Advisors Asset Management Inc. lowered its position in shares of Annaly Capital Management Inc (NYSE:NLY - Free Report) by 34.8% in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 229,196 shares of the real estate investment trust's stock after selling 122,136 shares during the period. Advisors Asset Management Inc.'s holdings in Annaly Capital Management were worth $4,655,000 at the end of the most recent reporting period.

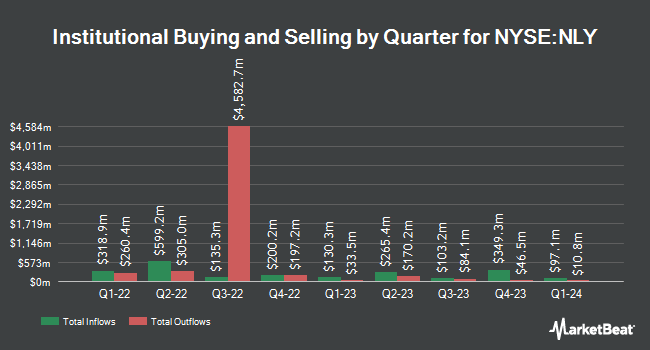

Several other institutional investors have also added to or reduced their stakes in the company. Jupiter Wealth Management LLC boosted its position in Annaly Capital Management by 3.4% during the 4th quarter. Jupiter Wealth Management LLC now owns 15,035 shares of the real estate investment trust's stock valued at $275,000 after buying an additional 492 shares during the period. Guidance Point Advisors LLC lifted its position in shares of Annaly Capital Management by 3.1% in the 1st quarter. Guidance Point Advisors LLC now owns 17,049 shares of the real estate investment trust's stock worth $346,000 after purchasing an additional 519 shares during the period. International Assets Investment Management LLC lifted its position in shares of Annaly Capital Management by 3.2% in the 1st quarter. International Assets Investment Management LLC now owns 23,222 shares of the real estate investment trust's stock worth $472,000 after purchasing an additional 725 shares during the period. Samalin Investment Counsel LLC lifted its position in shares of Annaly Capital Management by 3.0% in the 1st quarter. Samalin Investment Counsel LLC now owns 27,518 shares of the real estate investment trust's stock worth $559,000 after purchasing an additional 796 shares during the period. Finally, Ethic Inc. lifted its position in shares of Annaly Capital Management by 1.5% in the 1st quarter. Ethic Inc. now owns 54,848 shares of the real estate investment trust's stock worth $1,102,000 after purchasing an additional 800 shares during the period. Hedge funds and other institutional investors own 51.56% of the company's stock.

Analyst Ratings Changes

Several research firms have recently commented on NLY. Zacks Research cut shares of Annaly Capital Management from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, August 19th. Royal Bank Of Canada dropped their target price on shares of Annaly Capital Management from $22.00 to $21.00 and set an "outperform" rating for the company in a research report on Tuesday, May 27th. Jones Trading reaffirmed a "buy" rating and issued a $21.00 target price on shares of Annaly Capital Management in a research report on Thursday, July 24th. Keefe, Bruyette & Woods raised their target price on shares of Annaly Capital Management from $20.50 to $21.50 and gave the stock an "outperform" rating in a research report on Friday, July 25th. Finally, UBS Group raised their target price on shares of Annaly Capital Management from $20.00 to $21.00 and gave the stock a "neutral" rating in a research report on Wednesday, September 3rd. Seven analysts have rated the stock with a Buy rating and four have issued a Hold rating to the stock. According to MarketBeat, Annaly Capital Management presently has a consensus rating of "Moderate Buy" and a consensus target price of $20.83.

Read Our Latest Report on Annaly Capital Management

Annaly Capital Management Stock Down 0.7%

NYSE:NLY traded down $0.15 on Wednesday, reaching $22.12. 3,417,669 shares of the stock traded hands, compared to its average volume of 7,652,081. The company has a market capitalization of $14.20 billion, a price-to-earnings ratio of 21.93, a PEG ratio of 5.25 and a beta of 1.24. The company has a current ratio of 0.11, a quick ratio of 0.11 and a debt-to-equity ratio of 0.21. Annaly Capital Management Inc has a 12 month low of $16.59 and a 12 month high of $22.45. The company's fifty day simple moving average is $20.56 and its 200 day simple moving average is $19.98.

Annaly Capital Management (NYSE:NLY - Get Free Report) last released its quarterly earnings data on Wednesday, July 23rd. The real estate investment trust reported $0.73 earnings per share for the quarter, beating analysts' consensus estimates of $0.72 by $0.01. The business had revenue of $273.20 million during the quarter, compared to analyst estimates of $237.00 million. Annaly Capital Management had a net margin of 13.76% and a return on equity of 15.53%. Equities analysts predict that Annaly Capital Management Inc will post 2.81 EPS for the current fiscal year.

Annaly Capital Management Profile

(

Free Report)

Annaly Capital Management, Inc, a diversified capital manager, engages in mortgage finance. The company invests in agency mortgage-backed securities collateralized by residential mortgages; non-agency residential whole loans and securitized products within the residential and commercial markets; mortgage servicing rights; agency commercial mortgage-backed securities; to-be-announced forward contracts; residential mortgage loans; and agency or private label credit risk transfer securities.

See Also

Before you consider Annaly Capital Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Annaly Capital Management wasn't on the list.

While Annaly Capital Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.