record on Friday, May 30th were issued a dividend of $0.18 per share. This represents a $0.72 annualized dividend and a dividend yield of 0.62%. This is a boost from Advanced Drainage Systems's previous quarterly dividend of $0.16. The ex-dividend date of this dividend was Friday, May 30th. Advanced Drainage Systems's payout ratio is presently 12.50%.

Analysts Set New Price Targets

A number of equities research analysts have issued reports on the stock. Oppenheimer reduced their price objective on shares of Advanced Drainage Systems from $165.00 to $160.00 and set an "outperform" rating for the company in a research report on Friday, May 16th. Robert W. Baird lowered their target price on shares of Advanced Drainage Systems from $146.00 to $141.00 and set an "outperform" rating on the stock in a research note on Friday, May 16th. Loop Capital lowered their price objective on shares of Advanced Drainage Systems from $143.00 to $133.00 and set a "buy" rating on the stock in a research report on Friday, May 16th. Barclays increased their target price on shares of Advanced Drainage Systems from $130.00 to $135.00 and gave the company an "overweight" rating in a report on Friday, May 16th. Finally, UBS Group cut their price target on shares of Advanced Drainage Systems from $155.00 to $146.00 and set a "buy" rating on the stock in a report on Friday, May 16th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $139.88.

Get Our Latest Analysis on Advanced Drainage Systems

Advanced Drainage Systems Company Profile

(

Free Report)

Advanced Drainage Systems, Inc designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in North America and internationally. The company operates through Pipe, International, Infiltrator, and Allied Products & Other segments. It offers single, double, and triple wall corrugated polypropylene and polyethylene pipes; plastic leachfield chambers and systems; EZflow synthetic aggregate bundles; wastewater purification through mechanical aeration wastewater for residential and commercial systems; septic tanks and accessories; combined treatment and dispersal systems, including advanced enviro-septic and advanced treatment leachfield systems; and allied products, including storm retention/detention and septic chambers, polyvinyl chloride drainage structures, fittings, and water quality filters and separators.

See Also

Before you consider Advanced Drainage Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Drainage Systems wasn't on the list.

While Advanced Drainage Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.