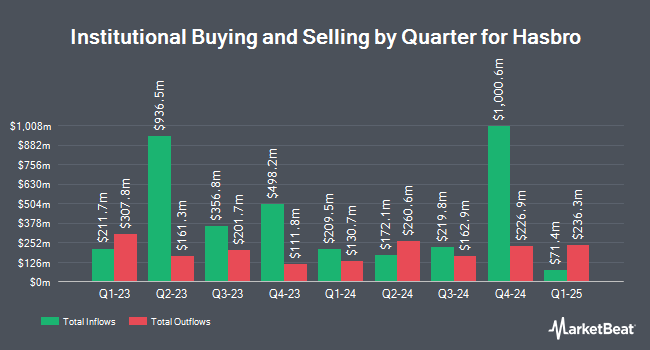

Advisors Asset Management Inc. lifted its holdings in shares of Hasbro, Inc. (NASDAQ:HAS - Free Report) by 58.4% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 30,700 shares of the company's stock after acquiring an additional 11,324 shares during the period. Advisors Asset Management Inc.'s holdings in Hasbro were worth $1,888,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. GW Henssler & Associates Ltd. increased its position in shares of Hasbro by 5.6% during the first quarter. GW Henssler & Associates Ltd. now owns 263,198 shares of the company's stock worth $16,184,000 after acquiring an additional 13,976 shares in the last quarter. Maverick Capital Ltd. boosted its holdings in Hasbro by 132.8% during the first quarter. Maverick Capital Ltd. now owns 11,543 shares of the company's stock worth $710,000 after purchasing an additional 6,585 shares during the last quarter. Caption Management LLC purchased a new position in Hasbro during the first quarter worth about $2,721,000. Vident Advisory LLC boosted its holdings in Hasbro by 39.8% during the first quarter. Vident Advisory LLC now owns 26,103 shares of the company's stock worth $1,605,000 after purchasing an additional 7,434 shares during the last quarter. Finally, Magnetar Financial LLC purchased a new position in Hasbro during the first quarter worth about $5,690,000. 91.83% of the stock is owned by institutional investors.

Hasbro Stock Performance

Shares of HAS stock traded up $1.80 during trading on Thursday, reaching $79.46. 783,476 shares of the company's stock traded hands, compared to its average volume of 1,986,140. The company has a market capitalization of $11.14 billion, a P/E ratio of -19.56, a PEG ratio of 1.02 and a beta of 0.59. The company has a current ratio of 1.66, a quick ratio of 1.32 and a debt-to-equity ratio of 12.31. The firm's 50-day moving average is $78.16 and its 200 day moving average is $68.23. Hasbro, Inc. has a 1 year low of $49.00 and a 1 year high of $82.19.

Hasbro (NASDAQ:HAS - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The company reported $1.30 EPS for the quarter, beating analysts' consensus estimates of $0.78 by $0.52. The company had revenue of $980.80 million for the quarter, compared to analysts' expectations of $891.82 million. Hasbro had a negative net margin of 13.37% and a positive return on equity of 64.49%. Hasbro's revenue was down 1.5% compared to the same quarter last year. During the same period in the prior year, the company posted $1.22 EPS. Equities research analysts expect that Hasbro, Inc. will post 4.33 EPS for the current year.

Hasbro Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, September 3rd. Investors of record on Wednesday, August 20th were paid a dividend of $0.70 per share. This represents a $2.80 dividend on an annualized basis and a dividend yield of 3.5%. The ex-dividend date was Wednesday, August 20th. Hasbro's dividend payout ratio is presently -68.97%.

Wall Street Analyst Weigh In

Several research firms recently weighed in on HAS. Citigroup boosted their price target on shares of Hasbro from $79.00 to $91.00 and gave the stock a "buy" rating in a report on Thursday, July 24th. The Goldman Sachs Group upgraded shares of Hasbro from a "neutral" rating to a "buy" rating and boosted their price target for the stock from $66.00 to $85.00 in a report on Monday, June 30th. JPMorgan Chase & Co. boosted their price target on shares of Hasbro from $75.00 to $94.00 and gave the stock an "overweight" rating in a report on Thursday, July 24th. Morgan Stanley boosted their target price on shares of Hasbro from $83.00 to $85.00 and gave the company an "overweight" rating in a research note on Thursday, July 24th. Finally, Bank of America boosted their target price on shares of Hasbro from $85.00 to $90.00 and gave the company a "buy" rating in a research note on Thursday, July 17th. Eleven analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $86.42.

Read Our Latest Stock Report on HAS

Insider Activity at Hasbro

In related news, CEO Christian P. Cocks sold 27,800 shares of the company's stock in a transaction that occurred on Thursday, August 21st. The shares were sold at an average price of $78.92, for a total transaction of $2,193,976.00. Following the sale, the chief executive officer directly owned 249,861 shares in the company, valued at approximately $19,719,030.12. This represents a 10.01% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, insider Roberta K. Thomson sold 1,002 shares of the company's stock in a transaction that occurred on Thursday, August 14th. The stock was sold at an average price of $79.81, for a total transaction of $79,969.62. Following the sale, the insider directly owned 51,301 shares in the company, valued at $4,094,332.81. This trade represents a 1.92% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 37,359 shares of company stock worth $2,970,828. 0.85% of the stock is owned by corporate insiders.

Hasbro Profile

(

Free Report)

Hasbro, Inc, together with its subsidiaries, operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong. The company operates through Consumer Products; Wizards of the Coast and Digital Gaming; Entertainment; and Corporate and Other segments.

Featured Articles

Before you consider Hasbro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hasbro wasn't on the list.

While Hasbro currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report